As one of Central London’s most highly regarded estate agents, we’re often asked to share our views — here are a few of our most recent pieces.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 4082

Section 32 of the Immigration Act 2014 sets out clear guidelines for landlords renting out property, with a code of practice known as ‘Right to Rent’. Under these measures, landlords must complete a verification process by obtaining, checking and recording identity documents provided by each prospective adult tenant.

What is the Purpose of Right to Rent checks?

The rules were brought in to ensure all people renting in the UK have the legal home office permissions to do so. It is therefore a legal requirement for landlords to check whether applicants are eligible to rent a residential property as their only, or main, home.

This also applies to tenants sub-letting all, or part of the property and to owner/occupiers taking in a lodger.

Who has the Right to Rent?

There are three groups of people who have unlimited rights to rent:

- British citizens, Irish citizens and those who have been given rights to live in the UK or granted settled status with no time limit.

- Individuals with verifiable, time-limited rights can also be allowed to rent. This includes applicants with pre-settled status.

- Individuals applying to rent a property are required to provide identity documents to a landlord or letting agent in the same way that they would present them to a border control official at an immigration checkpoint.

What do I need to do as a Landlord?

A landlord Right to Rent check involves inspecting the identity documents of anyone aged 18 or over who intends to live in your property as their only, or main home. You must carry out a check on each adult, even if they are not named on the tenancy agreement.

This applies even when there is no tenancy agreement or the agreement is not in writing.

Landlord’s checklist for Right to Rent:

- Ask prospective tenants to supply original documents that prove they have a right to be in the UK.

- Make an inspection of the documents, ensuring they are valid, original documents (the applicant must be physically present at the time of checking*).

- Make copies of the documents and record the time and date when the check was done.

- Undertake follow-up checks on relevant dates (for example, when the tenant’s visa is due to expire).

Under a temporary arrangement put in place in response to the Covid-19 pandemic, you can currently use an online service to check some applicants’ documents digitally. However, this facility will not be available after 30th September 2022.

You should record the full names and dates of birth of all adults planning to live on the property as part of the proof of right to rent. Also, note the names and birth dates of all children under 18 who will be living in the household.

The scheme doesn’t apply to children, but the landlord must be ‘reasonably satisfied’ that anyone introduced as a child is under 18. There is no requirement to carry out a Right to Rent immigration check when a child living at your property reaches the age of 18. But in the event of any follow-up checks on the household, this individual should be included as an adult.

How do I know which Right to Rent documents to Request?

If your prospective tenant has been issued with an e-visa you will need to use the Government’s online service to verify their status. When carrying out a manual check, you will need to refer to the official list of acceptable documents (page 48 of the ‘Landlord’s Guide to Right to Rent Checks’).

The verification process should be approached in the same way for the UK and non-UK citizens. The Government’s landlord guide urges landlords and letting agents to: “be consistent in how they conduct right to rent checks on all prospective tenants, including those who the landlord believes is more likely to be British citizens.”

What Should I do if my Tenant’s Visa has Expired?

If the occupant of your property continues to rent without a valid visa, you are required to report them to the Home Office.

If you are found to have permitted a tenant with no legal status to live on your property, you could be sent to prison for five years or receive an unlimited fine.

Further steps

Our estate and letting agents in Central London are always ready to advise clients on matters relating to letting a property. If you need any help with Government Right to Rent checks or any other aspect of buying or letting, our property specialists would be happy to advise you.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2981

“Every freehold house we've sold during the last month has been subject to multiple offers, all have gone above the asking price and in some cases as much as 5% above asking”, Sales Director, Joe Le Beau explains, with reference to the latest London property prices. He adds that 2022 has turned out to be “the year for house sales.”

Joe says he and his team have seen both domestic and international buyers display an “insatiable appetite” for London residential properties this year.

What are the current London house price trends?

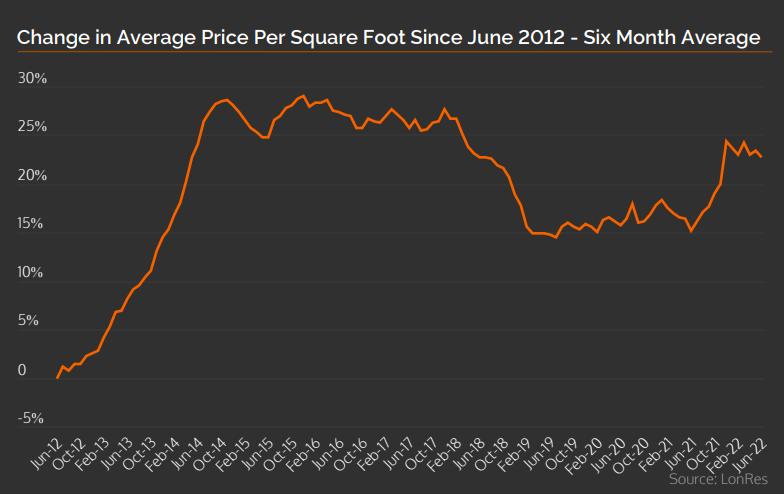

Joe Le Beau’s comments chime with a recent report from LonRes, the primary data source for London property professionals. According to Lonres’ summer 2022 report, prime central London property prices are still rising.

