MONDAY, 24 JUNE 2024

Our Analysis and Future Predictions for London’s Prime Property Market in 2024

summary

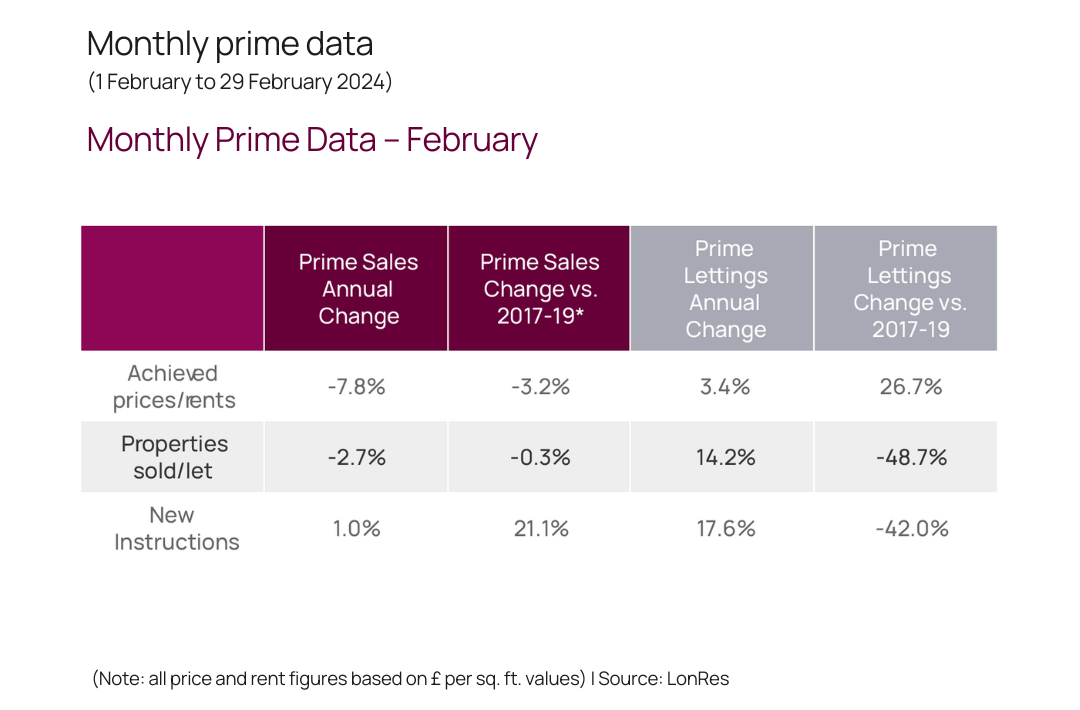

– In February, London prime properties sold for an average of 91.4% of asking price

– Newly agreed lets in February increased by 14.2% compared to February last year

– Prime London rental values are 26.7% above their 2017-2019 average

– LonRes reports that London prime property prices are similar to 2014 on average

Despite the media clinging to Nationwide’s recent report of the average house price reducing by 0.2% from February to March, the broader picture isn’t so bleak.

