MONDAY, 01 JULY 2024

Promising signs: London’s Prime Market Recovering as Stock Increases and Vendors Remain Motivated

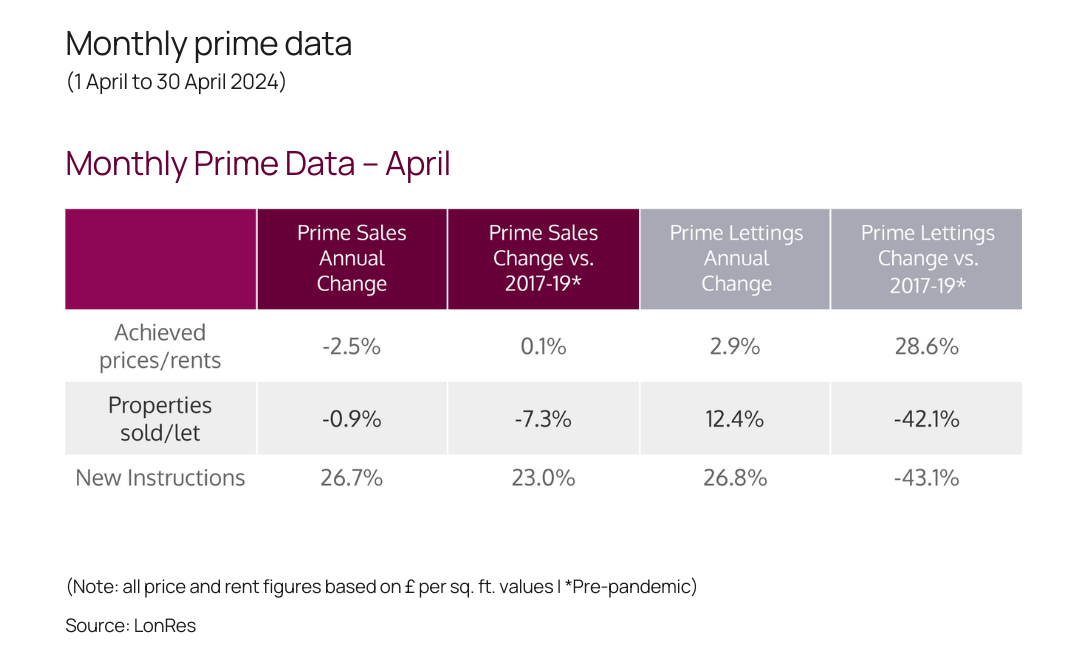

The prime central London property market is showing positive signs of recovering post-pandemic. Despite a subdued start to 2024, data indicates vendors are becoming more motivated to sell as we see a rise in supply and discounts. The increase in stock is also noticed in the lettings market as numbers begin to climb to pre-pandemic levels.

Prices across both sales and lettings are recovering nicely, too. Letting values are rising, and sales values align with pre-pandemic levels. Deals in both markets take longer to go through; however, they eventually reach competition.