Ever since the pandemic, we have seen a significant upward trend in property values, and prices continue to rise. At the top end of the London housing market (homes priced at £5 million plus) LonRes notes that sales in June 2022 were 11 per cent higher than those recorded for the same period last year.

Joe Le Beau observes that the demand for houses has been exceptionally strong this year. Although he has seen “a good level of flat sales”, he comments that apartments valued under £2 million are moving more slowly than they did six to eight months ago.

What has driven up housing market prices?

In the years before the pandemic, demand for homes in prime central London areas dropped, as buyer confidence was affected by higher taxation and concerns about Brexit.

Indications of a rebound in early 2020 were short-lived, as the first national pandemic lockdown was announced in March. But after the property market reopened in the summer of 2020, London house prices began to bounce back. Helped by factors such as the Stamp Duty holiday, they quickly rose above pre-pandemic levels.

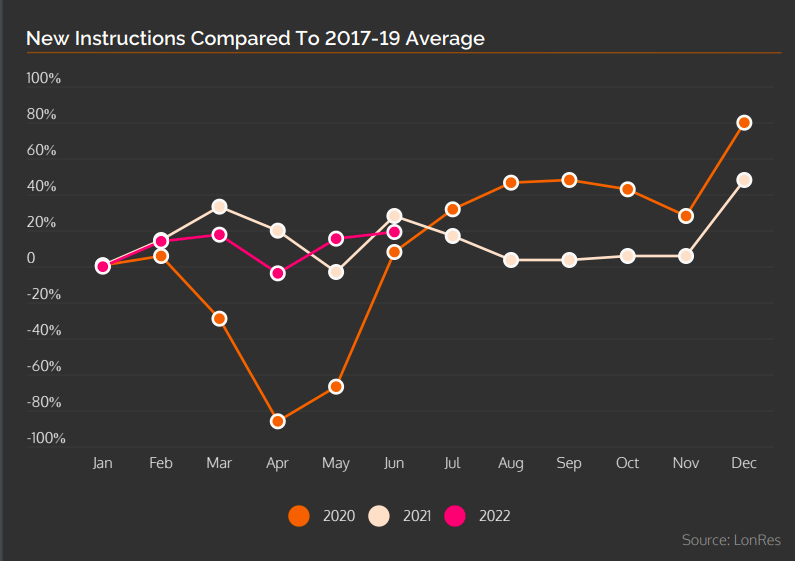

One unexpected consequence of the housing market boom is that it has reduced the number of properties available for sale, and this shortage has helped to keep the market buoyant during the first six months of 2022.

Will housing prices remain high in 2022?

Joe Le Beau acknowledges that mortgage-dependent buyers may have “concerns over rising interest rates and the cost of living generally.” He recommends that buyers requiring a mortgage should start looking for London properties right away. His advice is to “lock in a two or five year fixed term now", as rates are expected to rise in an attempt to damp down inflation.

LonRes notes that many buyers and sellers may be waiting to see what will happen in the autumn when the impact of the cost of living crisis on the housing market is likely to be clearer. Their summer report suggests that consequently, annual price growth may slow during the second half of 2022.

However, LonRes predicts that some investors may turn to property as a defence against inflation. The report adds: “This could sustain buyer demand in markets like prime London for longer than elsewhere.”

Buying wisely in 2022

Traditionally, London property has been viewed as a haven at times of global insecurity, so it is not surprising to see that LonRes is predicting an increase of interest amongst investors. The pound’s declining value is already attracting more overseas buyers, particularly investors from the Middle East.

As overseas investors return to the market, it is possible that we will see prime central London property prices defy the predicted slowdown and rise more quickly than expected during the second half of 2022. If you are thinking of buying a property in central London, the best advice may be to act now rather than wait for the market to cool.

If you are looking for a property in central London as an investment or a first or second home, then Joe Le Beau and his team of Prime Central London Estate agents will be happy to assist you.

We can also help you secure a suitable mortgage through our mortgage advisors, Connaught Private Finance.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2218

We know there’s a lot to consider when you are buying a second home in the capital. As you view a succession of properties for sale in London, you’ll find yourself considering a host of questions: What’s the area like? Are there good public transport links? Can I afford the asking price?

