MONDAY, 01 JULY 2024

Exploring The Rental Property Market in Prime London and Its Investment Opportunities

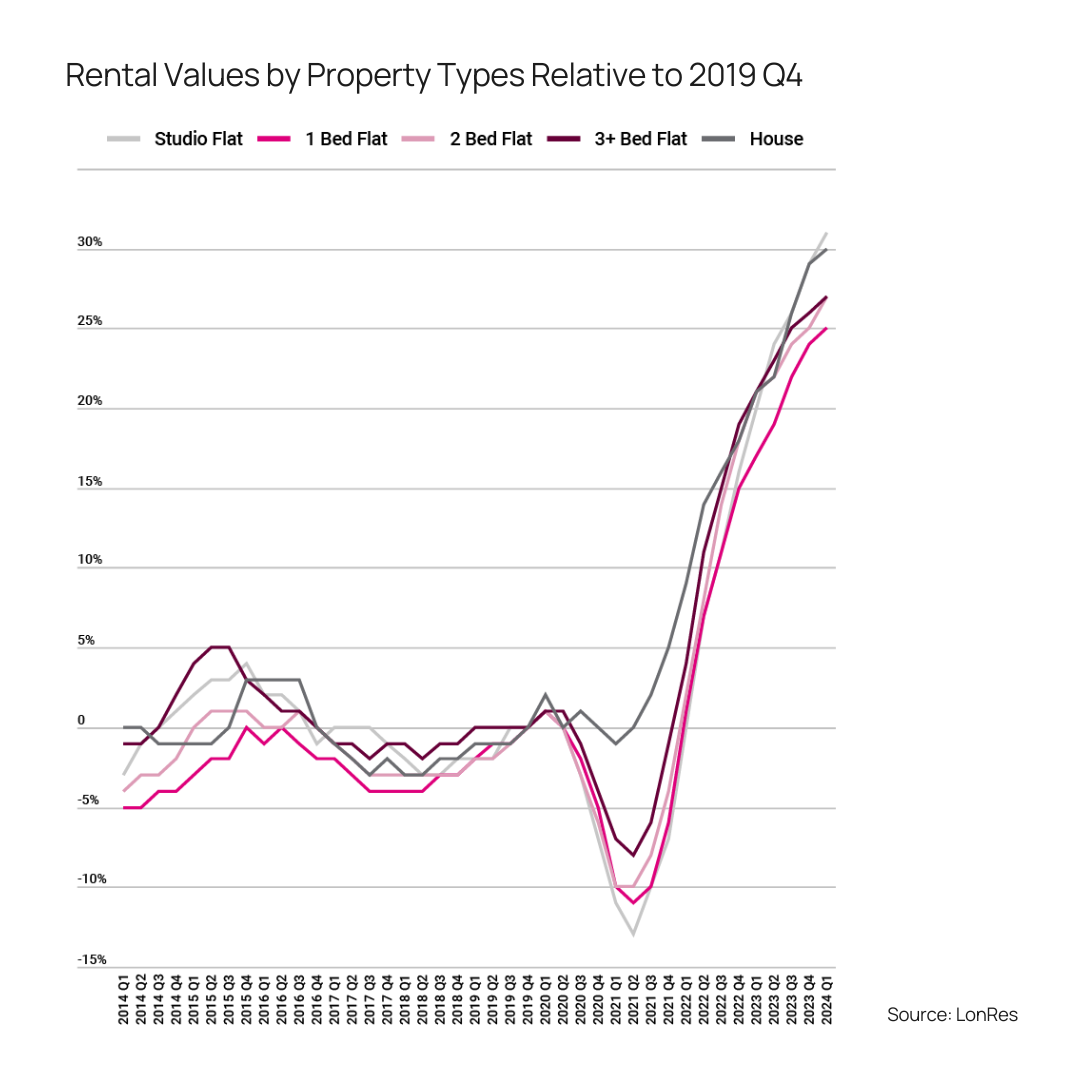

The prime London property sales market has experienced a turbulent twelve months; however, the London rental market continues to thrive. While we’re not seeing the same significant rises in rent values as in 2021, they continue to follow the trend of rises in the 3% to 4% range. Values are currently 28.6% above pre-pandemic averages.

