WEDNESDAY, 29 MAY 2024

The Prime London Real Estate Market Amid Rising Mortgage Rates

summary

– Demand is down by 14% amid economic uncertainty

– Instructions and mortgage approvals up amid rate rises

– Londoners now pay £7,530 p.a. more than in 2021 on average

– However, lower rates expected from Bank of England imminently

– Overseas cash investors at an advantage today

It’s been a sombre Spring in the prime Central London property market. Under economic uncertainty and rising mortgage rates, the property world hasn’t seen the same spring in its step as in previous years.

LonRes reports that demand is down by 14%. Sellers and buyers may choose to watch and wait, with the current average five-year fixed rate being 5.75%, compared to 2.64% in December 2021.

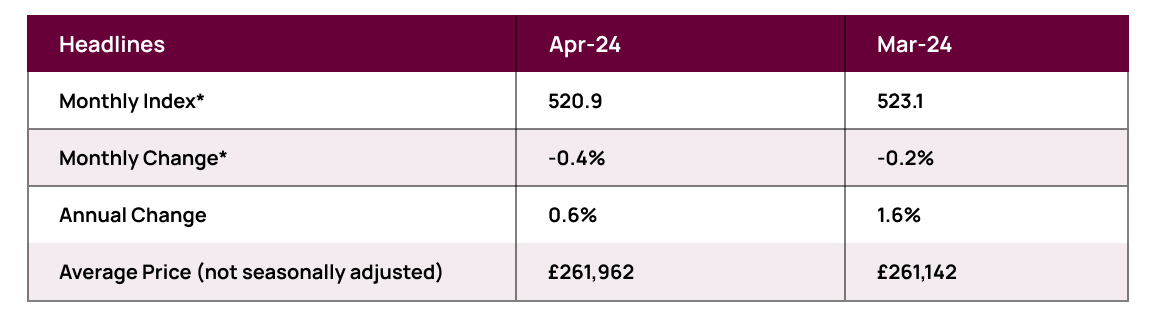

There’s also concern that while demand falls, house prices do too. Nationwide announced the annual price growth narrowed to 0.6% in April. It’s not all bad news despite mortgage rates and house prices moving in the wrong direction.