– Properties under offer are up by 19.9% compared to April 2023

– 24.2% more price reductions than 2023

– Despite falls, prices now track pre-pandemic levels

– Rental values in April were 28.6% above their 2017-2019 average

Properties Under Offer Are On The Rise

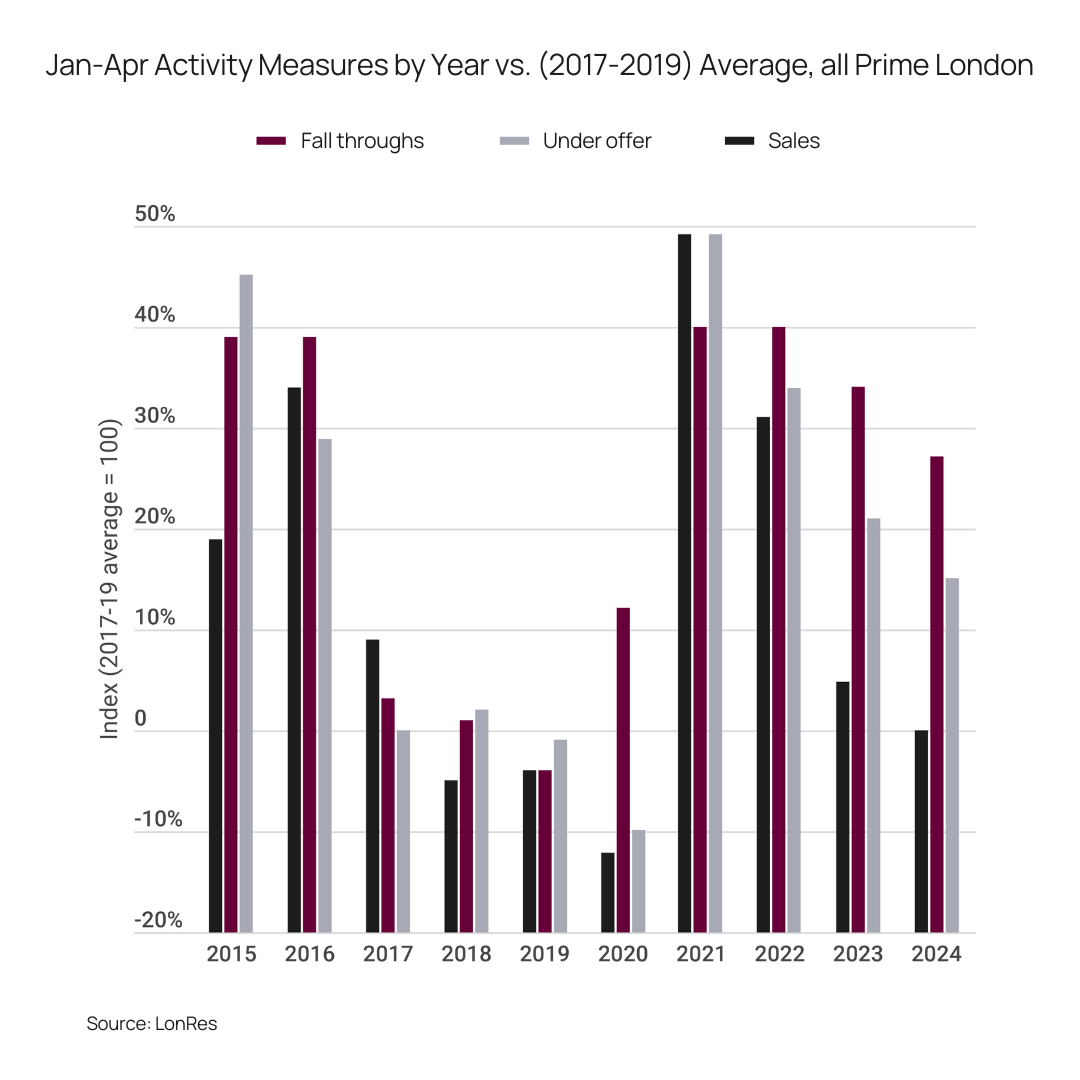

Despite the impending election and rising rates, the number of properties under offer in the prime London market continues on an incline. In April, they were up 19.9% compared to April 2023. This is 28.5% above the April 2017-2019 average.

While more properties are under offer, there has been an increase in fall-throughs. The fall-throughs can be attributed to properties spending around 10% longer on the market [Page 4]. Properties in a chain are stuck under offer for longer, making them more susceptible to fall-throughs. LonRes uncovered a 26.6% rise in fall-throughs in the first quarter of 2024 compared to pre-pandemic averages.

Supply Gets a Boost

Seller sentiment and determination to sell indicate a positive sales market. New instructions are on the rise and above pre-pandemic levels. The average number of new instructions in April was 26.7% up in 2023 and 23% above the pre-pandemic average. At the end of April, there were 10.5% more properties for sale than the previous year and 35.4% more than the end of February 2020.

Vendor motivation continues to grow, too. Keen to sell, vendors reduce prices. There’s been an increase of 24.2% more price reductions than last year and 3.1% fewer withdrawals.