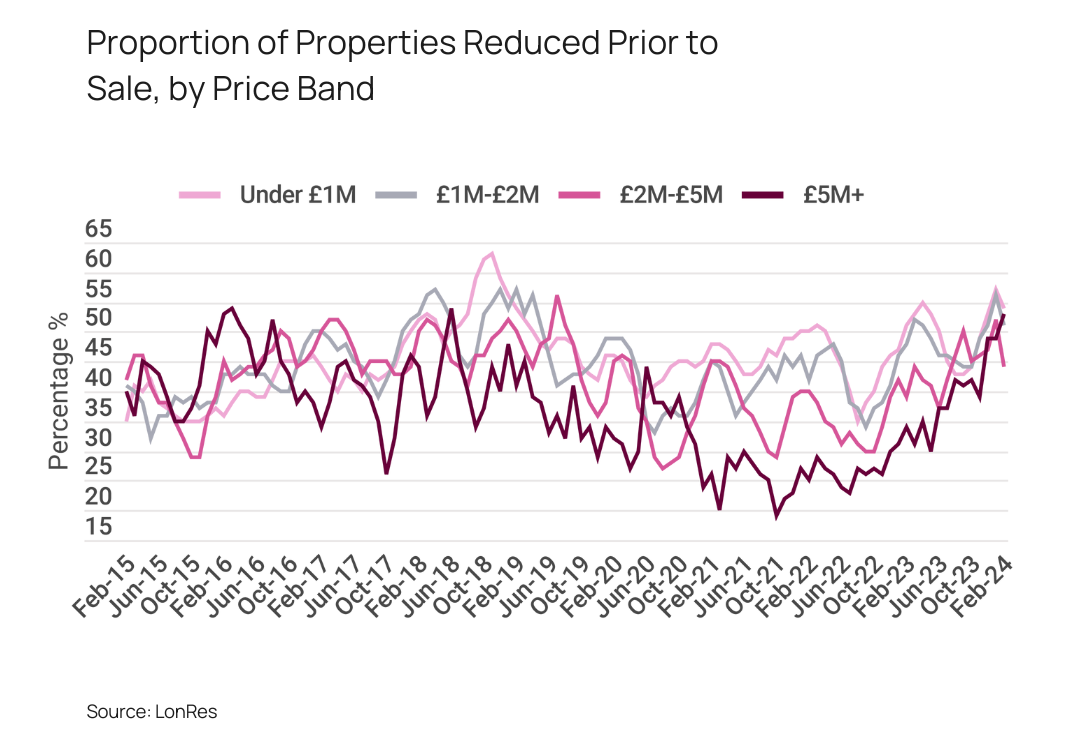

House prices in prime London are relatively stable. With a broad view, prices remain at 2014 levels with a 3.2% decrease from the pre-pandemic average (2017-2019). In a post-pandemic world, amidst rising rates, Amanda Bryden, head of mortgages at Halifax, said the housing market was “finding its feet in an era of higher interest rates“.

The high cost of borrowing and stamp duty costs are some factors driving the rental market’s growth in prime London. The number of newly agreed lets in February increased by 14.2% compared to a year earlier. These figures move in the right direction. LonRes data also indicates more rental properties listed on the market, suggesting more positive changes in the market.

London’s Current Prime Market

LonRes reports that London’s prime property prices are, on average, similar to those in 2014. However, areas and neighbourhoods have differences. For example, Mayfair and St James saw the most significant increase in prime Central London over the last decade with a 20.7% value increase, although this is partly due to the introduction of new high-end developments in the area.

In this buyer’s market, properties are often discounted before a sale. However, sold properties in prime London in February achieved an average of 91.4% of their asking price. This is an improvement on the previous month when average sold prices dropped below 90% for the first time since the first quarter of 2019.

We should remember that hour prices around the time of a UK General Election often show instability: with the recent announcement of a July 4th election, we can expect to see some ripple effects in the Prime Market, just as there has been in previous election cycles.

