FRIDAY, 17 MARCH 2023

The Post-Winter Sales Market for Prime London

How economic changes and political headwinds have affected the market post-pandemic – and how you can benefit.

– Prime London flats are back in demand

– In 2022, average prices per sq. ft. were just 1.4% below their 2015 peak

– The £5m+ market is strong, with 92% more sales in January 2023 compared to the same period in 2019

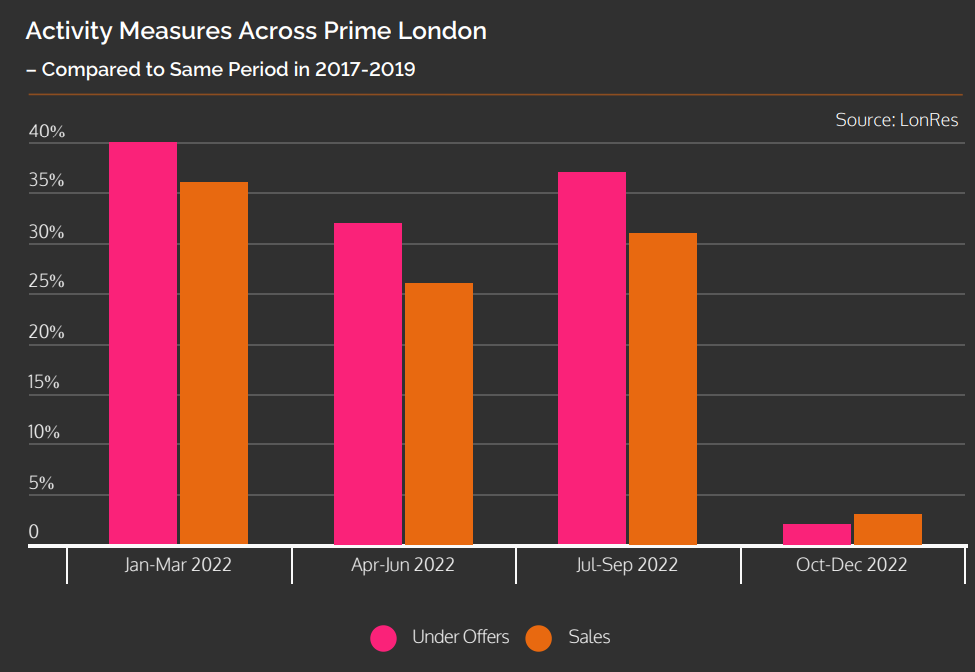

The prime London sales market began 2022 with a promising start, despite predictions of high-interest rates and inflation increases on the horizon. A hopeful ‘boom’ continued, with properties sold and under offer 26-40% higher than in 2017-2019 and prices returning to 2015 peaks1. However, the fourth quarter of 2022 was a different story.

Rising rates became a reality, and political turmoil at Westminster impacted the London housing market. Homebuyer sentiment fell following an economic downturn, discounts and fall-throughs increased, and market activity reduced.

It’s fair to say that 2022 was a year of flux. But how has the situation changed in 2023? In this article, we look at the prime London sales market figures from winter 2022-23 to make sense of the market for the rest of the year.

Prime Property Trends

In February 2023, the Bank Rate increased by 0.5 percentage points to 4%2. While many prime London sales are less dependent on mortgages, rising interest rates are still a factor that can impact the broader market.

Rising costs have also dictated the types of property that buyers pursue. During the 2019 – 2021 period, there was a race for space, as people searched for larger houses with gardens. The trend continued in the first three quarters of 2022. However, with energy prices and interest rates rising, the attraction to flats in prime London increased3.

London House Price Trends

The stamp duty holiday in the Summer of 2020 caused an influx of activity, with 78% more instructions across prime London compared to the same period in 20194. With this boom in activity came a rise in prime central London property prices, following years of tax changes and political issues unsettling buyers and keeping prices down5.

Across 2022, property prices continued on this trajectory, rising by 4.4%, and average prices per sq. ft. were just 1.4% below their peak in 2015 – great news for sellers looking to achieve the expected price for their property6.

Q4 of 2022 did affect the market, and new research from LonRes found an increase in properties, reducing prices during that period7. Although, this does present opportunities for overseas buyers looking for attractive investments in the UK.