Properties in Demand

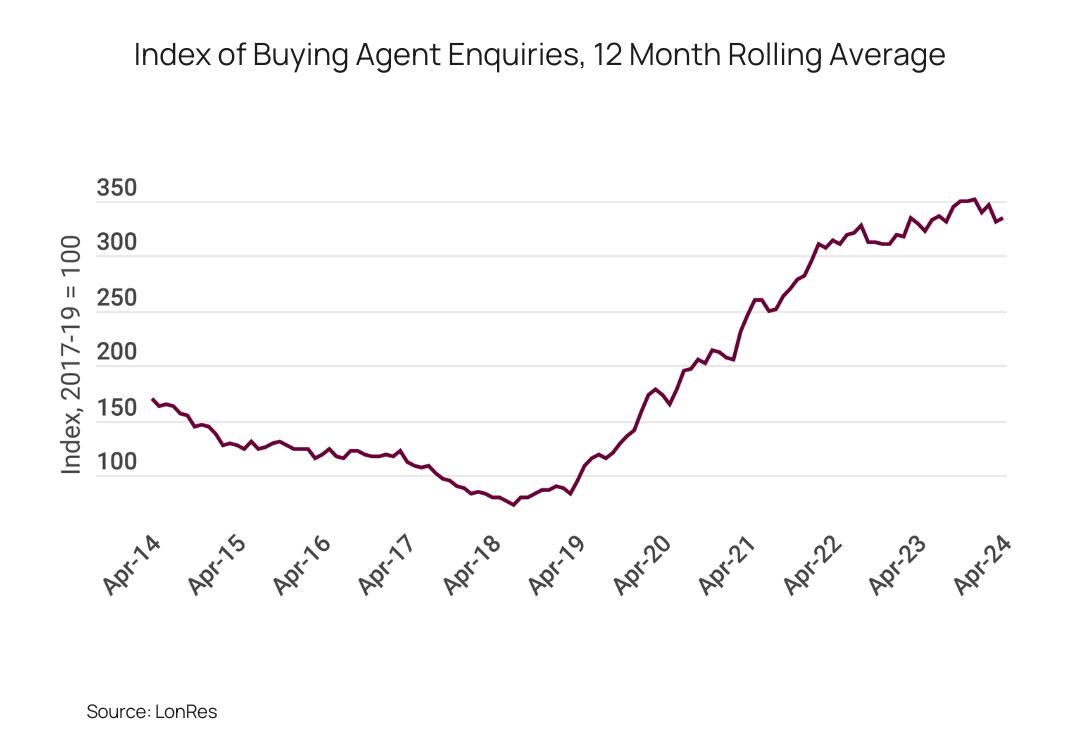

Buyers are keen to make moves, too. The sales and under-offer data show that the market is moving – despite it taking longer to complete. LonRes also notes that enquiries from buying agents are on the rise. Buying agents are considered serious, motivated buyers. The current 12-month average of enquiries is over triple the pre-pandemic levels.

Prices Begin to Recover

In April, the prime London sales market indicated signs of improvement. Average achieved prices are up in March, meaning there has been a monthly price rise twice in a row. This news suggests that the market may have passed the low point in values and is heading back on a trajectory. Currently, prices are 0.1% up on pre-pandemic levels.

