As one of Central London’s most highly regarded estate agents, we’re often asked to share our views — here are a few of our most recent pieces.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2062

As expected, the Bank of England has, once again, increased the interest rate to the highest it has been since 2008 in an attempt to tackle inflation.

The Bank of England has a target of 2 per cent inflation however it currently sits at 10.7 per cent, although it has begun slowing down following a steep rise. The vote to increase the interest rate was not unanimous among the nine members of the Monetary Policy Committee (MPC) with 6 voting in favour of a half-point rate increase, two voting to maintain at the current 3 per cent and 1 wanting to increase 0.75 per cent. This outcome shows that the MPC might be differing on what they think will be the best solution to the inflation.

What does this mean for mortgage rates going forward? Connaught Private Finance has seen fixed rates continually drop over the last month, even ahead of the anticipated interest rate increase, as the cost of borrowing has reduced on the international markets. We don’t anticipate any changes to those offerings in a response to this announcement.

Whilst tracker and variable rates will be immediately affected by the increase, they are still cheaper than the current cheapest fixed rate mortgage on offer over the same term.

The current view is that there will be further increases, although we do not expect them to be as frequent as they have been in the past months.

If you would like advice on your current mortgage or would like to discuss how this might affect your plans to purchase, please contact us at Connaught Private Finance on 020 3805 3035 or email This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 1897

- Vimeo Video ID: 774123321

Going into Q3, there were a lot of discussions regarding how the Prime Central London lettings market would perform. In a recent video, Head of Lettings at Berkshire Hathaway HomeServices London, Matt Staton, expressed that he was pleased with the market performance, which saw a record number of transactions across the prime areas of the capital.

Matt has noticed there has been a rise in rental prices during Q3, seeing an increase of rents by 15-20 per cent in comparison to the same periods for 2020 and 2021 – these now accurately reflect a pre-pandemic market, so prime London is returning to form.

You can watch Matt discuss Q3 and offer his predictions for the market in Q4 in the video below

LonRes’ Prime London lettings report

Landlords and investors can find more detail on the reasons behind the capital’s rent rises in LonRes’ most recent prime London market update.

LonRes reports that new instructions were down by 21 per cent in Q3, while at the same time, there were 29 per cent fewer properties under offer. This has resulted in an overall drop of 43 per cent in lettings transactions for the quarter when compared with last year.

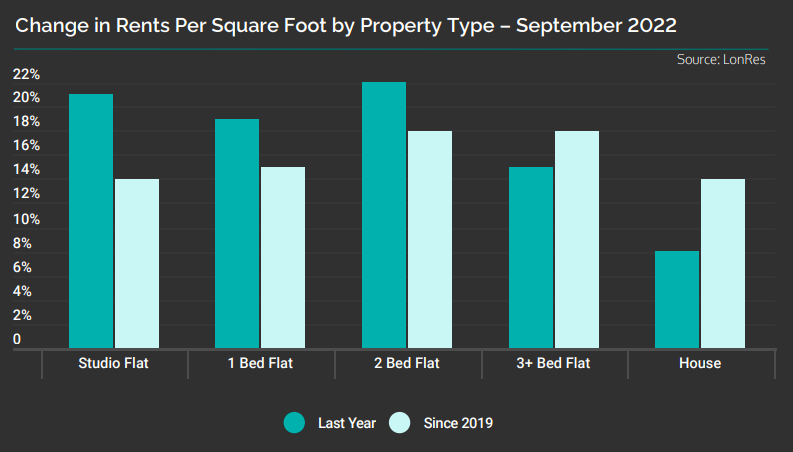

Rents are rising across the board, the rate of increase varies, depending on the property size and type but studios have seen a 21 per cent rise, one bed flats up to 19 per cent and two bed flats have risen by up to 22 per cent. Two and three bedroom flats have seen the largest price rise since 2019 (18 per cent), being higher than the growth rate record for house rentals in 2019.

