THURSDAY, 04 AUGUST 2022

What Will Happen To London Housing Prices in 2022?

“Every freehold house we’ve sold during the last month has been subject to multiple offers, all have gone above the asking price and in some cases as much as 5% above asking”, Sales Director, Joe Le Beau explains, with reference to the latest London property prices. He adds that 2022 has turned out to be “the year for house sales.”

Joe says he and his team have seen both domestic and international buyers display an “insatiable appetite” for London residential properties this year.

What are the current London house price trends?

Joe Le Beau’s comments chime with a recent report from LonRes, the primary data source for London property professionals. According to Lonres’ summer 2022 report, prime central London property prices are still rising.

Ever since the pandemic, we have seen a significant upward trend in property values, and prices continue to rise. At the top end of the London housing market (homes priced at £5 million plus) LonRes notes that sales in June 2022 were 11 per cent higher than those recorded for the same period last year.

Joe Le Beau observes that the demand for houses has been exceptionally strong this year. Although he has seen “a good level of flat sales”, he comments that apartments valued under £2 million are moving more slowly than they did six to eight months ago.

What has driven up housing market prices?

In the years before the pandemic, demand for homes in prime central London areas dropped, as buyer confidence was affected by higher taxation and concerns about Brexit.

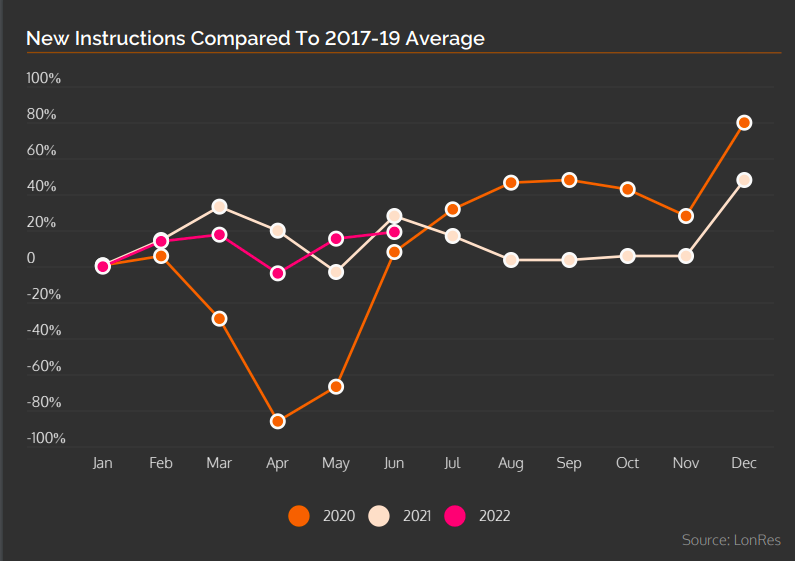

Indications of a rebound in early 2020 were short-lived, as the first national pandemic lockdown was announced in March. But after the property market reopened in the summer of 2020, London house prices began to bounce back. Helped by factors such as the Stamp Duty holiday, they quickly rose above pre-pandemic levels.

One unexpected consequence of the housing market boom is that it has reduced the number of properties available for sale, and this shortage has helped to keep the market buoyant during the first six months of 2022.

Will housing prices remain high in 2022?

the cost of living generally.” He recommends that buyers requiring a mortgage should start looking for London properties right away. His advice is to “lock in a two or five year fixed term now”, as rates are expected to rise in an attempt to damp down inflation.

LonRes notes that many buyers and sellers may be waiting to see what will happen in the autumn when the impact of the cost of living crisis on the housing market is likely to be clearer. Their summer report suggests that consequently, annual price growth may slow during the second half of 2022.

However, LonRes predicts that some investors may turn to property as a defence against inflation. The report adds: “This could sustain buyer demand in markets like prime London for longer than elsewhere.”

Buying wisely in 2022

Traditionally, London property has been viewed as a haven at times of global insecurity, so it is not surprising to see that LonRes is predicting an increase of interest amongst investors. The pound’s declining value is already attracting more overseas buyers, particularly investors from the Middle East.

As overseas investors return to the market, it is possible that we will see prime central London property prices defy the predicted slowdown and rise more quickly than expected during the second half of 2022. If you are thinking of buying a property in central London, the best advice may be to act now rather than wait for the market to cool.

If you are looking for a property in central London as an investment or a first or second home, then Joe Le Beau and his team of Prime Central London Estate agents will be happy to assist you.

We can also help you secure a suitable mortgage through our mortgage advisors, Connaught Private Finance.