As one of Central London’s most highly regarded estate agents, we’re often asked to share our views — here are a few of our most recent pieces.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 62

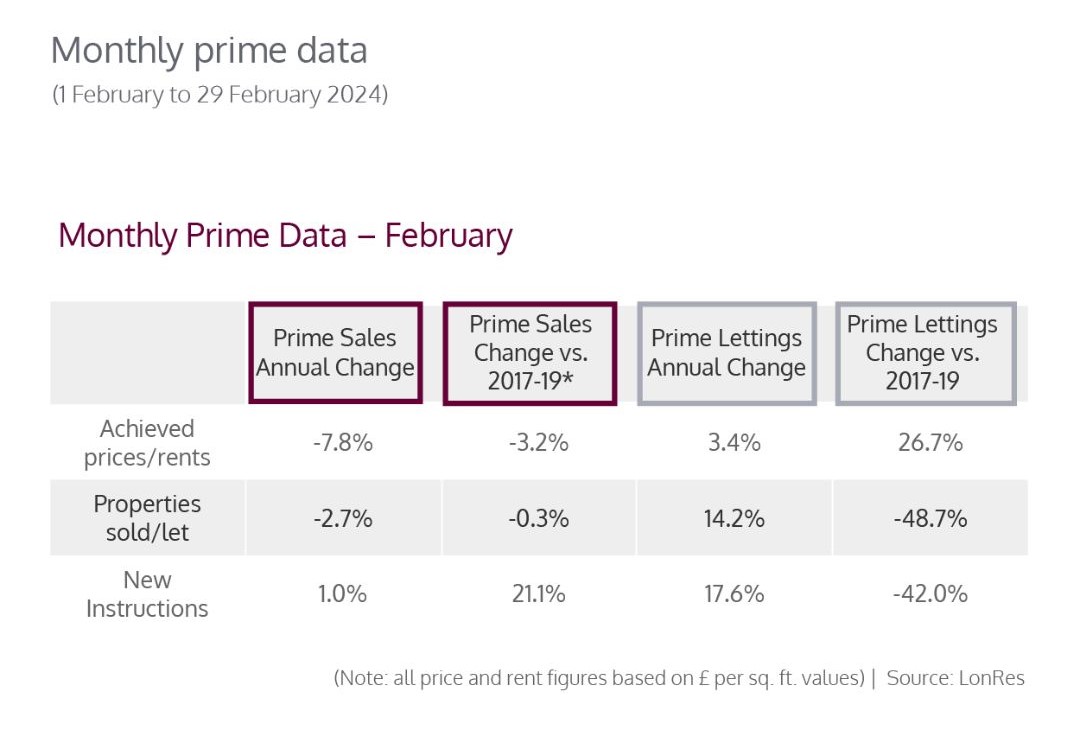

Despite an economic backdrop of a high base rate, there has been an increase in new instructions across both sales and lettings. While 50% of properties were discounted, in the broader picture, this is just 2% more than pre-pandemic reductions.

As we enter the second quarter of the year, it’s time to look at property data from the start of the year to now, to inform our opinions and advice on the prime London housing market.

Key takeaways

- New instructions rose in February by 1.0% on an annual basis

- In the last year, around 50% of properties saw a discount in price, which is 2% more than in 2017-2019

- Average rent in London currently sits at £2,119 after a 6.4% growth in the last year