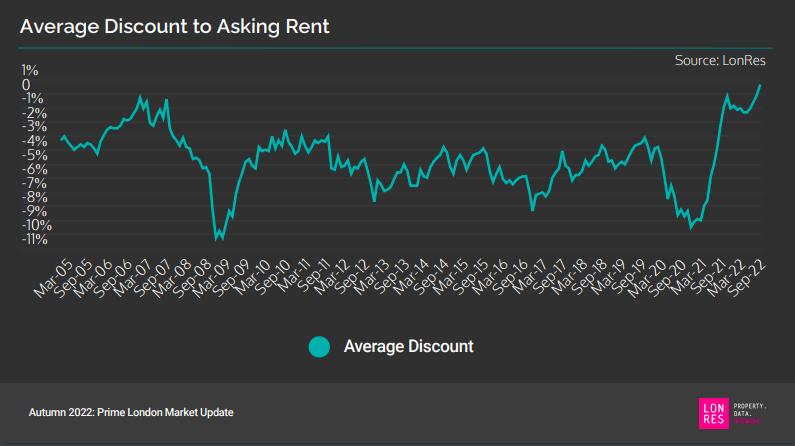

The decrease in available properties has also increased demand, for the first time in LonRes records, which began in 2005, the average discount to asking rents turned positive - tenants paid on average 0.6% more than asking when agreeing a new tenancy during September. Given the lack of available stock, it’s not surprising to find rental properties are being snapped up almost as soon as they are listed, time spent on the market is now close to a record low.

What will the lettings market look like in Q4?

The Bank of England’s decision to increase the base rate will inevitably affect property sales. Matt Staton has a few predictions as to how it might turn out, either pushing rents up even further or reducing the average.

One prediction is that the increase in interest rates might see homeowners deciding to sell their homes and returning to renting, thus increasing the competition for rental properties which has the potential to further increase the prices. Additionally, those who were considering to buy might alter their plans and continue to rent which will mean even less properties might be available.

More properties might come to the market which will stabilise the market, as mortgage-dependent owners might seek to sell their property but if they’re unable to achieve the price they’re after, they may end up renting the property instead.

With the current economic climate, there is no set path the market will follow, we may see the supply and demand level out as we enter Q4 but it’s clear that the appetite for Prime Central London is still as strong as ever.

If you are keen to take advantage of the growing prime central London rental index, why not get in touch with us? As leading central London estate agents specialising in luxury property, we are always happy to advise on the best investments for landlords. We can also support landlords with our highly efficient property management services.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2821

According to Rightmove, there are 443 estate agents in central London that handle property sales. While it’s great to have such a wide choice when you are selling your home, the challenge is to find an agent that’s right for you.

We believe the best way is to draw up a shortlist, then discover as much as you can about each estate agent’s fees and services. That’s why we’ve compiled a list of 15 key questions to ask before you sign on the dotted line.

1: What are your estate agents' fees for selling a house?

Before you sign up with the agent charging the lowest fees, check out what you can expect for your money. A lower fee could result in a more limited marketing campaign, which could in turn lead to fewer viewings.

2: Do you charge a withdrawal fee?

If you think your circumstances may change, it’s a good idea to check what the agent will charge if you pull out of the sale. By withdrawing before the transaction has completed, you may become liable to pay the agent’s expenses.

3: I'm unhappy with my current agent and thinking of switching. If a buyer introduced by my last agent made an offer through you, would I have to pay double commission?

In most cases, it’s unlikely that you will end up paying two sets of commission, but there are steps you can take to avoid this. If you’ve just left one agent and are asking another to market your property, explain the situation to your new agent.

4: Are there any hidden costs I should know about?

Check whether items such as property photos, marketing, floorplans and managed viewings are covered by the fee. Some agents will charge extra for things like 360º walkthrough videos.

5: What kind of contract will you use when you sell my property?

The type of contract will depend on whether you want to use just one agent, or several. The most common type of contract is ‘sole agency’, where you instruct just one agent to sell.

6: How do estate agents value houses?

Your agent should be aware of the many factors that can affect property values. You could ask them to explain why two seemingly identical houses in the same street might be priced differently.

