MONDAY, 24 JUNE 2024

The Upswing in Prime London’s Property Market in Early 2024

summary

– In the first quarter of 2024, prime property in outer London grew by 0.8%.

– Bank of England reports 32% more mortgage approvals in February 2024 than the year before.

– Higher-rate taxpayers selling residential property will pay 4% less capital gains tax than last year.

– Sales agreed in inner London were up by 15% compared to Q1 2023.

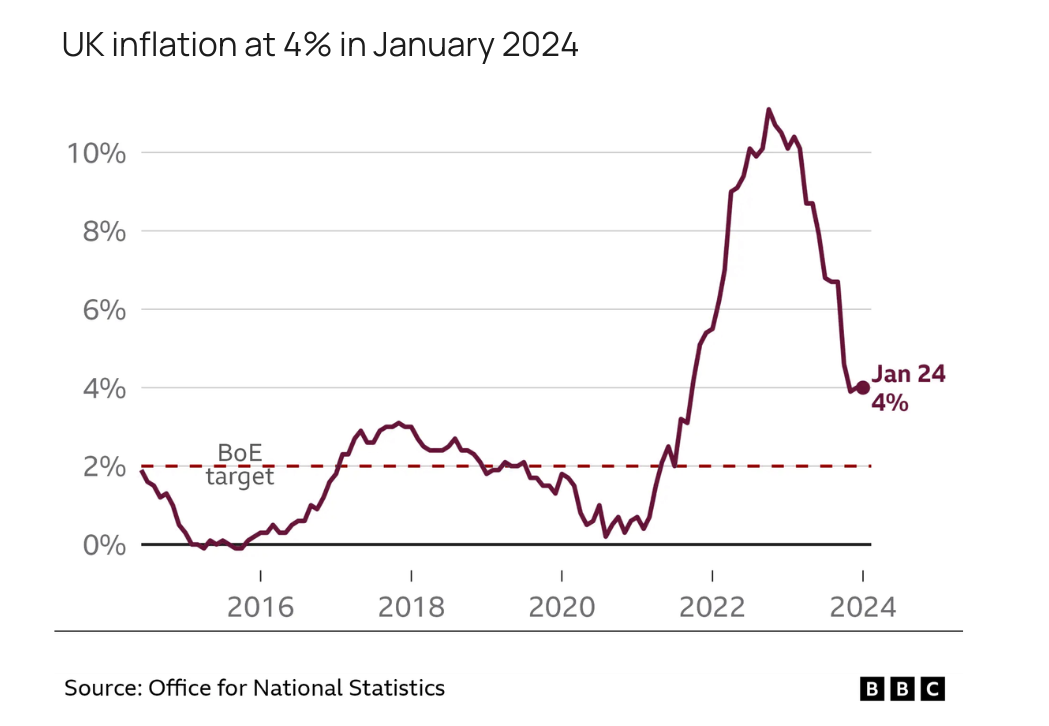

The prime London markets have experienced turbulent times in the last 18 months, with a tough mortgage market, high inflation rates, and economic uncertainty.

However, the first quarter of 2024 shows the first signs of recovery. The market has stabilised, with property prices in central London and outer London experiencing a slight rise in the last year and a significant rise in the previous decade.

With a date set for the general election, buyers and sellers can make informed decisions on their next moves. Inflation reduced to 2.3% in May 2024, and experts predict the Bank of England base rate to fall in the coming months. These factors indicate lower rates and a more stable mortgage market.

Market Overview

House prices in Prime Central, inner and fringe have increased in the last decade. In prime central, there was an average increase of 3.1%, with Mayfair and St James’s seeing the most significant increase of 20.7%. The prime inner average was 18.9%, with Fitzrovia, Bloomsbury and Soho seeing a 32.6% uptake. The prime fringe average was 18.3%, with Vauxhall, Nine Elms, Borough and Kennington seeing rises of 28.8%.

Price rises in the areas will be due to inflation and area development. For example, a regeneration project at Nine Elms gained the area access to the Northern Line in 2021, pedestrianised areas and new developments. On average, in the last five years, there has been a 10% increase in London property prices.

Average house prices in London have remained relatively flat over the previous 12 months, rising by 0.1%. The average discount applied to London property stands at 4.3%. With this in mind, those looking to purchase for investments or a residence could benefit from a good deal.

Market Influences

While rates remain higher than before 2021, the mortgage market is more stable. Currently, rates have averaged around 5% for a five-year fixed rate and 5.4% for a two-year fixed rate.

Political uncertainty has also impacted the market. An upcoming general election, tax changes and the abolition of non-dom status have all affected the prime central London market.

With the abolishment of the non-dom tax status, international investors and individuals may be cautious about a move to prime London. However, London remains an attractive place to live in, with excellent schools, incredible properties, and excellent business connections. These factors will continue to encourage international investors and individuals to the area.