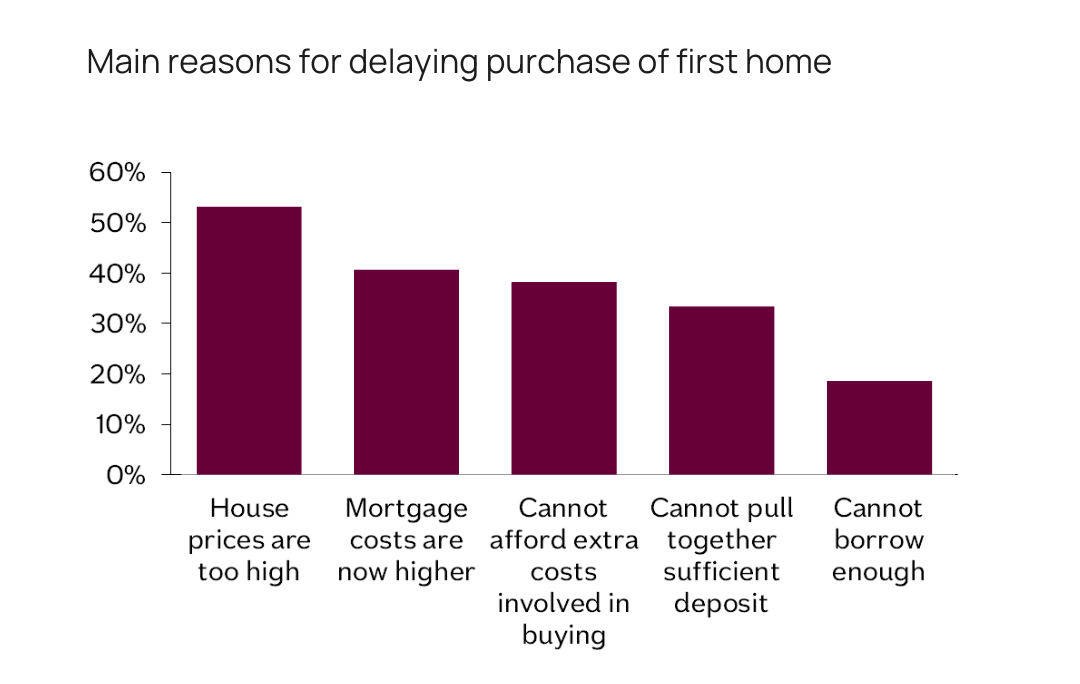

With the average two-year fixed mortgage rates at 5.91% and five-year fixed rates at 5.48%, affordability is a significant challenge for new buyers and movers requiring a mortgage. With this in mind, buyers seek discounts on properties to reduce monthly costs.