7: What is my home worth?

The agent should be able to back up their assessment of your home’s value with evidence. Ask them to show you similar London properties that have recently sold for an equivalent price.

8: When is the best time to sell a house?

There are certain times of the year when the property market becomes more active, and a good estate agent will advise you of the best times to sell.

9: What's your approach to marketing? How will you advertise my property?

Encourage the agent to describe what they will do to market your central London property. Ask about their reach when it comes to advertising your home to overseas buyers.

10: Where will my property be listed?

At the very least, your listing should appear in major property portals, social media, printed publications and the agent’s own website.

11: How quickly will you be able to put my property on the market?

According to Zoopla, it’s possible to list your property within one to three days. In practice this often takes a little longer, to allow for images of the property to be taken and property details to be agreed.

12: How often can I expect to hear from you? And will you report potential buyers’ feedback after each viewing?

You should feel confident that your agent will maintain good levels of communication throughout the process. You should receive immediate feedback from potential buyers after each viewing.

13: How quickly do you find buyers for houses similar to mine?

Everyone hopes for a speedy sale, so it could be useful to know how long it has previously taken the agent to sell similar properties.

14: Your agency covers sales and rentals. Are you more active in property sales or lettings?

As you are selling your property, you may prefer to avoid an agency that seems to be more focused on the lettings side of their business.

15: What makes you different from any other agent?" "Do you have any recent client testimonials?

Ask the agent to tell you why they believe their service is better and more effective than their rivals. Read the testimonials on the agent’s website and don’t forget to research Google and TrustPilot reviews.

When selling your London home, you should look out for an agent with a strong reputation and a great track record for selling similar properties. If we can help with your home moving plans, we would love to hear from you.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2956

We know that serving an eviction notice is never easy for a landlord. Even the most straightforward evictions can cause stress and anxiety for both landlord and tenant. But the eviction process could become considerably more complex if - and when - the proposed Renters’ Reform Bill is finally voted into law.

During the recent political upheaval - which saw LIz Truss voted in as Prime Minister, swiftly followed by her resignation - doubts were raised concerning the fate of the promised new reforms. However, a government research briefing published on 24th October confirmed that the reading of the Bill is still scheduled to go ahead.

Under the new laws, Section 21 of the Housing Act 1988 – which permits ‘no-fault evictions – will be jettisoned. The new legislation will instead allow tenants to stay on indefinitely, provided they do not breach their tenancy agreements.

In 2021/22, Londoners saw an 81 per cent rise in no-fault evictions. While the proposed legislation is undoubtedly good for tenants, the changes could create challenges for landlords.

Here we examine what landlords can currently do when dealing with problematic tenants. We’ll also look at what you can expect when the new Bill becomes law.

What are the signs of a bad tenant?

The words ‘good’ or ‘bad’ can be highly subjective, but generally, if your tenant is doing one or more of the following, you have a problem:

Not paying rent, or regularly making late rent payments

- Damaging the property - either deliberately or through negligence

- Failing to take care of outdoor spaces they have signed up to manage

- Carrying out illegal activity on the property

- Causing disputes with neighbours, or disturbing neighbours

- Keeping pets at properties where a 'no-pet' clause appears in the agreement

- Allowing extra people to live permanently at the property

- Sub-letting the property without permission

Very often, problem tenants won’t be first-time offenders and that’s why it is vital to follow up all references when you are taking on a new tenant. These days sophisticated screening services are available to carry out background checks.

First steps

If your tenant is causing problems, the first thing to do is simply talk to them. Try to resolve the situation if possible, for instance, by setting up a rent repayment plan.

Always follow correct procedures, even though the tenant is not holding up their side of the agreement. For example, don’t be tempted to abuse the rights of a landlord to enter a property by turning up unannounced.

A lot of problems can be avoided by having a well-written lease. The lease should clearly set out basic rules and maintenance expectations. Wherever possible, swap legal jargon for plain English so the requirements are easy to follow.