Your new pied-a-terre or buy-to-let will be a big investment, so it’s right to ask questions. But as you pore over the listing details, making notes to check on energy efficiency, security and concierge services, there’s one thing you may forget to ask: “How much is Stamp Duty on a second home?”

This question is important because Stamp Duty can add a significant amount to the overall cost of the property.

How Much are Second Home Stamp Duty Rates?

Calculate your Stamp Duty

Enter your purchase price, to calculate the stamp duty.

Stamp Duty Land Tax (SDLT) is a progressive tax payable when you purchase a freehold, leasehold or shared ownership property costing over £125,000.

Anyone in England, Wales, and Northern Ireland buying a new home will pay the standard rate of SDLT. (the only exceptions are for first time buyers). However, a higher rate is imposed for property owners purchasing buy-to-let properties or second homes. In those cases, buyers will be required to pay a 3 per cent surcharge unless they are purchasing a property that is exempt.

The table below shows that as the property price bracket increases, the SDLT rate also rises.

A buyer purchasing a £1.5m apartment as their main residence will pay £86,250 in SDLT. However, using a second property stamp duty calculator, you’ll see the amount of Stamp Duty payable on a second property is 3 percent higher.

Consequently, for anyone buying that £1.5m apartment as an additional home or buy-to-let, the Stamp Duty payable on a second property is £45,000 more: making a total of £131,250 above the agreed price.

Are there Exemptions and Ways to Avoid Paying the Second Home Surcharge?

Some properties are exempt from Stamp Duty, but the list is limited. It includes caravans, mobile homes, houseboats and properties costing less than £40,000.

There are a few circumstances in which the higher rate won’t apply. For example, if you happen to own a portfolio of properties but are simply replacing your main residence.

What if the property you buy is destined to become your primary residence, but you haven’t sold your old home yet? You will pay the higher rate in this case, but you can apply for a refund when the original property has sold, using HMRC’s online form. However, you must ensure your old home sells within 36 months (three years). HMRC will allow a longer period for the property to sell a) if the impact of the pandemic prevented the sale or b) if the sale was halted due to action taken by a local authority.

If you live in the UK but own a property (or a part of one) costing £40,000 or more anywhere else in the world, you will still be liable to pay the higher tax rate when you buy a further property. The same applies if you are an overseas resident who owns a property abroad. Buyers are treated as non-UK residents for SDLT if they are not present in the UK for 183 days or more in the 12 months before the date of the property purchase.

Extending a lease

You could be forgiven for thinking that simply extending a lease on another property that you own (such as a buy to let or pied a terre) wouldn’t make you liable for the additional 3 per cent SDLT.

Unfortunately, it does. Provided the payment doesn’t fit within the nil rate band and the premium agreed is £40,000 or over, you will be charged 3 per more for the transaction.

Stamp Duty, Partners and Family

You will not pay SDLT if the property you own has been left to you in a will.

If you are married or in a civil partnership, you are considered a single financial unit by HMRC. What if you live with your property-owning partner without legal ties and don’t own property yourself? In that situation, you can avoid the higher rate of SDLT, provided your partner has no financial involvement in the transaction.

Couples who are separated are treated as separate entities regarding their property ownership. That means each spouse can buy a property and it won’t be linked financially to any property their ex-partner owns.

Do you own a home but want to buy a property for your child’s use? Even if you’re not going to benefit from the property yourself, in the taxman’s view, it’s still your property, so you will have to pay the extra 3 per cent.

Still confused?

Stamp Duty rules can get complicated, particularly for globetrotting families who spend their time moving between several properties (and therefore may not consider they have one ‘main residence’). If you would like to talk through your Stamp Duty situation, why not get in touch with one of our property experts? We would be more than happy to help.

Contact us and let us know what type of property you are looking for.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2689

- Vimeo Video ID: 729185527

As geraniums bloom in the capital’s window boxes and the Royal Parks explode with summer colour, the central London rental market is also enjoying a burst of renewed vitality.

In sharp contrast to the challenging market conditions we experienced during the pandemic, recently demand for rental properties has significantly exceeded supply.

Here we explore the reasons why London lettings are enjoying a renaissance. We also publish the latest update on the London lettings market by our Head of Lettings, Matt Staton, which offers some good news for both renters and landlords.

A Struggling Market

A year ago, the London rental market was struggling to recover from the challenges of the pandemic. International students had returned home, overseas visitors had disappeared, and many of the capital’s business premises were closed.

Meanwhile, Londoners tired of successive lockdowns had moved away from central areas in search of larger properties with more indoor and outdoor space.