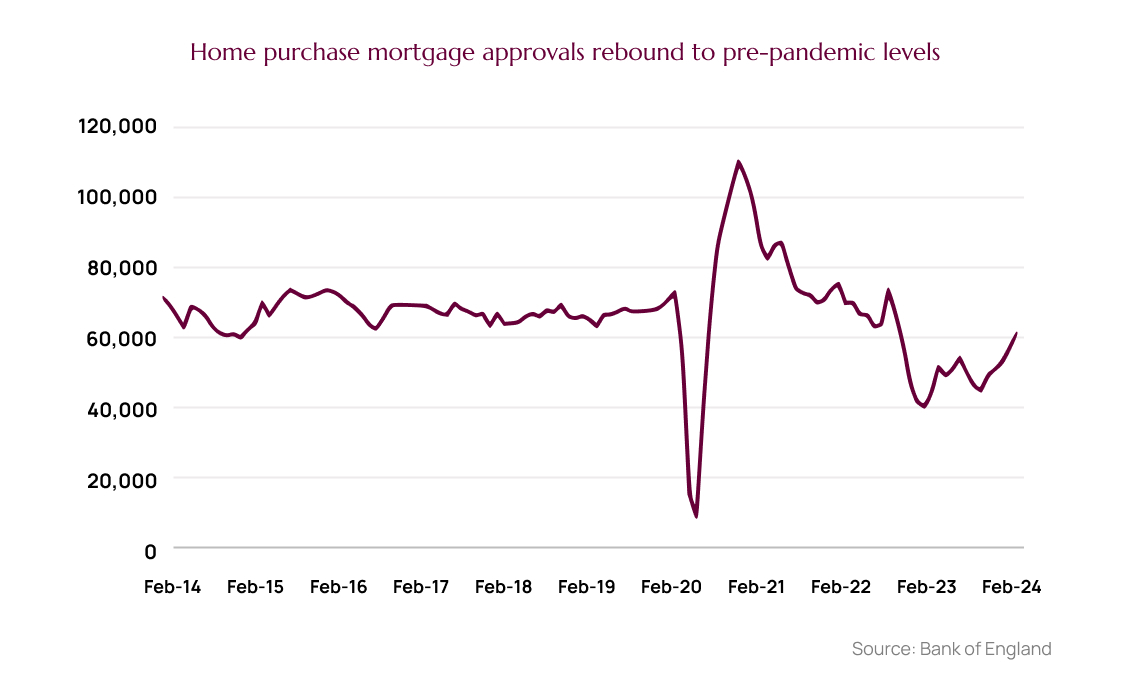

There’s been a flurry of new listings in the prime London market, with a 21% increase in instructions. Mortgage approvals are on the rise, too, with the Bank of England reporting 32% more mortgage approvals in February 2024 than a year earlier. For prime London, cash buyers may find good deals, particularly those with nothing to sell or from overseas.

We explore the impact of rising rates in prime London and the relationship between mortgage rates, demand, and house prices.

An Overview of the Prime London Market

Traditionally, Spring is when we see high activity in the prime Central London property market. This year is no different, with a 21% increase in instructions. However, with mortgage rates edging up again in recent weeks, there’s a lack of enthusiasm to make moves.

Rates are starting to climb again as borrowing becomes more expensive for lenders. The 5-year swap rate in the UK in April 2024 was 3.9045, up from 3.66443 in April 2023. When this rate rises, lenders increase their rates to make a profit. Despite the high number of cash buyers in prime London, those who require mortgages may be hesitant until there are some reductions. In London, residents pay an average of £7,530 extra per annum than in 2021.

Amanda Bryden, head of mortgages at Halifax, remains hopeful. Recognising that rates have remained high but stable, she said, “While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability.”