Sales Activity and Buyer Behaviour

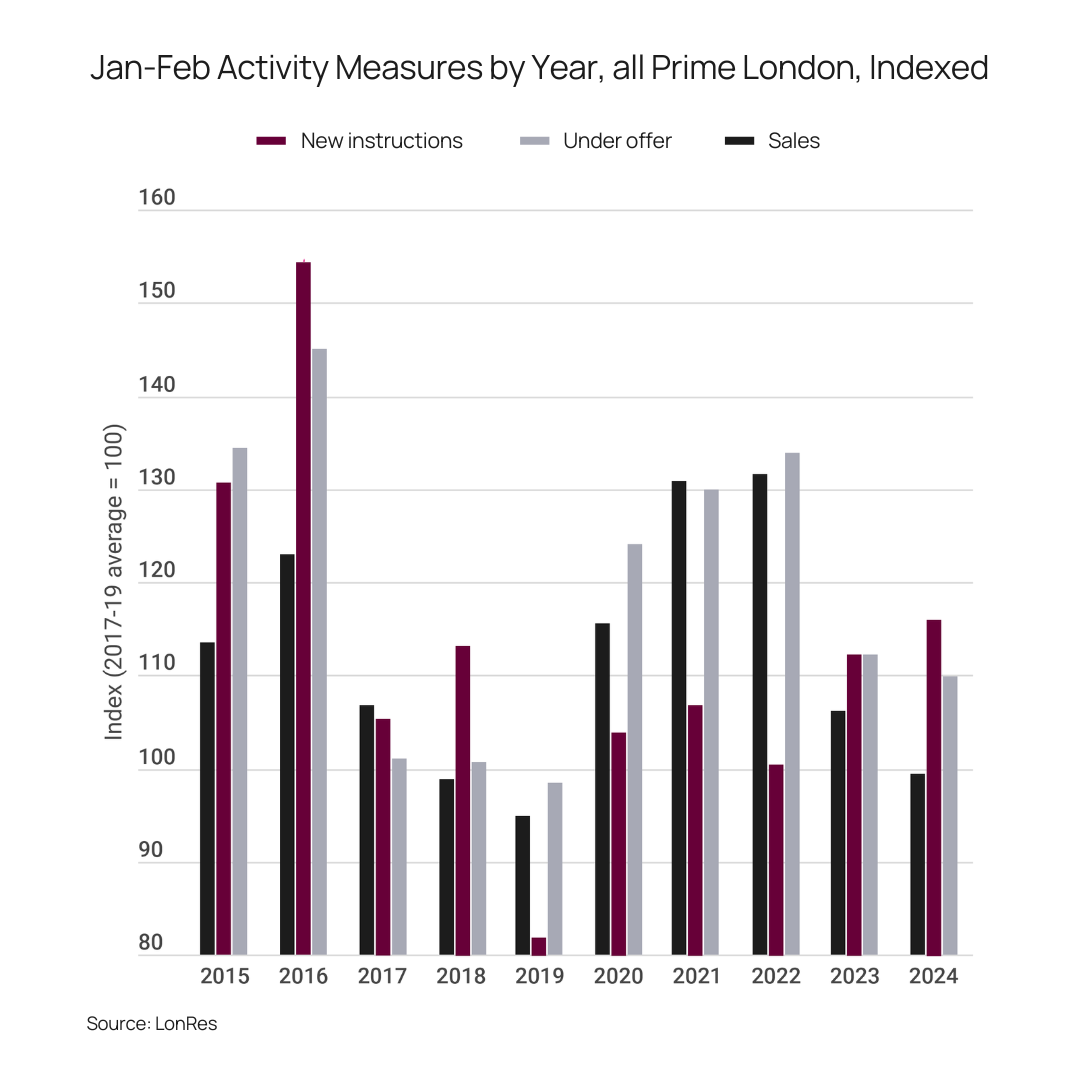

According to data from TwentyCi, sales agreed in inner London were up by 15% compared to Q1 2023. The number of new instructions rose in February 2024 by 1% annually, making it more than 20% higher than the 2017-2019 average. The LonRes March report states how fall-throughs and withdrawals remain low, and that activity is in line or slightly ahead of pre-pandemic levels.

Nick Gregori, head of research at LonRes, said, “We’re seeing fewer withdrawals and fall-throughs than expected, given the volume of stock for sale.”

Stephen Moroukian, Head of Product and Proposition for Real Estate Financing at Barclays Private Bank and Wealth Management, explains buyer behaviour and what they’re looking for in 2024. He said, “Buyers are also increasingly focused on practicality – factors like commute times, reliable internet connectivity for remote work, and achievable budgets are taking centre stage.”

While some may look to upsize and increase their debt with stabilising mortgage markets, flat sales are beginning to rise. During 2020, flat sales fell. By late 2020, house sales began to rise, but flats were down by 15% compared to Q4 2019. Houses have continued outperforming flats, reaching over 60% by the end of 2021. As of Q1 2024, just a few percentage points separate the two property types.

The super prime market continues to perform well. Transaction volumes across London from properties worth £10m and above are up 9.1% in 2023.

Expert Predictions

Economists at EY Item Club predict UK interest rates to fall to 4.5% this year. Analysis by research firm Capital Economists suggests The Bank of England will lower the base interest rate to 4% by the end of 2025.

With a date set for the general election, buyers and sellers may choose to wait to see tax changes and incentives from a potential new government. However, Richard Donnell, executive director at Zoopla, doesn’t expect disruption in the prime London markets. He said, “…particularly as there is not a huge divide in policy between the two main parties and with few specifics on housing other than a focus on reforming the private rental sector and boosting housing supply.”

A Positive Outlook

There have been signs of green shoots in the prime London property market in the first quarter of 2024, with slight price increases and a rise in sales.

Experts predict further falls in inflation. These cuts would mean buyers have bigger budgets to upsize and increase their loans.

While investors and buyers in the prime London market may remain cautious, the outlook is positive. International investors benefit from currency savings, and higher-tax rate payers enjoy smaller capital gains tax. Seeing the impressive price growth in inner and outer London over the last decade, investors may be inclined to search for properties in areas undergoing regeneration and new luxury developments.

For further information on market trends or to consult with a property expert on an investment decision, contact our Berkshire Hathaway Home Services offices.