- Sales of £5m+ homes were up 4.2% on February 2023

Economic Outlook

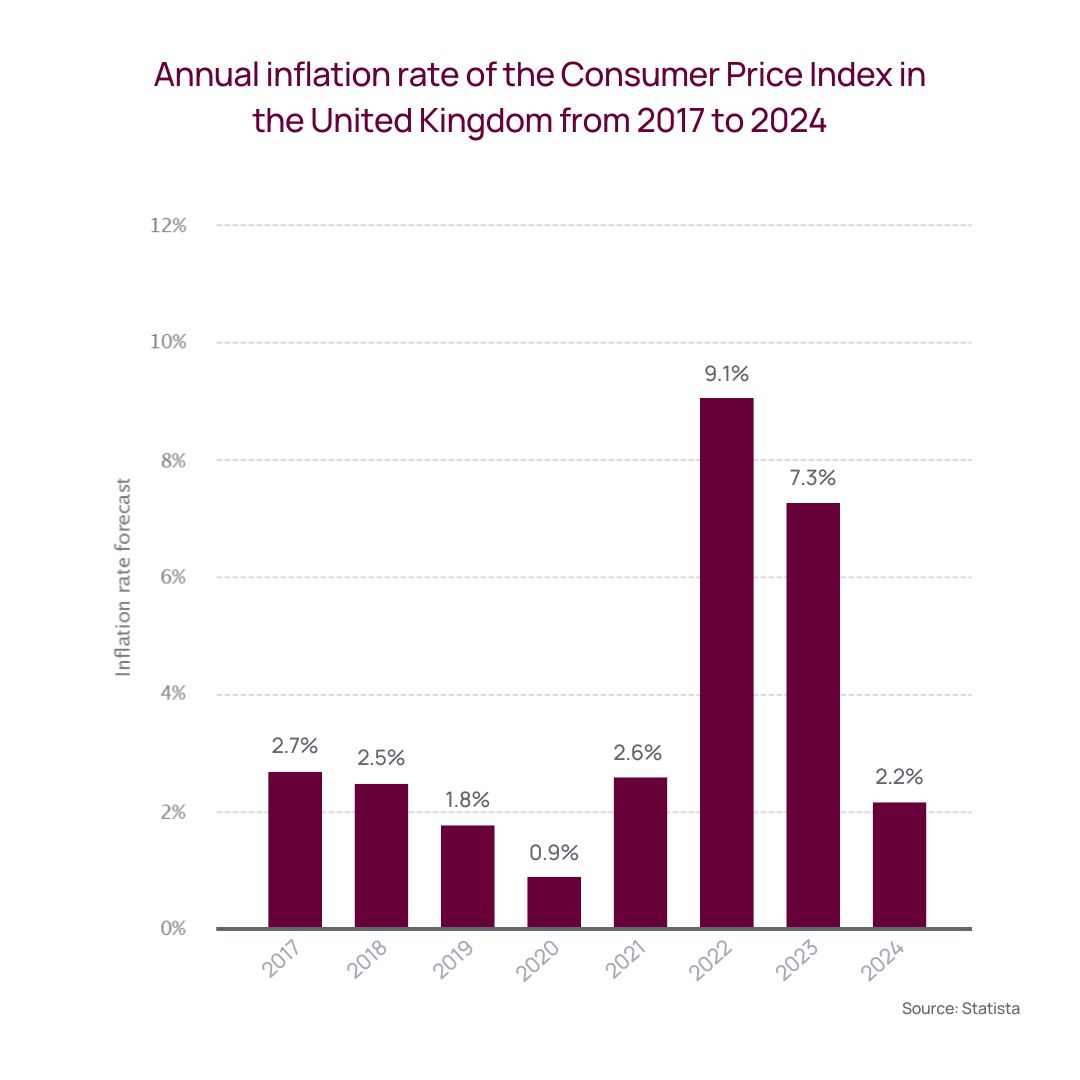

In March 2024, the Bank of England held the base rate at 5.25%. Rates are predicted to fall to 4.4% by the end of 2024. With the inflation rate at 4.8% and forecast to reach 2.2% this year, sellers and buyers can have more confidence in the housing market – particularly if they require a mortgage. Landlords may feel relief as cost of living declines, reducing the financial strain on stretched tenants.