Prime London Market Trends

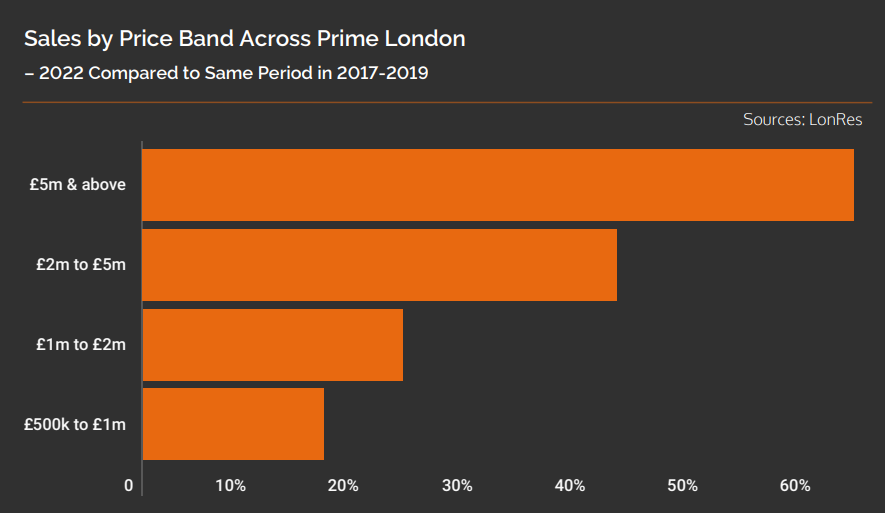

Data from LonRes shows high numbers of new property instructions at £5m and above, recording the highest growth compared to the pre-2020 average during 2022. The number of sales in this price band is 92% higher than in January 20198 and 56% higher than in January 2022. In 2022, sales in this price bracket were 63% higher than the average for 2017-20199.

While there was a fall in sales in the final quarter of 2022 as buyer sentiment changed following economic and political issues, activity across all price bands was higher than the 2017-2019 averages. The £1m-£2m market had 23% more sales in 2022, and the £2m-£5m saw an impressive 42% rise. The £5m market only makes up around 8% of sales, but it held the highest growth in 2022 compared to pre-2020 averages, strengthening the top end of the market10.

The tail end of 2022 saw price reductions. Long before this, the general lack of stock had led to inflated prices as supply struggled to neet demand; however, this situation was not likely to last. So when the supply of houses picked up again, these previously inflated prices went through a sharp correction to remain competitive. This led to some sellers – who had previously bought at market highs – pulling out of the market, once they realised their target price was unachievable.

LonRes reports that many properties were withdrawn from the £5m+ market, perhaps as sellers took their property off the market because prices weren’t as expected11.

The London sales market looks ahead to Spring

Sales in prime London may be less dependent on mortgages. However, the rise in energy prices has been a driving factor for buyers prioritising flats over larger houses. This is good news for prime London as much of the housing stock falls into this category.

Activity in the prime London market was strong through 2022 – while it dipped in January 2023 – Spring shows promise for future plans. LonRes Managing Director Anthony Payne explains, “January is usually a quiet month for the housing market, and everyone’s attention will be focused on the next couple of months as the spring market gets underway.”

For more insights into the prime London property market, contact BHHS for a conversation about selling or buying property in the current climate.

References

https://www.lonres.com/local/newsletter/London-Report–January-2023.pdf

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2023/february-2023

https://www.lonres.com/local/newsletter/London-Report–January-2023.pdf

https://www.lonres.com/public/resources/latest-publications/prime-london-market-update-october-2020

http://info.lonres.com/rs/147-UIS-364/images/LonRes%20Residential%20Review%20Autumn%202019.pdf

https://www.lonres.com/local/newsletter/London-Report–January-2023.pdf

https://propertyindustryeye.com/trend-for-prime-london-price-reductions-continues/

https://propertyindustryeye.com/trend-for-prime-london-price-reductions-continues/

https://www.lonres.com/local/newsletter/London-Report–January-2023.pdf

https://www.lonres.com/local/newsletter/London-Report–January-2023.pdf

https://propertyindustryeye.com/trend-for-prime-london-price-reductions-continues/

https://propertyindustryeye.com/trend-for-prime-london-price-reductions-continues/