TUESDAY, 22 AUGUST 2023

Exploring the potential and demand of the Marylebone property market

Known for elegant Georgian architecture and its village-like feel, Marylebone is a popular location for property investments and rental opportunities. With a close-knit community and range of properties available, Marylebone attracts UK and international buyers.We take a closer look at a snapshot of the Marylebone property sales and lettings market, backed by the following statistics:

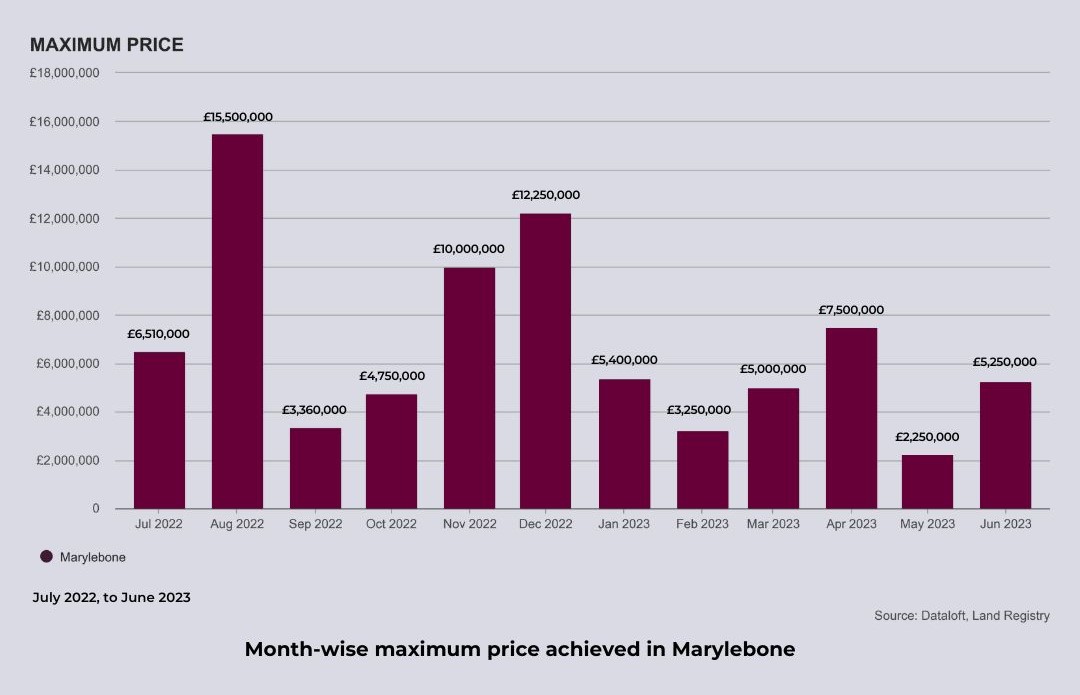

– The highest value recorded by the Land Registry over the past 12 months was £4,925,000 for a house and £15,500,000 for a flat.

– 96% of homes let in the past 12 months were flats.

– Rental values have increased by 12% in the last 12 months.

– The median monthly rental price of houses from Jan ‘23 to Jun ‘23 was £20,171, and for apartments was a median of £5,463 .

– Median sale price of property for the last 12 months: £1,302,190 (Source: Dataloft) and £1,401 per square foot (Source: Dataloft).

Marylebone Sales Market Update

With a bustling high street, chic bars, boutique shops, top schools and excellent transport links in and out of the city, Marylebone is a highly desirable London location. From period property conversions to grand terraces and charming mews houses, the Marylebone property market has much to offer.

We take a detailed view of the thriving Marylebone property market, exploring its demand, investment opportunities, and influential market conditions.

Furthermore, we’ll look at the future for Marylebone real estate based on the positivity from the last year, sharing insights into the opportunities presented to sellers, landlords, and investors.

A desirable London location

Marylebone is a desirable location with exceptional transport links in and out the city – and with that house prices don’t come cheap. In the last 12 months (1 Jul’22 to 30 Jun’23), the highest flat sale price was £15,500,000, and the highest house sale was £4,925,000. (Source: Dataloft). The lowest recorded sale was as a one-bedroom flat at £640,000.

While prices here are high, overseas investors have benefited from advantageous exchange rates – particularly cash buyers paying in dollars from America, Singapore and the Middle East.

The nature of demand for sales and lettings

Over the last year, there have been 285 Marylebone property sales, totalling £438,799,058, and 431 properties let. Marylebone is a highly desirable area, with Gloucester Place NW1 fetching the most transactions annually. In Marylebone, the majority of the housing stock is flats, often converted Georgian buildings and modern apartment blocks.

Across total sold properties in the last year, 93.5% of sales were flats and 6.5% houses. When it comes to renting, 96% of homes let out in the last 12 months were flats (Source: Dataloft). Tenants in the area range from single professionals to families, with 31.2% of renters aged between 25 and 29.

Marylebone Lettings Market Update

Flats come in all sizes, with two-bedroom flats being the most popular to let at 30.8% of the total, closely followed by three-bedroom flats at 28.7% and one-bedroom flats at 26.6%. In Marylebone, renting is a desirable way to live in the area. While some rent for a London base, others set up long-term homes here. Marylebone fetches some of the highest rental yields in the capital. In the last year, the lowest recorded let price was £1,430 per month for a studio flat, while the highest was a three-bedroom long let house at £18,417 per month.

A sound investment with positive outlook (sales & lettings)

– Median Sale Price for the Property for the last 12 months: £1,302,190 (Source: Dataloft) and the median sale price per square foot for the last 12 months: £1,401.

– Median rental price of houses per month in the last six months (Jan’23 to Jun’23) was £20,171 per month, and the median price of apartments to rent was £5,463 per month.

For landlords, particularly those overseas who can embrace the excellent exchange rate, Marylebone international real estate presents a great opportunity.

While terraced house prices have increased by 8.3% in the last year, flat prices have risen by 2.2%, making it a great time to sell them. The last year has shown real promise for rising property prices in the area, and buyers from overseas are taking advantage of great deals through exchange rates.

Both UK and overseas landlords have the potential to reach impressive yields with a 12% rise in rental values since July‘22. With demand in the area high and the number of available properties low, they can expect reduced void periods too.

The future of Marylebone real estate

As we draw our exploration of the Marylebone property market to a close, we are optimistic about the property market in this prime London location. As Marylebone estate agents, in the last few years, we’ve seen more people returning to the city and looking to rent and buy. With Marylebone being a hotspot for activity, transport and close to some of the best schools in London, we believe Marylebone will continue on a trajectory. Whether you’re a prospective domestic buyer, an international investor, or an eager tenant, the Marylebone property market promises desirable homes and the lifestyle to match.

Note: The following postcodes have been used to define Marylebone – NW1 5, NW1 6, W1B 1, W1B 2, W1C 1, W1G 0, W1G 6, W1G 7, W1G 8, W1G 9, W1H 1, W1H 2, W1H 4, W1H 5, W1H 6, W1H 7, W1U 1, W1U 2, W1U 3, W1U 4, W1U 5, W1U 6, W1U 7, W1U 8.