A detailed move-in inspection, carefully documenting your property’s condition, should be carried out before the tenant moves in. Take time-stamped digital photos and videos of everything, from walls to kitchen units to sanitary ware. This makes it easier to present your case in the event of damage.

Make sure your tenant’s deposit is protected in one of the three official deposit protection schemes registered in England and Wales. If you do not, and your tenant takes legal action, the court could compel you to protect the deposit, issue a fine or rule that your tenant has the right to stay on after the tenancy agreement ends.

It probably goes without saying that you should also conduct regular inspections as the tenancy proceeds. But don’t forget to give tenants adequate notice of inspection dates.

How to report bad tenants to credit bureaus

Tenants who want to maintain a good credit rating can now link their rental payments to leading credit bureaus such as Equifax and Experian. Equally, landlords can report missed payments to the same organisations.

To register, you will need to provide personal information together with your business details. Once you have signed up, you will be able to report any late or missed rent payments.

Most tenants will be keen to maintain a high credit rating. The knowledge that they may be reported if they default could be enough to keep rent payments coming in on time.

How can a landlord evict a bad tenant?

In England, you will need to follow different procedures for eviction, depending on the type of tenancy agreement you use. Currently, you must give at least two months’ notice for an Assured Shorthold Tenancy (AST), but the period can be longer for different types of tenancy.

When can I issue a Section 21 or Section 8 notice? A Section 21 notice can’t be used during the term of the tenancy, only if your tenant won’t move out when the fixed term comes to an end. Section 21 can also be issued when a fixed term tenancy rolls on to become ‘periodic’ (a tenancy with no fixed end date). Currently, landlords do not need to give a reason for eviction.

If the tenant has broken the terms of their agreement, this calls for a Section 8 notice. Under Section 8 a Landlord must appear in court and argue their case to regain possession. In pursuing Section 8 you may need the services of an eviction specialist or solicitor to bring about a successful eviction.

What will evictions look like in future?

Under the proposed Renters’ Reform Bill, all assured tenancies, or assured shorthold tenancies, will become periodic tenancies. A landlord will only be able to evict a tenant under reasonable circumstances, which will be defined in law. This might include needing to sell the property, or a landlord having to remove their tenants in order to live on the premises themselves.

In order to make it easier for landlords pursuing legal routes, the government has promised to speed up court proceedings. boost mediation services and improve on current grounds for possession.

Hiring a Property Manager

We all lead busy lives and you may decide that you need some help with the tasks and responsibilities that flow from being a landlord. So how should you go about finding a good Property Management Service?

Always look out for a company with a strong reputation. Ask friends and colleagues for their recommendations, explore online reviews and, if possible, visit managers’ offices in person to get a feel for how they operate.

Check out the full range of services they offer. The point of employing a manager is to leave you free to get on with your life, so the more responsibilities they can take on, the more you will be able to relax. A good management company should take care of everything, including tenant screening, advertising, maintenance and legal compliance, as well as all the paperwork.

When you are interviewing prospective managers, don’t forget to ask about their marketing activities.

- Will they take high quality photos and videos of your property?

- Will they list it on the leading property portals?

- Do they use social media to maximise exposure?

- And do they have established networks - both nationally and globally - they can use to attract the widest possible audience?

How do I keep up to date with new lettings laws?

There are plenty of online sources – including the official government website - to help you stay up to date with laws that affect landlords. But be aware that the anticipated changes (which will be voted on in parliament no later than May 2023) herald a huge step-change in lettings legislation.

If you would like advice on becoming a landlord or help to find a tenant for your rental property, why not get in touch with our prime london estate agents? We also offer a comprehensive Property Management Service to maintain your rental property in perfect condition.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2390

As prime central London rental prices rise, driven by a shortage of housing stock, buy-to-let properties in the capital are an increasingly attractive proposition for would-be landlords.

Most landlords are savvy investors who understand and respect the needs of their tenants. However, there are a few individuals who sidestep good business practices in favour of making an easy profit.