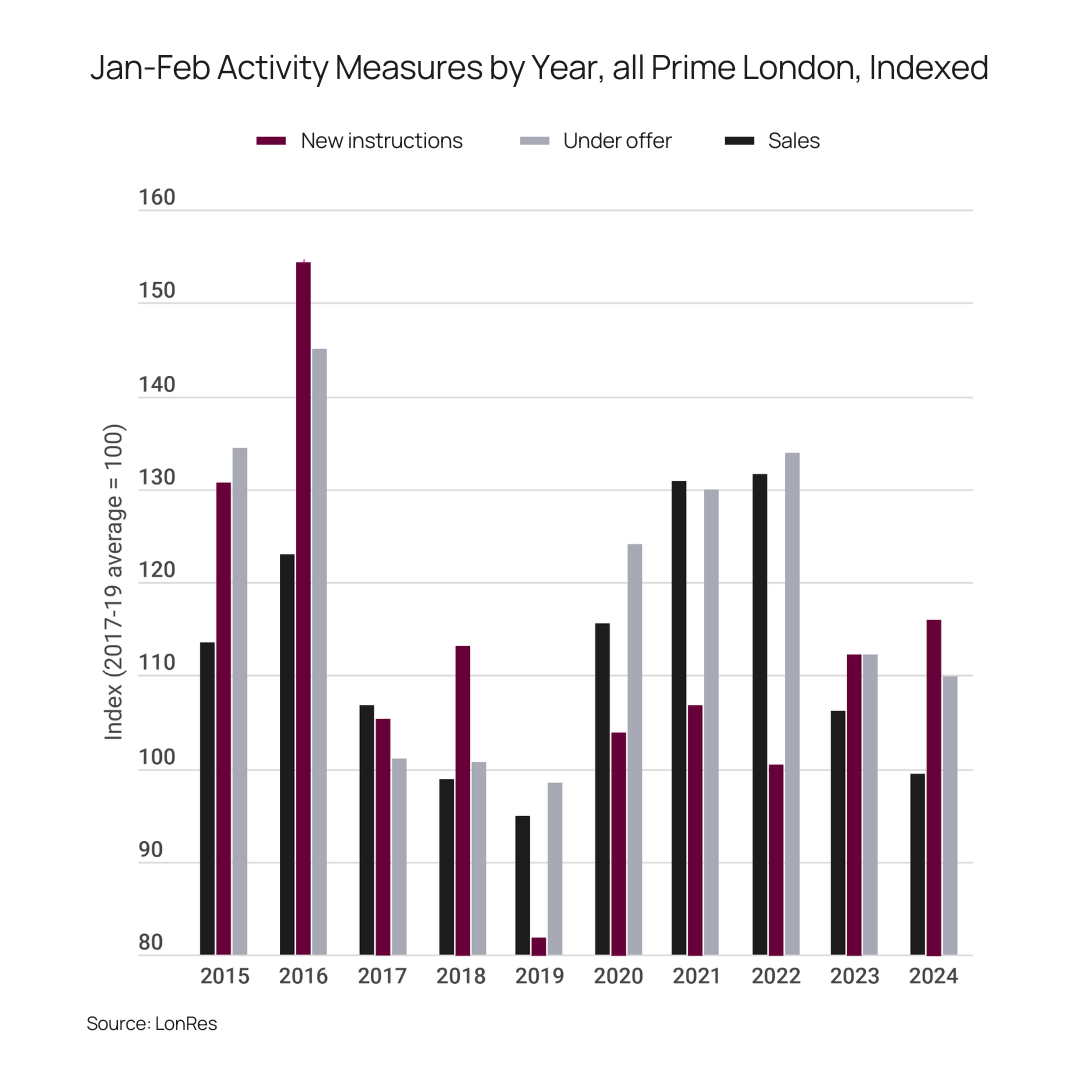

Head of research at LonRes, Nick Gregori, said, “The prime London sales market is showing some resilience in the face of negative external factors– such as high interest rates and global geopolitical issues – but activity for the time of year remains relatively subdued.”

For cash buyers, the mortgage rates are irrelevant. This has helped the prime London market remain resilient during times of inflation. In fact, 19.9% more properties went under offer in April than the same month last year.

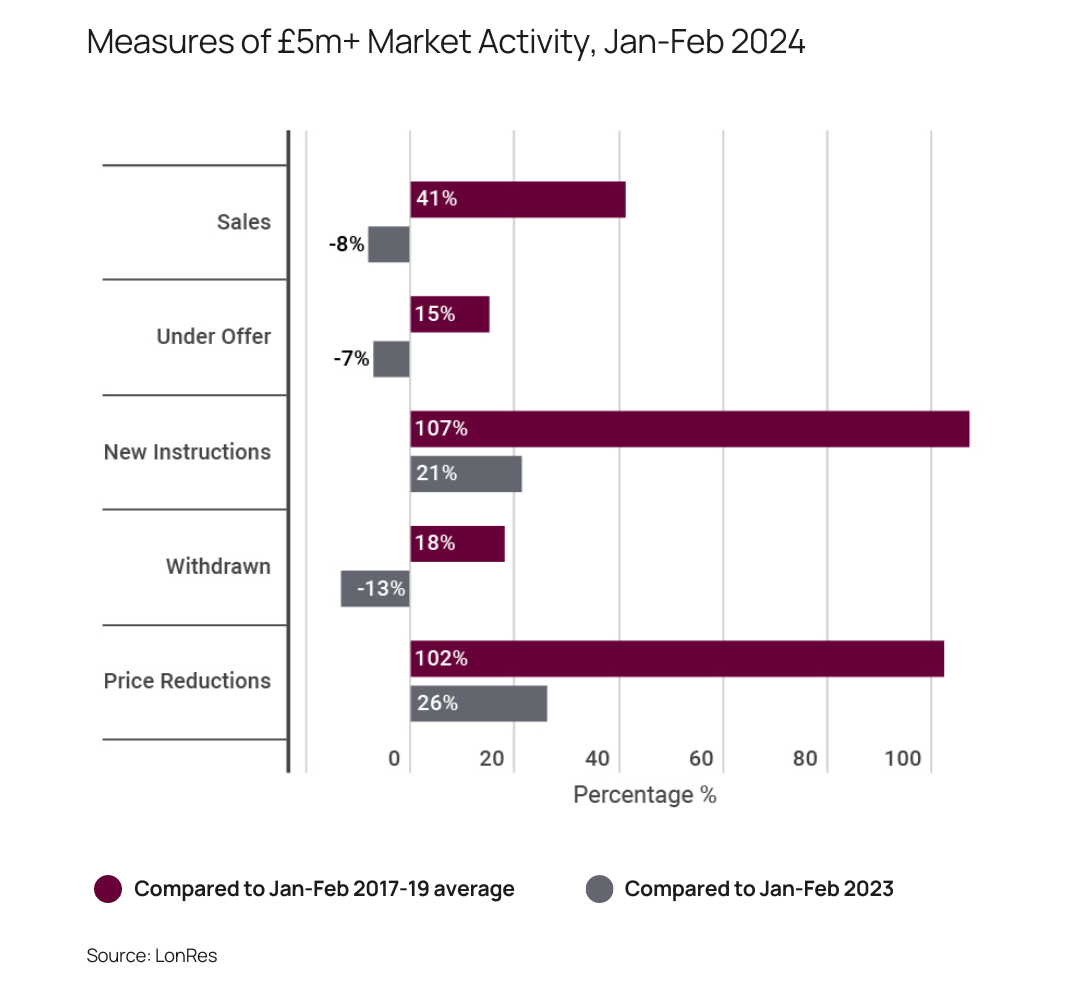

According to LonRes, the top end of the market is the best-performing sales market sector. The £5m+ activity sits well above long-term trends. In February, sales were 4.2% higher than in the previous year and 25% above pre-pandemic February averages.