The result was a raft of empty properties in prime central London areas, and rents dropped accordingly. According to Rightmove, by March 2021, the average rent in central London areas such as Knightsbridge and Notting Hill had fallen by 17% to 19%, respectively (set against March 2016 figures).

The seriousness of the situation forced some landlords to sell their properties, leaving fewer homes available to rent.

Why is the Demand for Rental Properties So High?

More recently, the cost of living squeeze has encouraged tenants to stay on in their rented properties, to avoid higher rents and moving costs. These factors have prevented normal levels of rotation within the market, causing central London rental prices to rise.

Last month, Matt Staton reported that demand for rental accommodation in the capital had risen by 40%, while the amount of available rental accommodation had dropped by 60%.

The huge surge in applicants looking for properties to rent in London is mainly due to the high demand that built up during the pandemic. Renters were reluctant to move for a variety of reasons, including job insecurity. Recently, however, they have been returning to the market in large numbers.

Are Rental Properties Still in Short Supply?

In his video update, Matt Staton comments that there are now more rental properties coming on to the market, as more landlords are willing to let properties and more tenants are deciding to move on. In particular, those tenants who found homes last year when prices were already starting to recover, are now starting to move on and look for new properties.

This should improve rotation in the lettings marketplace, leading to more choice for tenants.

What is the Future of the London Rental Market?

The shortage of new rental properties coming to market has pushed rental growth to 28.3 per cent. Rents are currently 5.6 per cent higher than the previous peak, recorded in 2018.

This year, lack of available stock is likely to underpin further rental growth in prime central London areas. However, the rising cost of living may eventually cause rental levels to settle.

Despite challenging financial headwinds and the current geopolitical uncertainty, there are reasons to feel optimistic about the prime London lettings market. In a recent ‘Rent Expectations’ survey by the Royal Institute of Chartered Surveyors (RICS), 59% of respondents said they anticipated further rental growth.

The increased availability of properties and the strong rental returns we have achieved through our lettings networks is positive news for tenants and landlords alike. If you want to let your property, or are considering a buy-to-let investment, or need help finding your ideal new home in a competitive marketplace, we would be delighted to hear from you.

Why not get in touch with one of our experienced property specialists and let them know what you are looking for?

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 2694

The first quarter (Q1) figures for 2022 have produced some encouraging signs of recovery for prime London property prices and central London lettings. Over the last three years, property prices have risen by 10.9 per cent, to just 4.4% below their previous peak in 2016. Recently we have seen more sale properties go under offer – a positive indicator of overall market health. At the same time, the London rental market has bounced back triumphantly, breaking LonRes records.

Sales Market Update

Prices in the three prime LonRes areas (prime central London, prime London and prime fringe) increased by an impressive 5.2 per cent over the year to Q1 2022. The highest growth recorded, at 6.8 percent, was for house prices in prime central London, while prime fringe came in at 2.5 per cent.

However, the latest quarterly figures for the London residential property market show that overall annual growth has slowed, with a slight fall of 0.02 per cent.

Contrast Between Flats and Houses

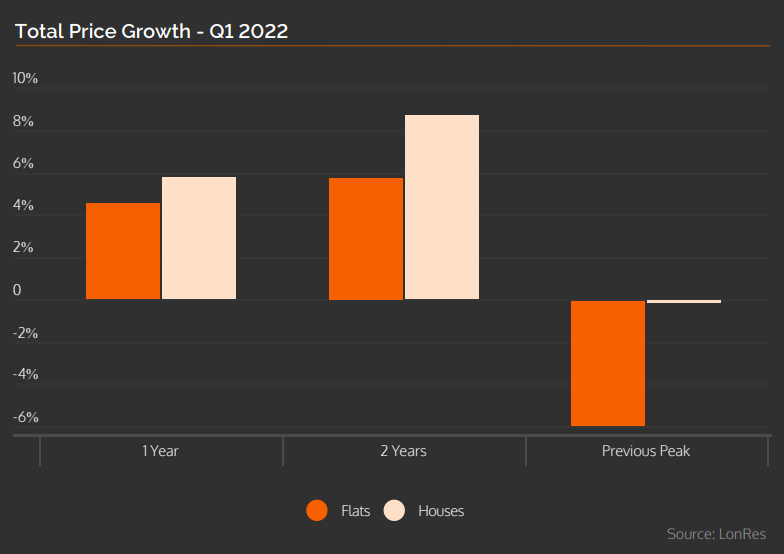

This dip in growth is the result of the continuing imbalance between the cost of flats and houses. During the pandemic, home seekers prioritised properties with home offices and outdoor space, and this trend continued after restrictions were lifted.