Typically, a nightmare landlord will disregard important safety checks, ignore tenants’ requests for repairs and even threaten eviction when the going gets rough. You may feel intimidated by your landlord’s attitude, but don’t give up.

Here we include some advice for tenants dealing with the worst landlords, including how to report a landlord for harassment.

When Do You Need Help?

Here are some of the issues you could face when dealing with a dodgy landlord:

- Failure to carry out repairs for which they are responsible.

- Not implementing important safety checks, such as annual gas and electricity inspections.

- Harassing you (for example, by entering the rented property without your permission).

- Discriminating against you by charging higher rent or deposit because of your ethnicity, nationality, age or gender.

- Trying to force you out of the property unlawfully.

- Not protecting your deposit in a Deposit Protection Scheme.

- Unreasonably asking to deduct money from your deposit at the end of your tenancy, triggering a tenancy deposit dispute.

What are my Landlord’s Responsibilities?

Your landlord has a duty of care towards you, your family and any visitors. The most basic expression of that care is providing you with a safe and healthy place to live. If you don’t believe the property is fit for human habitation and your landlord doesn’t respond to your concerns, your local London council can help. For problems involving damp or mould, pest infestations or other health-related issues, the council can call in their environmental health team.

Your landlord has a duty of care towards you, your family and any visitors. The most basic expression of that care is providing you with a safe and healthy place to live. If you don’t believe the property is fit for human habitation and your landlord doesn’t respond to your concerns, your local London council can help. For problems involving damp or mould, pest infestations or other health-related issues, the council can call in their environmental health team.

What Can my Landlord Deduct from the Rental Deposit?

Here are the most common reasons why landlords deduct money held by a tenancy deposit scheme in the UK:

- There is unpaid rent at the end of the tenancy

- You have outstanding bills linked to the property – for example, if the landlord has to put their own money into a prepayment meter

- Items belonging to the landlord are missing

- There is direct damage to the property and any contents owned by the landlord

- You have neglected to care for, or maintain, parts of the home and this has caused indirect damage

- You have left the property in an unclean, unhygienic state at the end of tenancy

- You have failed to maintain certain facilities – for example, a garden area (this could be subject to the agreement in your contract)

- You have left unwanted belongings at the property after the keys have been returned (without arranging to pick them up)

One grey area is the question of what constitutes ‘fair wear and tear’ when it comes to a deposit dispute. The UK housing charity Shelter defines it as "unavoidable change in a property over time caused by normal everyday living."

Fair wear and tear could include things such as small scuffs to paintwork, faded drapes or furnishings, worn flooring or frayed carpets.

When you raise a dispute on the basis of ‘fair wear and tear’, the dispute resolution service will collect information from both sides (i.e. you and the landlord) before reaching a decision.

It’s therefore important to arm yourself with as much information as you can before you move out.

Just before you leave, take photos that clearly show the condition of the property, including any furniture or equipment provided as part of the rental.

What if my Landlord is Trying to Evict me Illegally?

In law, your landlord can’t evict you for simply making a complaint, although some nightmare landlords may try to do so (this is known as ‘revenge eviction’). An eviction is illegal when your landlord or their representative tries to make you leave your rental accommodation by means of threat or intimidation (for instance, by cutting off the electricity or water supply or changing the locks).

Your local London council will act if you fear you will be illegally evicted. Their officers can talk to your landlord and could even prosecute if the landlord has broken the law. However, it’s important to make contact with the appropriate local authority housing or environmental health team as soon as possible (don’t forget to make a note of your assigned officer’s number in case of emergency).

Steps to take in the Case of a Complaint or a Dispute

Talk to your landlord: landlord and tenant disputes are never easy, but the best approach is to calmly talk through the issues with your landlord. Before you enter into any discussions, read up on your rights and make sure you have any evidence required to hand. If your landlord refuses to discuss the matter or won’t admit there is a problem, you could seek further advice.