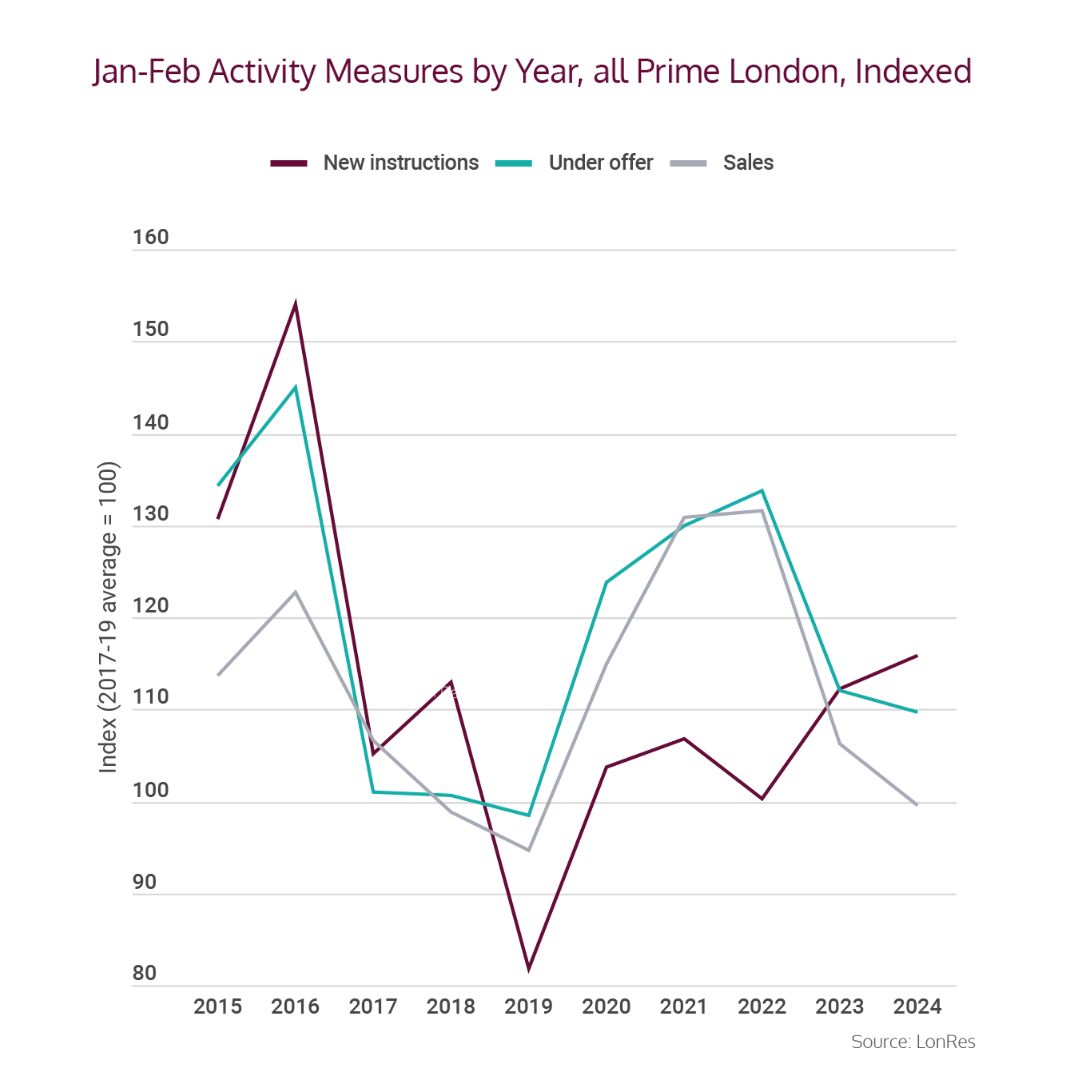

A Positive Start For New Instructions

Spring is a prominent time for a flurry of properties coming to market. This year has continued to endorse the trend as properties for sale in prime London rose in February by 1.0% annually. This is evidently 20% higher than the 2017-2019 average. By the end of the month, there were 7.5% more properties available in February 2024 than in the same month of 2023. Under offer numbers are around 10% higher than last February. This is a positive sign for those looking to make a move this summer.