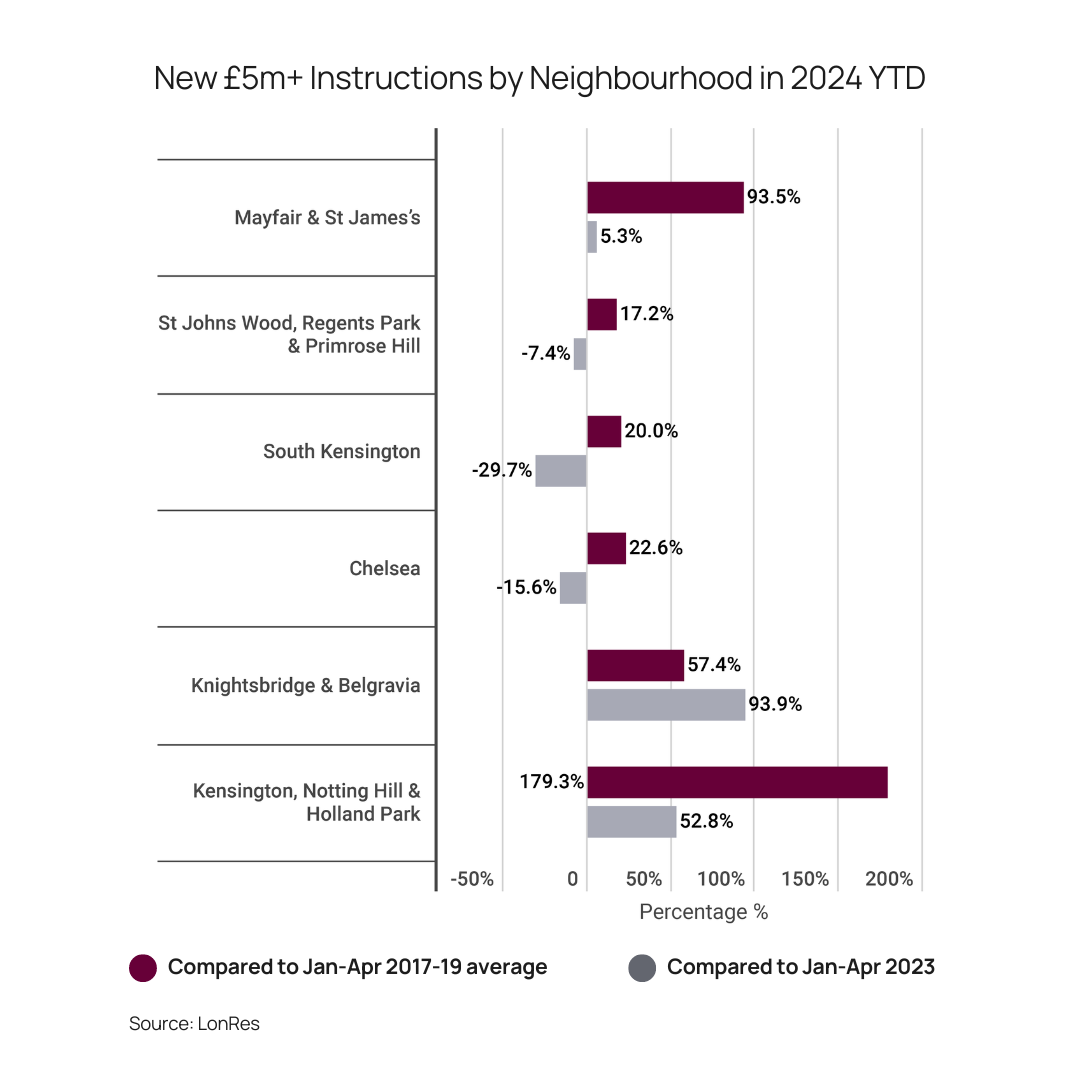

The £5m+ Market Continues to Grow

The £5m+ market is also looking positive. Activity is strong, with sales instructions 67.2% higher than the previous year, almost doubling the 2017-2019 average. We also see new instructions, with 26.1% more instructions for £5m+ properties than the previous year.

However, not all neighbourhoods are seeing the same growth. Knightsbridge and Belgravia have seen new instructions of £5m+ properties almost double compared to the same period pre-pandemic. South Kensington experienced 30% fewer £5m+ instructions in 2024, and Chelsea 15% less than the previous year.

Positive Signs in London Rental Property Market

In the first quarter of 2024, the lettings market has shown signs of improvement with stable values and increased activity.

Activity in the prime London lettings market is held back by lack of supply after landlords exited the market or put a pause on building portfolios – research from Simply Business found that just 3% of landlords are planning to buy a property in 2024.

However, there are signs of green shoots in the prime London rental market. In Q1, New instructions grew by 14.4% annually, and properties under offer were up by 1.4% [page 8]. In April, new instructions were 26.8% higher than a year earlier. While these numbers remain lower than their pre-pandemic averages, they’re heading in the right direction.