Bodies such as the Citizens’ Advice Bureau or the London Renters’ Union can offer help for tenants with difficult landlords. The housing charity Shelter is also a good source of information for renters. However, don’t be tempted to withhold rent payments during a dispute, as this could provide your landlord with legal grounds for eviction.

Make a formal complaint: If the landlord doesn’t respond after you have discussed the problem, you could make a formal complaint. Put everything in writing, an email or a letter.

You have a legal right to know your landlord's contact details, so if you can't find them on your tenancy agreement or in your rent book, you should ask the landlord or their representative for that information. Be sure to keep copies of all correspondence.

Escalate your complaint: if you do not receive a response within a reasonable timeframe, you can escalate the complaint by informing your local authority. In London, you can follow the steps provided by the London Assembly, using a simple online form to describe your situation. As a final resort, you can also take court action by making a claim against your landlord.

Feeling Confident as a Tenant

Tenants should feel confident that they will be listened to and treated fairly. The proposed Renters’ Reform Bill promises to revolutionise renting by banning ‘no fault’ evictions, abolishing fixed-term tenancies and creating a landlords’ register.

The government is also preparing to "name and shame" nightmare landlords on its social media platforms. It will do this by publishing findings by the Housing Ombudsman Service that exposes bad practice. In some cases, the Secretary of State's office will intervene directly to follow landlords’ progress, to ensure they are following the official recommendations made after their cases were investigated.

Meanwhile, renters looking for London properties can get some reassurance when they sign up with experienced letting agents or landlords who have established a positive reputation within the capital’s lettings market.

If you are searching for estate agents in central London who can help, why not get in touch with us?

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2231

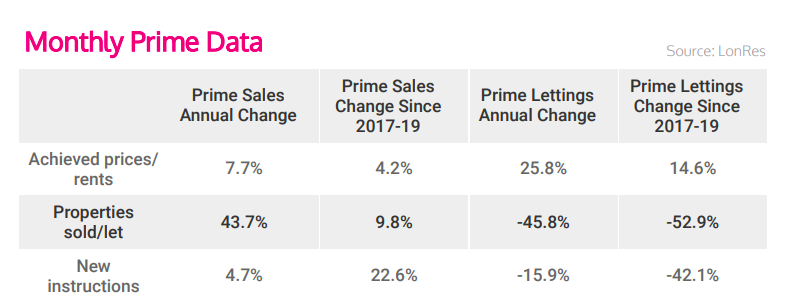

The latest update on the prime London property market reveals some positive news for vendors and investors, as summer sales figures show a significant rise above pre-pandemic levels.

In the lettings sector, a shortage of housing stock is driving up rental costs. Figures for July show that year-on-year, the number of new lets was down by 45 per cent.

Rising interest rates, combined with increases in the cost of living, have caused considerable anxiety for homebuyers and renters in the past few months. But in spite of these wider economic concerns, the central London property market has remained remarkably resilient.

What’s happening to Prime Central London property prices?

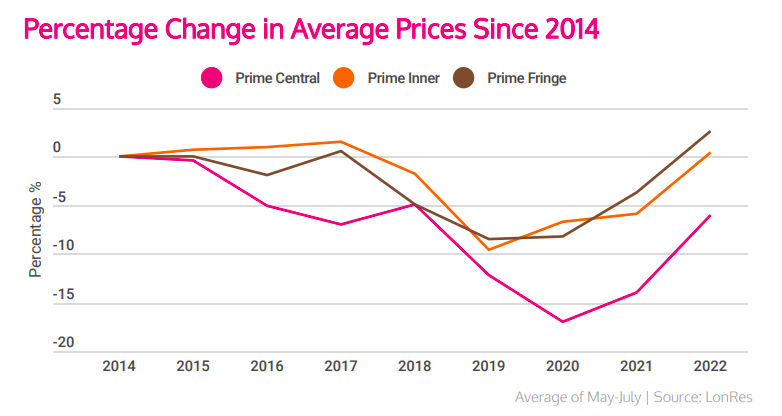

In July, London property sales were 9.8 per cent higher than average figures for 2017-19, with prices rising by 4.2 per cent. This represents the highest growth since January 2015. The chart below shows the change in average prices for Prime Central, Prime Inner and Prime Fringe sectors since 2014.