There is a notable difference in yields and values depending on where the rental property is located in prime London. We explore prime London locations and the value and returns of property in the locale.

– Rental values of studios increased by 30.5% at the start of 2024

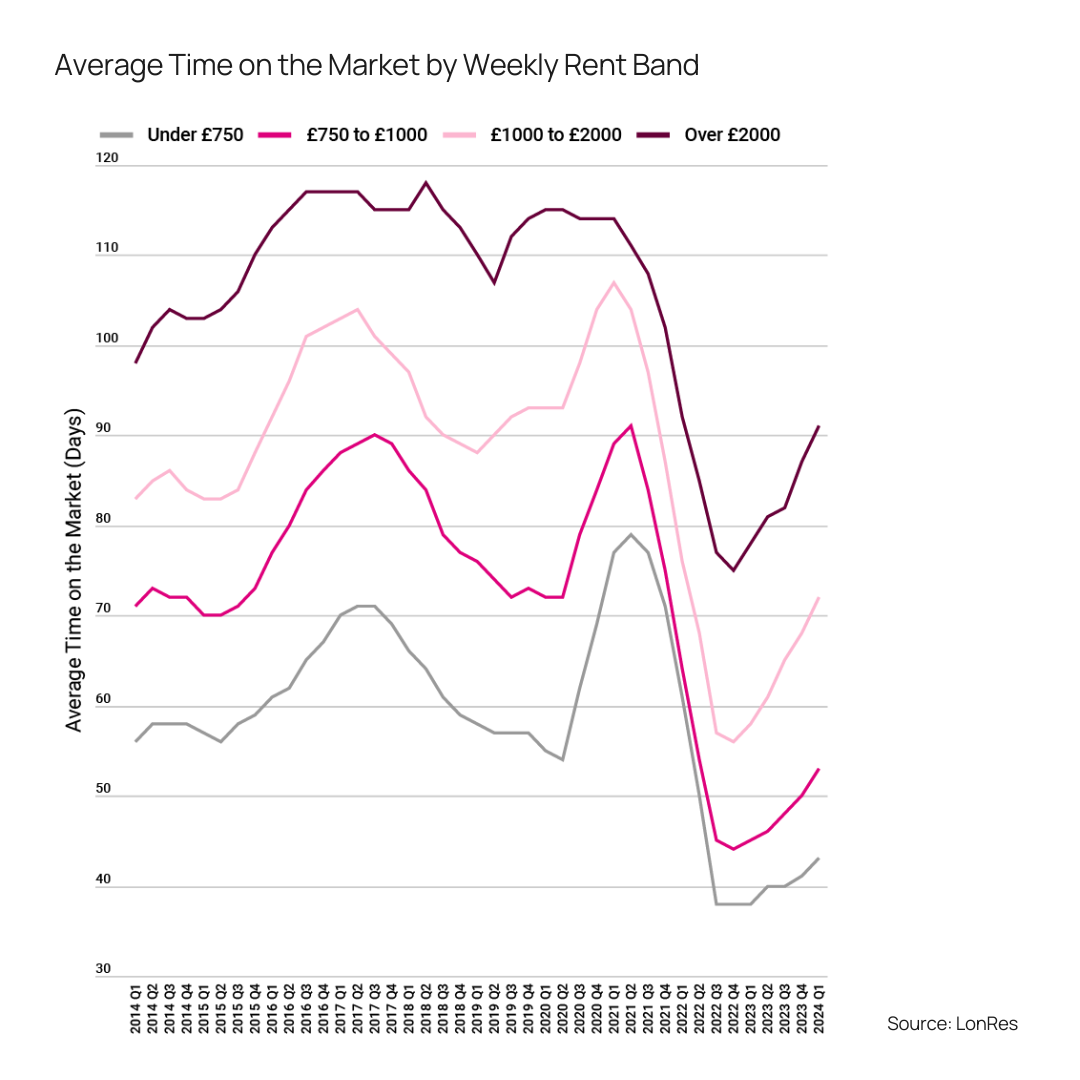

– Lower-cost rental properties spend an average of 79 days on the market

– Properties over £2000 per week take an average of 111 days to let