A Rental Market Surge

In reaction to mortgage pressures and tax changes, almost half of all UK landlords tried to sell their investment properties between September 2022 and 2023. However, we’re starting to see signs of the market stabilising.

The number of newly agreed lets in February increased by 14.2% compared to last February, and new instructions rose by 17.6% last month. While this is still below the pre-pandemic average, things are moving in the right direction, with 48.1% more properties to let on the market at the end of February than a year earlier.

Annual rental growth is on the rise, too, after a few months of falls. At 3.4% in February ‘24, values were 26.7% above their 2017-2019 average.

Ultra-high net-worth (UHNW) individuals may opt to rent over buy for several reasons. With stamp duty costs reaching as much as 17% for foreign buyers who own a property overseas, taxes can quickly spiral. Borrowing costs are also high. For tax planning and other reasons, some wealthy buyers still opt to fund their purchase, or part of it, using finance. The uncertainty with the looming general election may also concern UHNW buyers as taxes could change with a new government. This makes renting a more practical option.

Transaction Dynamics

The average time from listing to exchange has remained similar over the last five years. It was 166 days across prime London in February 2024, compared to 164 in February 2023 and 165 days pre-pandemic (2017-2019). This indicates the market is moving at the same speed as expected.

Nick Gregori of LonRes said, “Once again, the sentiment in the market has been a little more positive than the story told by the latest sales data. Agents are telling us they are busy, and while we are recording deals being agreed, there seems to be slow progress from offer to exchange, which means actual transaction figures remain muted.”

To encourage sales and increase properties on the market, the Chancellor announced a cut in the rate of capital gains tax in the Spring budget. Higher-rate taxpayers will now pay 24% tax on the profit from the sale rather than 28%.

For those looking to buy a second residential property, stamp duty will be due on each property without a discount. The government says this is due to the need for evidence that the stamp duty benefit encouraged investors into the private rental market. With this in mind, those who previously looked to own a city base may be more inclined to rent.

Future Outlook for Prime London

With the looming uncertainty of a general election and high interest rates, some prime London property sellers may opt to watch and wait. However, research from Dataloft suggests this could be a flawed strategy.

Dataloft looked at house price changes before and after seven previous general elections in Greater London, the South East, South West, East Anglia, and Northamptonshire. Data found that property price growth was more likely to decrease in the three months after the country went to the polls. In Central London, house prices fell 9.4% in the three months following Boris’ election. This information suggests it might be better to list a property ahead of any changes in January 2025.

The research from Dataloft also shows that sales slowed in the three to four months before voting day. According to the study, once the result is known, the policies and political landscape certainty means the market will become more active].

London’s prime markets seem to hold up well despite economic uncertainty. For example, there were only 0.3% fewer sales in February than the 2017-2019 February average.

International buyers have the advantage of potential currency benefits, allowing them to find a great deal in prime London property. With demand for rental properties on the rise and rents high, London homes have the potential for a profitable investment.

As the London rental market reaches a pivotal turning point, with improved activity and rental growth, it’s a good time to invest in prime London property. With high stamp duty costs, borrowing costs, and political uncertainty, renting is more attractive than ever.

Final Thoughts

As we move into the summer months, we will see the market stabilise. While prime London house prices have slightly decreased, they generally track the same line as in 2014. With higher rates, taxes and political uncertainty, renting is an attractive option within prime London – good news for investors looking to take advantage of the 3.5% annual rental growth.

Do you want to discover more about the prime London market trends and dynamics? Read the latest LonRes report here.

Contact our Central London estate agents if you’re interested in learning more about London prime property prices, the London rental market, or properties for sale or rent in the capital.