The years prior to the pandemic (2017-2019) saw demand for London properties fall away, and this resulted in a drop in average house prices. However, the introduction of the Stamp Duty Holiday in late 2020 kickstarted a reversal in fortunes for the capital’s property market.

Although the end of the Stamp Duty discount in September 2021 caused a brief lull in sales activity for properties under £5m, growth remained strong at the top end of the market.

Over the past year, demand has continued to grow and this has resulted in a 43 per cent increase in the number of properties sold (compared with 2021 figures). This dramatic upswing is partly due to the return of overseas buyers, keen to enjoy the extra value offered by a weakening pound. It also reflects the fact that many homeowners who left the capital during the pandemic have now moved back to London.

What can we learn from current London house price trends?

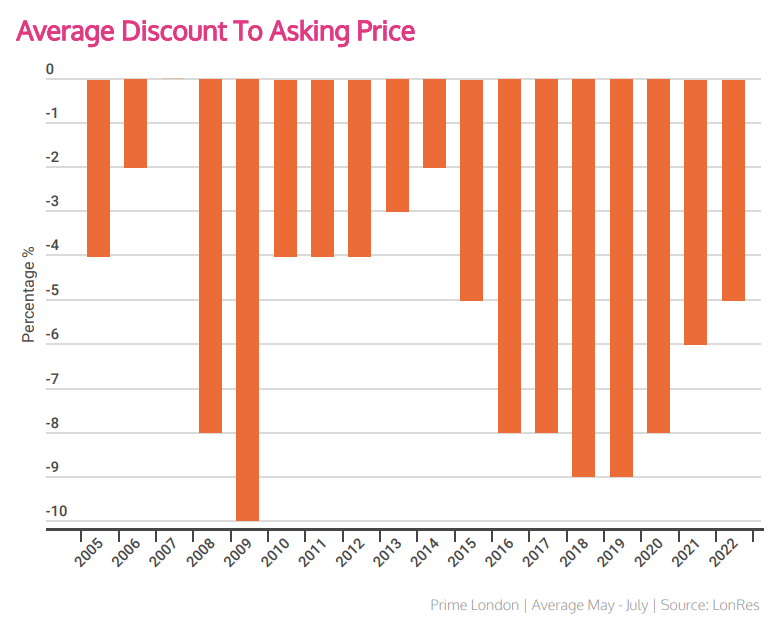

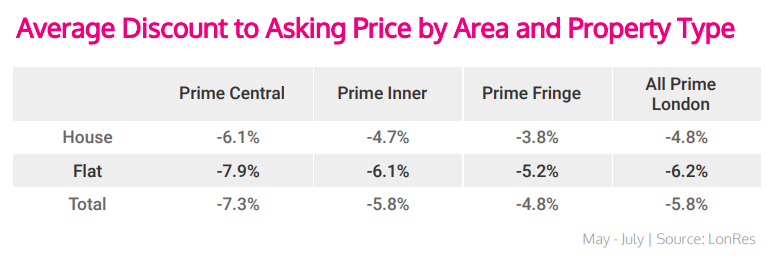

Recent property market growth has impacted the average discount to asking price. Buyers can no longer expect the discounts of up to 10 per cent they enjoyed in 2018/19. Instead, they are currently settling for an average asking price reduction of around 5.8 per cent.

This shows a closer alignment of buyer and seller expectations. Sellers no longer insist on listing their properties at prices achieved at the top of the market, while buyers understand that low offers are less likely to be accepted.

The charts below illustrate the average discount to asking price, by year and property type.

How has the London rental housing market been affected?

Lonres, the data platform for property professionals, has reported that figures for new instructions, under offers and new lets fell well below normal over the summer months.

One of the greatest issues facing the London lettings market is the lack of available rental property, and this shortage has been compounded by the current economic uncertainty. Existing tenants, wary of rising rents, are choosing to save money by renewing their tenancies instead of moving on.