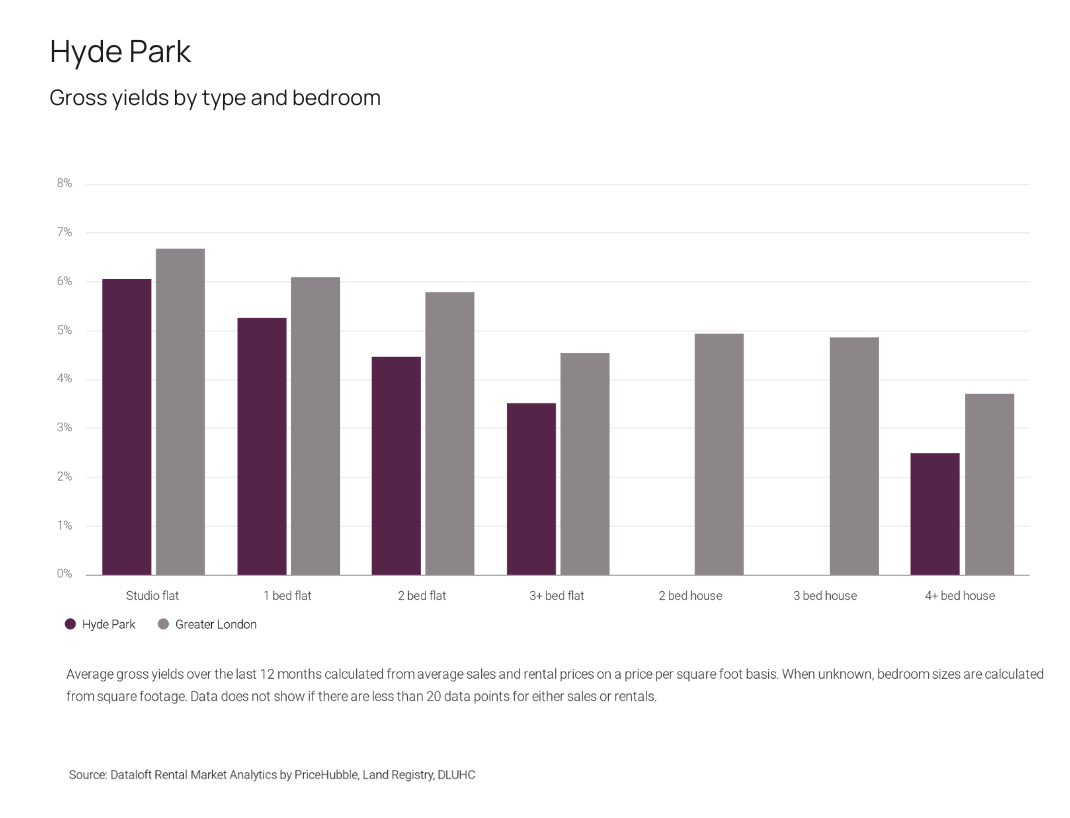

– On average, a studio flat in greater London sees a return of 6.7% and a 3-bed house 4.9%

The Economic Backdrop

The lettings market hasn’t recovered to the same averages of new listings seen pre-pandemic. Demand for all rental types dramatically reduced in 2020, with studios seeing the sharpest fall. Falling demand coupled with economic uncertainties led some landlords to sell their investments.