Prime London Statistics and Trends

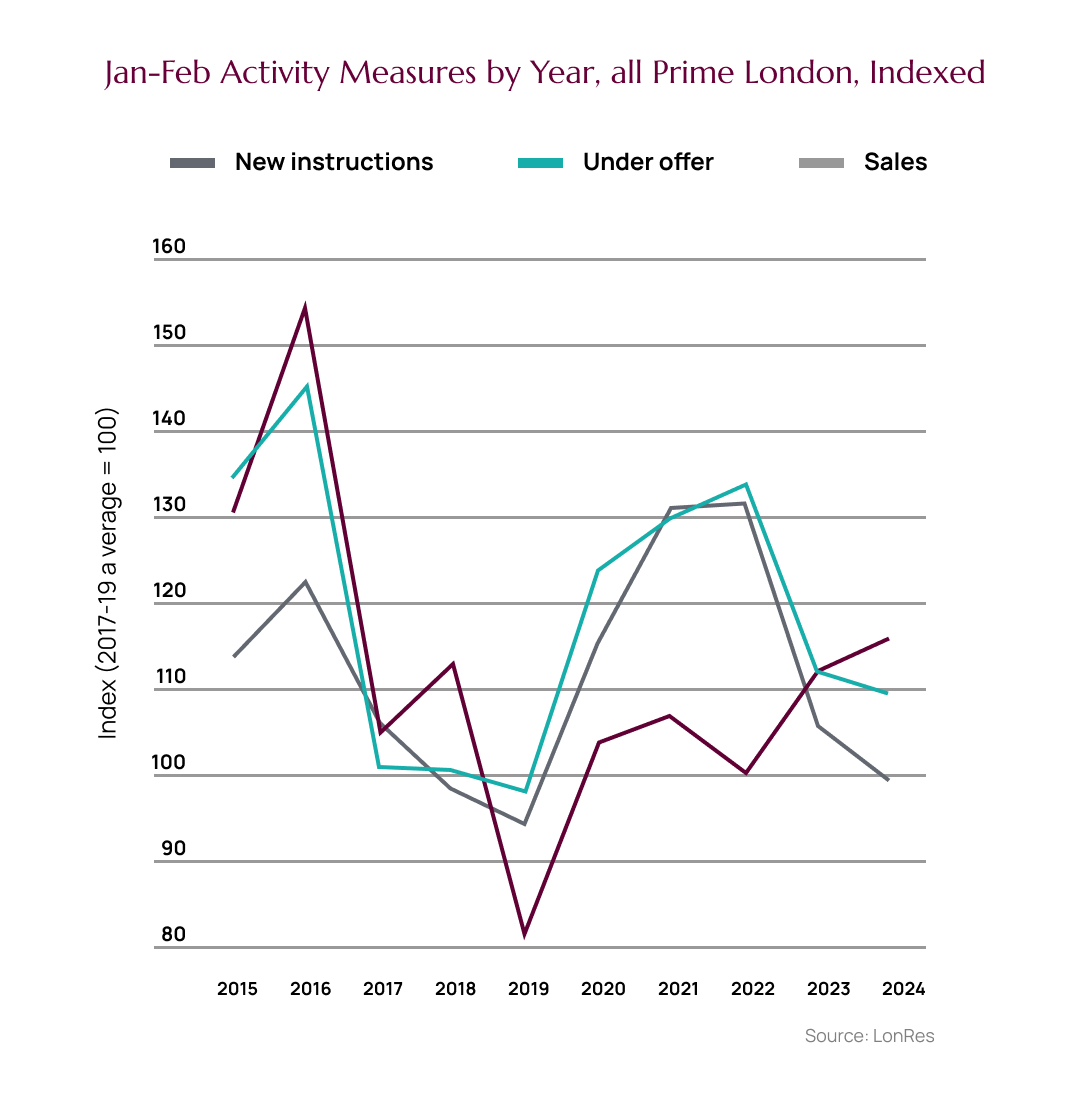

While there has been an increase in new instructions, this is met with a 14% decline in demand. Growing supply and static demand means more properties are for sale in prime London. At the end of February 2024, there were 7.5% more properties for sale in prime London than in the same month of 2023 and 25.9% more than in February 2020.