As a result, new applicants are forced to compete for the few remaining rental properties and consequently face tougher tenancy terms and higher rents.

Autumn is traditionally a busy time for the lettings market. Still, the imbalance between supply and demand could have a negative effect on the growth in activity normally seen during this period. Landlords entering the market or expanding their portfolios at this time can look forward to high rental yields and strong demand from tenants.

How can I find the best deal this autumn?

Whether renting or buying a property in London, you will benefit from getting the right advice. As leading estate agents in Central London, we specialise in luxury properties that make great homes and attractive property investments. Whether you are looking for a high-quality, new build apartment or a traditional townhouse, why let our expert sales team take care of the search?

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2155

The signature scent of a new build home is a heady mixture of fresh paint, aromatic wood and new carpet: and it’s surely one of the reasons why we find new properties so attractive.

A newly-built home is move-in ready, without the telltale signs of previous occupancy you might find in an existing property. But are there other, more compelling, reasons to invest in a new build home?

Here we examine the benefits of buying a new build and other considerations when purchasing directly from a developer. What are the pros and cons of buying a new build?

The Pros Include:

No chain: as the first ever owner of your property, you’ll avoid the stress caused when your property purchase gets bogged down in a slow-moving chain of buyers.

Convenience and energy efficiency: High specification new builds incorporate the latest technology, with ‘smart’ features that make life easier and more convenient. You should also benefit from lower energy bills: over 80 per cent of new build homes have an EPC rating of A or B.

Add your own stamp: when you buy off-plan, you may be able to decide on certain aspects of the build. This could give you a choice when it comes to fixtures, fittings and finishes. You could even be invited to adapt the layout to suit your lifestyle.

Tempting incentives: in order to encourage buyers, some developers will add in extras, such as the cost of new carpets or paying the Stamp Duty on the sale.

An advantage for first-time buyers: for many people, a new build property offers hope of getting on the property ladder through schemes such as Help-to-Buy and Shared Ownership (both are only available if you purchase a new build).

Warranty assurance: all new build property comes with a warranty, so you can expect that any initial problems will be dealt with at no cost to you.

The Cons Include:

Lack of space: certain developments are constructed in a way that allows the maximum number of properties to be built on a limited footprint. Always look for reputable developers who won’t cut corners when it comes to room size or storage.

Service and maintenance charges: make sure you are clear about the costs of all ongoing charges – for repair, service, maintenance and block management - before you sign the contract. If you are buying an investment property to rent out, bear these costs in mind when you calculate the potential rental income.

Snagging: even the highest quality new builds will have snagging issues. Even if it’s something relatively small, like a squeaky door or a faulty tile in the bathroom, you’ll want to get it fixed before you move in. Arrange for a snagging survey carried out by a professional as early as possible.

Are New Builds a Good Investment?

You can expect to pay more for a new property. Usually, a new build premium is included in the price of your new home. However, premiums on new build properties in London (costing anything from 0 – 16 per cent) are often lower than premiums in other parts of the country.

A new build property may be one of the few options available when you are trying to buy a home in a sought-after part of London. In areas where properties are in high demand, it’s highly likely that your purchase will turn out to be a good investment. This is particularly true of popular areas such as Marylebone, where older properties rarely become available, and new hotspots like West End Gate and Chelsea Creek.

In places where there is less demand, the value of your investment may depend on the length of time you intend to hold on to your property. If you are planning to sell it within a couple of years, it’s unlikely that you will reap a substantial profit on the sale. However, if you are prepared to wait for five, six years or even longer, you should be able to benefit from your investment.

If you are looking for new properties in a luxury development, Prime Central London is a great place to start your search. World-class cultural facilities, exclusive stores and an array of open green spaces make London a highly desirable place to live and work.

At BHHS London, we work closely with some of the best luxury developers in the capital. Why not browse our new build properties for sale below and book a viewing?

Sign up for our VIP monthly newsletter

Get the latest ideas, insights and inspiration It's free