Both flats and houses have shown broadly similar growth levels over the past year (4.5 percent for apartments and 5.7 per cent for houses). However, the disparity between both property types becomes clearer when the statistics are compared with the previous market peak of 2016. House prices are now just one per cent below the 2016 peak, while flats remain almost 6 per cent below.

A Difference in Transaction Volumes

This year’s data may look less impressive without the inflated figures created by the 2021 Stamp Duty Holiday, but house transactions have exceeded expectations. The Q1 2022 transaction figures are just 0.9 per cent lower than the last peak in late 2013, although flats still lag behind the previous peak of early 2014, at minus 27 percent.

Sales have now reached levels similar to pre-pandemic averages. However, the number of homes that have recently gone under offer suggests that transaction figures will rise in the coming months.

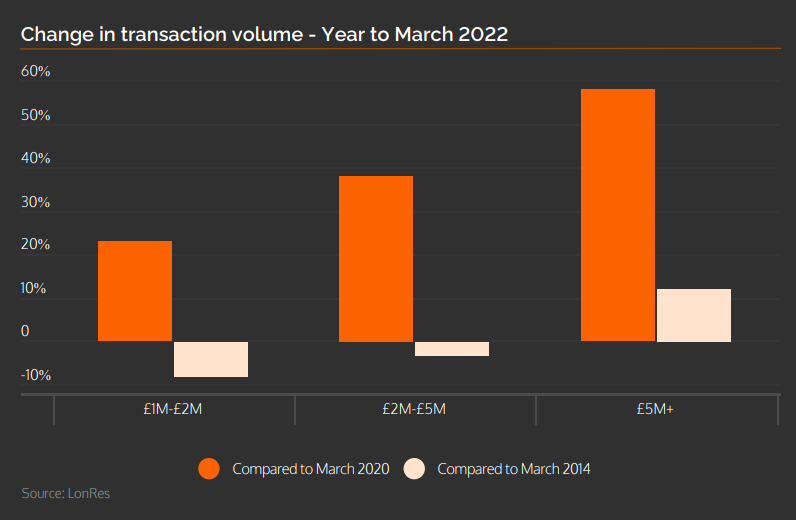

The chart below shows that price bands were also subject to variation. Transactions at the top end of the market were 58 per cent higher than those recorded just before the pandemic. They were also 10 per cent higher than the figure noted at the previous peak in 2014.

Activity levels for lower priced properties have also recovered well when compared with pre-pandemic figures, and current figures show they are just below their previous peak.

Lettings Market Update

The lettings market has seen exponential growth throughout the UK – largely driven by a lack of rental stock. The same is true for London rental properties, where demand has bounced back after a short-lived, pandemic-driven exodus. This has resulted in an overall annual growth rate of 22 per cent across all three areas of the prime London property market.

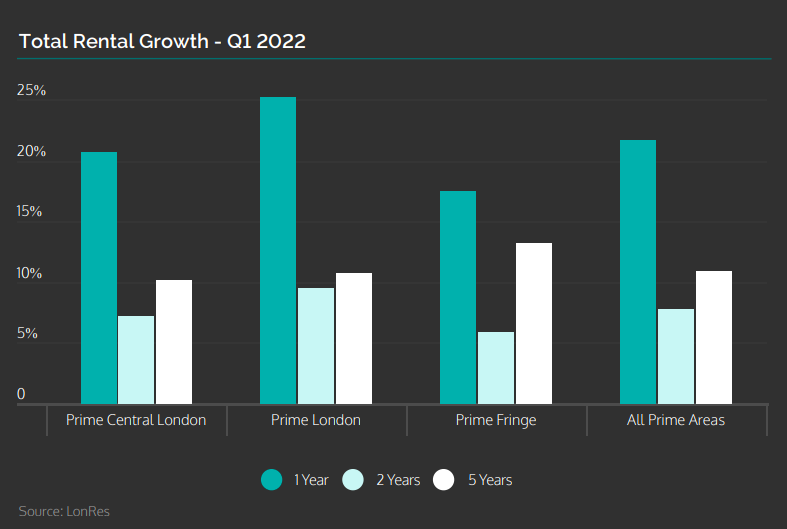

As the chart above shows, in Q1 2022, annual rental growth rates averaged 25 per cent in prime London, 20 per cent in prime central London and 19 per cent in prime fringe.

An Exponential Rise and Robust Demands

Rents have achieved new record highs, topping previous peaks recorded in Q2 2007 (19 per cent) and Q3 2010 (16 per cent). However, these remarkable rates must be considered against the backdrop of the substantial falls experienced during the pandemic.

As Q1 2022 figures show a 4.4 per cent rise in rents across all prime areas, rents are expected to remain at a higher level than those recorded before the pandemic.