However, shortly after the sharp drop in rental demand, we began to see a dramatic increase in Q3 2021. The low supply of rental properties and growing demand significantly drove up prices—prices that had only grown an average of 1% in the five years preceding 2019.

Rental values for houses remained similar in 2020, then climbed to reach +29.9% relative to Q4 2019. Studio values fell fast to -13.0% as renters left the city to work from a family home out of the city. At the start of 2024, studios recovered, reaching a high of +30.5%.

Inflation Impacting Tenants

Smaller properties with smaller price tags are being let faster in prime London. In Q2, the average time on the market for a property at £2000+ per week was 111 days, for a £750 per week property, it was 79.

While rates for loans, energy, and food remain high, tenants may be wary of committing too much of their monthly budget to a high rental payment.

Landlords are offering discounts, too – a possible reaction to the longer void periods on the higher-priced properties. Average discounts have grown from zero in Q3 2022 to 4.1% in Q1 2021. The proportion of properties that see their asking rent reduced before being let increased from 11.9% to 33.8% over the same time frame.

New instructions for rental properties are on the rise. With the weak pound, overseas investors have had the opportunity to take advantage of bargain property investments. In Spring 2024, there were 38.8% more properties available for rent at the end of March than in 2023. The increase in supply is what is cooling the significant value rises to more stable levels.

High Yields in Prime London

Yields in prime London have risen to reach 4.53% across the area in Q1. While this is slightly down from the peak of 4.58% in Q3 2023, it is 3.7% above the average since 2021.

There is a trend in prime London of smaller properties fetching higher yields. According to Dataloft, in Notting Hill, a 1-bed flat sees 4.3% returns, compared to a 4+ bedroom property producing a return of 2.2%. Chelsea follows the same trend, with studio flats fetching 5.1% and 4+ bedroom houses at 2.7%.

On average, a studio flat in greater London sees a return of 6.7% and a 3-bed house 4.9%. The average gross yield in greater London is on the rise, up by 0.4% in the last 12 months.

Rental values differ across prime London neighbourhoods. For example, the average rent achieved for homes to let in Mayfair was £4,960 per month. This is a +4% change on the previous 12 month period. Knightsbridge & Belgravia was £4,066 per month, remaining the same as the previous 12 month period.

While Regent’s Park saw an average -5% change on the previous 12-month period, one bedroom flats increased 20.3% and two-bedroom flats by 5.7%. The value of three-bedroom flats decreased by 15%.

Three-bed flats and four-bed house values also decreased in Knightsbridge & Belgravia by 4.2% and 10.4%, respectively, while studios grew by 11.3%.

However, it’s not always the case that larger properties are decreasing in rental values. In Hyde Park, a three bed house has increased by 58.1% on an annual basis.