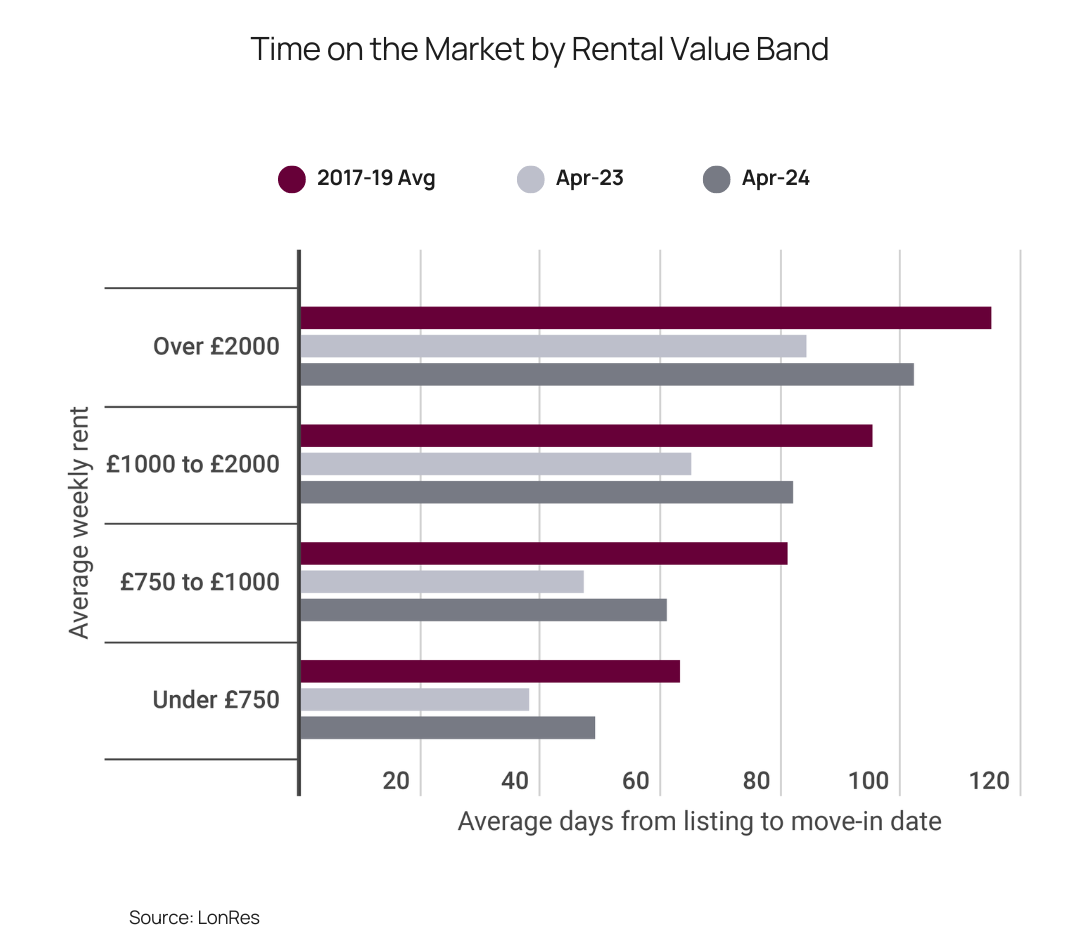

The market isn’t moving as quickly as in previous years. In July 2022, the average time on the market was 44 days. In April 2024, it was 64 days. Time on the market is higher than in 2022. However, it is less than in 2017-2019, which was 64-84 days.

While the market is slower than a few years previous, rental growth is rising. In April, it was 2.9% across prime London, continuing the 3 to 4% rise trend. In April, rental values were 28.6% above their 2017-2019 average.

Future Outlook

The future outlook of the prime London sales market is positive, with values tracking pre-pandemic levels and new instructions increasing, indicating we may be over a difficult period. Properties are taking longer to sell, making them vulnerable to fall-throughs. However, vendors remain motivated to sell by offering discounts. Investors and determined buyers can take advantage of these discounts, particularly if they’re willing to wait a little longer for completion.

With high interest rates for homeowners and economic uncertainty, prime London buyers may be more inclined to rent. Landlords looking to increase their portfolio can take advantage of demand, discounts, and the increase in rental values.

Our agents are ready to discuss the central London property market. Hear about properties for sale in London, properties to rent in London and London interest rates from our team.