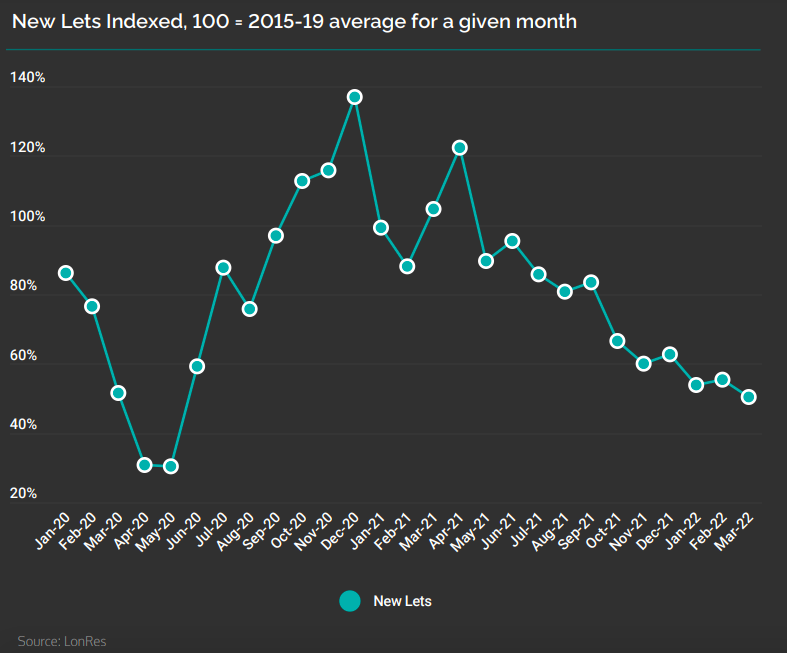

The demand from tenants remains strong. In the six months up to March 2022, properties were, on average, let in 45 days. In the same period the year before, properties remained on the market for 89 days. But as the chart below shows, the lack of rental stock is causing an issue with turnover in the rentals market, and new lets are down by 46% compared to the pre-pandemic average.

To sum up, after a busy 2021, the market has continued to strengthen, with overall activity returning to pre-pandemic levels. The latest survey from the Royal Institution of Chartered Surveyors reveals that the UK housing market is currently in excellent health, although activity could begin to slow if mortgage rates continue to rise.

If you are looking to buy, rent or invest in London property this year, why not contact one of our expert advisors?

- Details

- Written by Mouriya

- Category: Local Events

- Hits: 6888

“I will never move”, says Marylebone-based broadcaster and influencer Jo Good. Jo, who bought a one bedroom flat in Marylebone High Street over two decades ago, has now become one of the area’s most familiar faces.

She is typical of the many celebrities, city professionals and wealthy globetrotters who love living in Marylebone. The winning combination of old world charm and contemporary chic makes it a vibrant place to shop, eat and drink.

Local residents appreciate being minutes away from all the delights of London’s West End, including exclusive Mayfair and the luxurious shops of Bond Street. Marylebone is also one of the most family-friendly spots in the capital: boasting a number of world-renowned schools and colleges as well as some of the best private medical practices in Europe.

As any Marylebone neighbourhood guide will tell you, the area is well connected for onward travel (you can reach Heathrow Airport from nearby Paddington Station in just 22 minutes). Additionally, Regent’s Park - one of London’s most beautiful Royal Parks – is right on the doorstep.

A Popular ‘London Village’

Marylebone is famously described as a ‘London village’ because of its strong sense of community. Grab a coffee at one of the area’s busy pavement cafes to observe the steady buzz of neighbours greeting one another, waiters chatting to their customers and influencers snapping selfies with their fashion-conscious friends.

According to Jo Good, “The young influencers here call Marylebone High Street the new Kings Road”. The area certainly attracts an international crowd of fashionistas, drawn by the array of independent shops, bright cafes and trendy bars.

A Great Place to Shop, Drink And Dine

Many shops and restaurants in Marylebone have become local institutions, having served their customers from the same spot for decades.

Durrants Hotel, one of the last remaining privately owned hotels in London, is an excellent example of a long-running Marylebone business. Established in 1789, the 92-room hotel has been owned by the Miller family since 1921.

Linda Dauriz, CEO of Swedish fashion brand Tiger of Sweden, set up shop in Marylebone because she felt it was “the perfect destination for shopping and strolling.” She says the area offers “a vibrant and inspiring mix of retail stores, restaurants and cafés in a truly unique setting”, adding: “it feels metropolitan and intimate at the same time.”