Property Rental Types

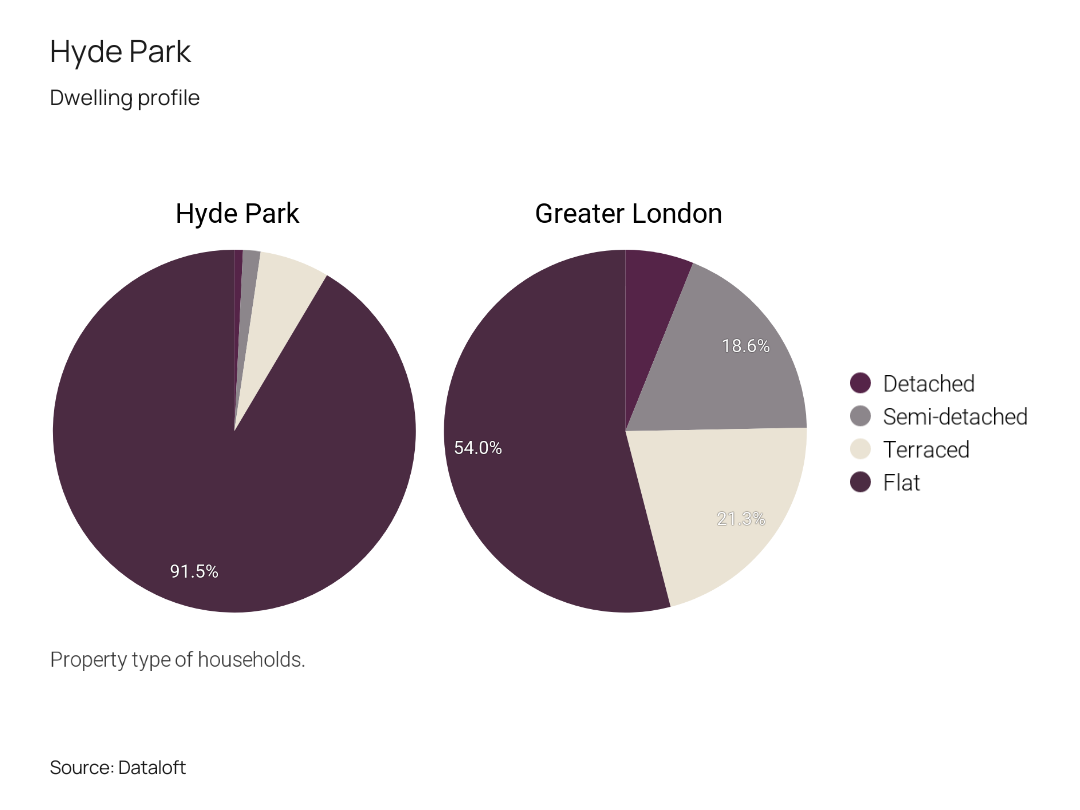

Property stock in prime London is made up of studios, flats, terraced houses, and detached houses.

Across prime London postcodes, the majority of rental stock is flats. In Hyde Park, 91.5% of stock is flats, with 35% being 1 bedroom. In Chelsea, 91% are flats, with over a quarter of the 1 bedroom, and 3+ bedrooms. In Camden, 92% are flats with a near-equal split between 1, 2, and 3+ bedrooms.

Prime London House Prices

Property prices in prime London are fairly stable following a decline. Currently, they are 0.1% higher than pre-pandemic levels. Purchasing a buy-to-let property in the current economic climate could mean a great deal.

In May 2023, the average property price in Chelsea was £1,533,106, in May 2024, it was £1,317,336 – a 14% drop [Dataloft]. However, the last few months have remained fairly stable, indicating we may have passed the low point of property prices.

Challenges and Opportunities

Landlords are facing tax uncertainties, an impending election, and higher rates of borrowing. Tenants are contending with rising costs of everything from bills to food shopping – and fewer options for rental properties.

Renters may seek the security of a longer tenancy agreement. While landlords may favour shorter terms to give them the freedom to sell if needed, landlords would benefit by offering longer agreements to avoid the risk of long void periods between tenants.

Tenants in the city increasingly value outside space. Landlords looking to invest in properties in prime London might consider smaller properties with gardens, balconies, or access to a shared outside space. The new London Plan sets a minimum standard of 5 square metres of outdoor space to be included in every dwelling.

Final Thoughts

LonRes reports that rental stock on the market is recovering from the low point reached at the end of 2021. There is plenty of opportunity for landlords to enter the market and take advantage of the high yields and demand in prime London rental property. With the weak pound, overseas investors can access incredible deals.

Studios and flats with one to two bedrooms are realising an increase in value. However, the larger property’s values remain stable or slightly lower, depending on the area.

Investors looking to build their portfolio should discuss the demand, yields, and London prime property prices in the local areas. While tenants are favouring smaller properties in some London neighbourhoods, there’s a higher demand and value increase in larger properties across other parts of prime London.

To hear about the London rental market, London property prices, and investment properties for sale in London, contact our Central London estate agents. If you have something to sell ahead of investing in a new property, we offer a free property valuation in prime London, too.