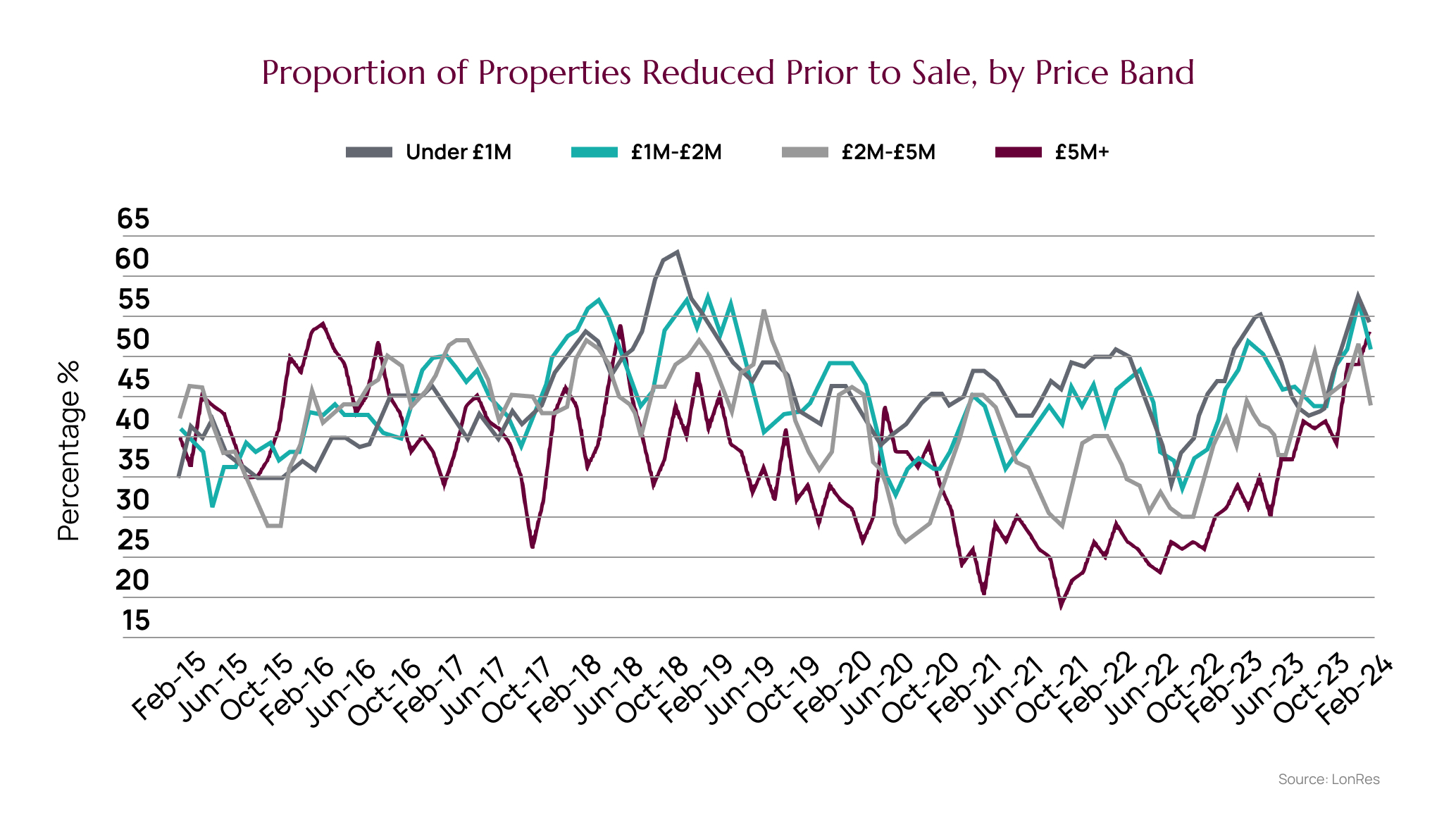

To sell, some sellers have reduced prices. Average sold prices fell by 7.8% in February, taking values back to 2014 – 32% below the pre-pandemic average. In 2017-2019, 48% of properties had a reduction in price before being sold. This fell to 41% in 2021 and 2022. Since the start of 2023, more properties in the £5m+ bracket are making reductions, setting the average around 50%.

There is an indication that activity is holding up in the market. While the number of transactions in February 2024 was lower than a year ago, falling by 2.7%, there were only 0.3% fewer sales in February 2024 than in pre-pandemic years 2017-2019.

In a broader context, the first few months of the year align with trends seen before the pandemic and in 2023. However, activity has fallen back from levels in 2021 and 2022 – before mortgage rates surged. Under-offer numbers are 10% higher than over the year to date, and actual transaction volumes are relatively level. Looking back at the bigger picture, the market remains balanced.

What’s Influencing the Prime London Market?

When rates are high and rising, it can impact consumer confidence and spending. Homeowners may be less likely to upsize or move house when unsure of the financial future. Increased living costs coupled with high interest rates may push more people to the London rental property market rather than to buy. LonRes reports that rental growth increased slightly in February, and activity levels improved.

The Bank of England has held the base rate at 5.25% since August 2023. In June this year, it is expected to cut the rate, and by the end of 2025, it is projected to reach 3%.

Prime London Market Movements

Should mortgage rates fall as expected, the affordability would boost market activity. More buyers would enter the market, pushing up demand. If the housing supply is low due to development delays, house prices could see a rise.

Lower rates are good news for landlords and investors, who’ll enjoy better investment returns. Cash-buying overseas investors benefit from being unconcerned by rates and can take advantage of house prices instead.

If interest rates remain high, the market may see reduced activity and a potential decline in house prices. Existing homeowners may be less inclined to sell or move. Construction work and renovations may be delayed due to rising materials costs and reduced demand, leading to a shortage of homes in the future. Potential buyers may be more inclined to look at rentals until rates fall.

In this instance, buyers requiring a mortgage in the prime London property market may consider downsizing or wait to move until the rates reduce. When mortgage rates are high, those selling property may see their property remain on the market for a longer period and see price reductions.

The Near-term Outlook for Prime London

Mortgage rates remain higher than pre 2021. However, they are hovering at an average of 5%, with suggestions that they’ll fall soon. Buyers and investors will have more confidence in financing a purchase when rates are stable.

As inflation starts to drop, buyers may have more in their budget to spend on the additional mortgage costs. For international investors, the weak pound means they can benefit from excellent deals in the capital and greater returns.

For more information on the prime London real estate market during rising mortgage rates, contact your local BHHS London offices.