Marylebone’s pubs, bars and eateries specialize in bringing an innovative twist to traditional menus. At the Marylebone Bar, you can enjoy handcrafted artisan cocktails created by expertly trained mixologists. Furthermore, The Hidden City, real world Sherlock Holmes adventure Games starts here where you can engage in a treasure hunt style experience led by your phone, one of the most interesting ways to discover Marylebone. Meanwhile, if you fancy some European influence Souli Food offers specialist teas from Paris, coffee from Rome and made-to-order fruit juices.

At Home Marylebone, the experience is all about “eating, drinking and wellbeing”. Based in a fabulously Instagrammable building decked with swathes of greenery, the restaurant prides itself on serving healthy food round the clock. Local foodies also congregate at the Sunday Farmer’s Market, where fresh, seasonal produce is available all year round.

A Great Place for Families

Families living in Marylebone can choose from a range of private and state schools, some within easy walking distance. The area is also home to world famous educational establishments such as the London Business School and the Royal College of Music.

Schools for younger children include Hampden Gurney CofE Primary School (rated Outstanding by Ofsted) and St Joseph’s RC Primary in nearby Maida Vale (rated Good). Portland Place is a small, independent, non-denominational and co-educational school, while Queens College on Harley Street welcomes girls from the age of four.

At the Secondary level, there are a number of excellent schools either within Marylebone itself or a short distance away. The Wetherby Senior School is the latest new establishment from the Wetherby Group, offering a traditional British boys’ school education with an international outlook.

The Southbank International School employs the IB World method to foster inner belief, openness and academic excellence. The Frances Holland School, on the edge of Regent’s Park, is a popular independent school for girls.

Leisure and Fitness

Just to the north of Marylebone lies the 166-hectare expanse of Regents Park, with the green space of Primrose Hill just beyond. The park is blessed with a wide range of attractions and amenities, including an open air theatre, a large zoo and an impressive range of sports facilities. To the west of the park is the world famous Lord’s Cricket Ground, where top international cricket teams regularly compete.

Marylebone has some superb gyms, although residents are perhaps more likely to be found in yoga or pilates studios. Indaba Yoga and Total Chi Yoga, and Pilates are highly rated by local fitness fans.

Properties in Marylebone

Marylebone enjoyed something of a property boom in the Georgian era, and some of its finest homes date from that time. There are also many buildings from the Victorian and Edwardian periods, including a number of magnificent mansion blocks.

Most of the grand period houses have now been split up into apartments, although undivided properties can still be found around Regent’s Park. You can also find streets of terraced properties in the area, while new build luxury apartment blocks continue to pop up whenever a site becomes available.

Marylebone’s traditional heritage may be reflected in its timeless architecture, but the lifestyle on offer here is refreshingly contemporary. Residents can move easily between the exciting retail and leisure opportunities of London’s West End and the tranquil green spaces of Regents Park and Primrose Hill. Alternatively, they can simply stay local, enjoying everything that Marylebone’s smart independent shops, restaurants, bars and cafes have to offer.

If, like Jo Good, you relish the idea of living in a friendly community on the doorstep of London’s West End, we would be happy to show you some fantastic Marylebone apartments for sale or rent. Simply contact our Marylebone estate agents and let them know what you are looking for.

- Details

- Written by Mouriya

- Category: Local Events

- Hits: 4468

London’s property market consistently ranks amongst the top 10 most expensive housing markets in the world. According to Rightmove, a home in London now costs an average of £664,400 (compared with the average sold price for the country as a whole, which stands at £354,564).

In line with London’s status as one of the globe’s wealthiest cities, it is home to a large number of high net worth individuals. Last year The Guardian reported that one in ten Londoners have assets worth more than £720,000, making them dollar millionaires.

The wealthiest parts of the capital are almost all to the west, with areas such as Knightsbridge, Kensington, Mayfair and Chelsea attracting elite buyers from across the globe. These central London neighbourhoods are blessed with fine properties, low crime rates, upmarket shops, world class cultural venues, excellent transport connections and access to open green spaces.

We look at five London areas that offer exceptional lifestyle benefits to those who can afford to live here.

Mayfair

Average Price: £2,697,280 to £3,100,000*

Annual Change: 39% lower

Most popular property: Flats with average price of £2,492,699

Terraced Properties: £70,88,682

*According to the DataLoft’s price of properties sold in Mayfair and Land Registry Records

Noted for its elegant architecture and upscale shops, as well as the expensive cars driven by its patrons make Mayfair one of the most expensive places to live in central London.

Defined as the area between Regent Street, Oxford Street, Park Lane and Piccadilly, it’s one of the most desirable and sought after spots in the capital, with property prices to match.This area boasts no less than twenty six Michelin-starred restaurants. and its proximity to the West End makes it a great lifestyle destination. Here you’ll also find leading art galleries, top auction houses, exclusive private members’ clubs and five star hotels.

Mayfair was once considered an ‘old school’ destination, favoured by the British aristocracy, but nowadays, you’ll find a cosmopolitan mix of affluent Brits and overseas residents who all enjoy the finer things in life.

See properties available in Mayfair

South Kensington and Knightsbridge

Knightsbridge:

|

South Kensington:

|

*According to the DataLoft’s price of properties sold in Knightsbridge and South Kensington and Land Registry Records

The SW7 postcode covers two of the most expensive areas in London. These neighbourhoods are renowned for high-end stores (Knightsbridge is home to both Harvey Nichols and Harrods). However, there are also plenty of independent shops, Michelin-starred restaurants and chic bars to keep wealthy residents happy. Music lovers enjoy being minutes away from venues such as the Royal Albert Hall and the Corelli Room at the Royal College of Music.

South Kensington’s grand museums quarter, featuring world class museums such as the V&A and the Museum of Natural History, is a huge draw for adults and children alike. At its northern edge, Knightsbridge is bordered by the open, green expanse of Hyde Park, which offers popular sports activities such as tennis and horse riding.

The SW7 area is a magnet for high net worth individuals, attracting successful entrepreneurs, politicians and high profile diplomats. Boasting some of the capital’s most beautiful homes, Knightsbridge and South Kensington are rightly described as two of the poshest areas in London.

See properties available in this area

Chelsea

Average Price: £1,601,397 to £2,032,837*

Annual Change: 4% higher

Most popular property: Flats with average price of £980,506

Terraced Properties: £4,239,214

Semi-detached: £7,233,048

*According to the DataLoft’s price of properties sold in Chelsea and Land Registry Records

The heart of this exclusive neighbourhood is The Kings Road, which begins at Sloane Square and ends close to the riverside area of Chelsea Creek. Chelsea’s reputation as a haven for artists and celebrities peaked in the 1960s and 70s. However, the area’s funky upscale boutiques, high end eateries and buzzing bars continue to attract fun-loving, high profile individuals with money to spend. Just across the river, Battersea Park offers space to relax and unwind.

Culture lovers enjoy visiting the Royal Court Theatre, the Saatchi Gallery and Chelsea Physic Garden, while football fans relish the proximity to Chelsea Football Club’s Stamford Bridge stadium.

The types of property available here range from apartments in striking modern developments, flats in traditional mansion blocks, pretty mews cottages in cobbled streets and impressive detached homes.

See Properties Available in Chelsea

Marylebone

Average Price: £1,038,917 to £1,374,680*

Annual Change: 14% higher

Most popular property: Flats with average price of £952,176

Terraced Properties: £1,933,570

*According to the DataLoft’s price of properties sold in Marylebone and Land Registry Records

This sophisticated, cosmopolitan ‘London village’ may be only minutes away from the glitz and glamour of the West End, but it still retains a genuine village vibe. It’s also a welcoming haven for homebuyers from across the globe, who are drawn to Marylebone’s relaxed atmosphere and old-world charm.

The area is a regular hang-out for celebrities, who can often be observed sipping coffee at a pavement cafe or browsing the area’s exclusive independent boutiques. Marylebone High Street offers a range of exclusive shopping and dining opportunities, making it one of the best places to stay in London.

You can buy fresh lobster at Fishworks, enjoy crumpets and coffee at the Ivy Cafe or choose a smart contemporary sofa at The Conran Shop, all without leaving the village.

See Properties Available in Marylebone

Westminster

Average Price: £939,472 to £1,437,873*

Annual Change: 12% lower

Most popular property: Flats with average price of £819,797

Terraced Properties: 1,924,783

Semi-detached: £1,617,645

*According to the DataLoft’s price of properties sold in Westminster and Land Registry Records

Home to iconic landmarks such as Big Ben and the houses of Parliament, Number 10 Downing Street and Buckingham Palace, Westminster is the stage for almost everything that happens in British politics. So it’s not unusual to spot famous politicians and media personalities scurrying through the streets in between parliamentary sessions.

Second homeowners and international buyers are all drawn to the cachet of living in Westminster. However, the buzz of ‘Westminster village’ doesn’t just attract political types. This is an area known for its lovely period properties, impressive mansion blocks and sleek, highrise developments. It also boasts some of the most expensive shopping streets in London: Regent Street, Bond Street and Oxford Street are all located within the borough of Westminster.

Whether you are buying a primary or secondary home in London or looking for a buy-to-let investment, we would love to help you find your ideal property in any of these locations and beyond.

Interested in finding out what your home is worth in one of these areas or your own area to compare?

Sign up for our VIP monthly newsletter

Get the latest ideas, insights and inspiration It's free