While demand remains static, the gradual increase in supply means the prime London sales market remains relatively balanced.

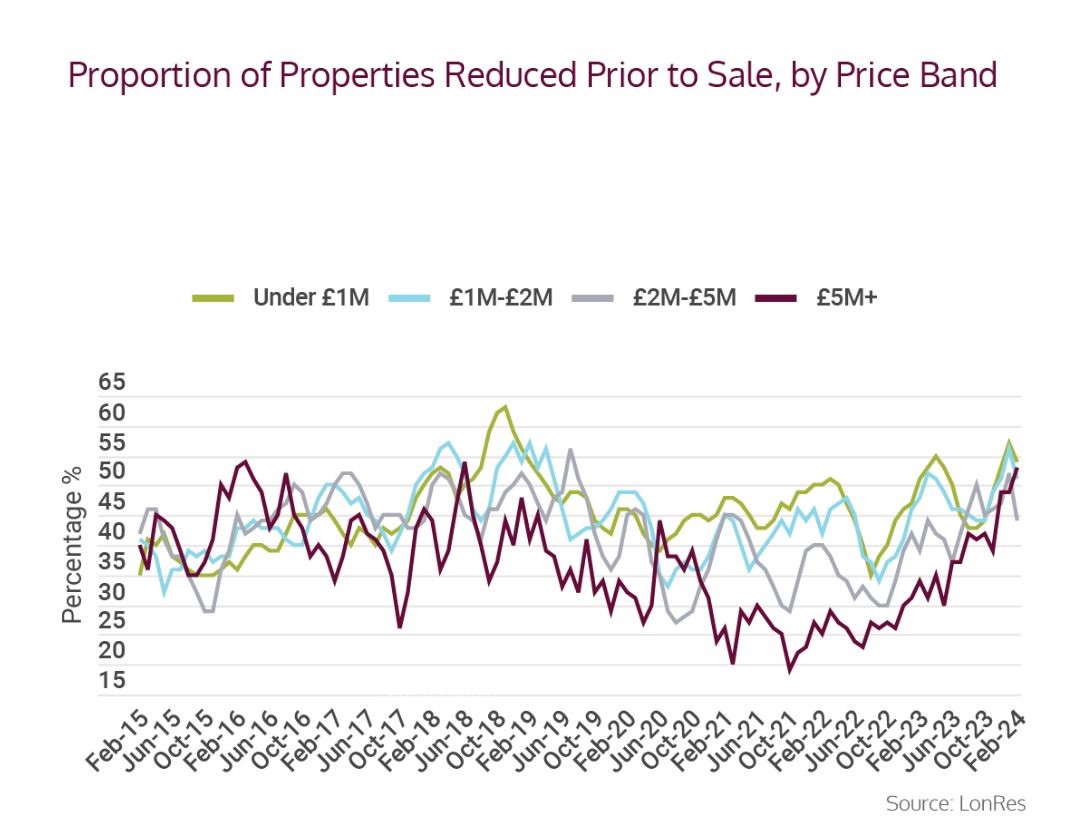

Discounts Remain Consistent

Analysing the data on price reductions and time to sell indicate the current market position. With a broader view of the data, the metrics aligned with trends. In the last year, around 50% of properties saw a discount in price, which is 2% more than in 2017-2019.

In the prime London market, sellers received an average of 91.4% of the sale price. This is an increase of 1.4% in January when the figure fell below 90%. Pre-pandemic average discounts were around 10%, so on a broader outlook, the price reductions held firm.

Average time on the market has also remained stable. Across prime London in February 2023, the average time from listing to exchange was 166 days. Since 2017, this figure has moved from 165 and 164 days, showing long-term consistency.

A Broad View Of The £5m+ Market

While sales of £5m+ homes were up 4.2% in February 2023, properties under offer were 11.5% lower. However, an accurate picture of the £5m+ market requires a broader view rather than focusing on small market segments.

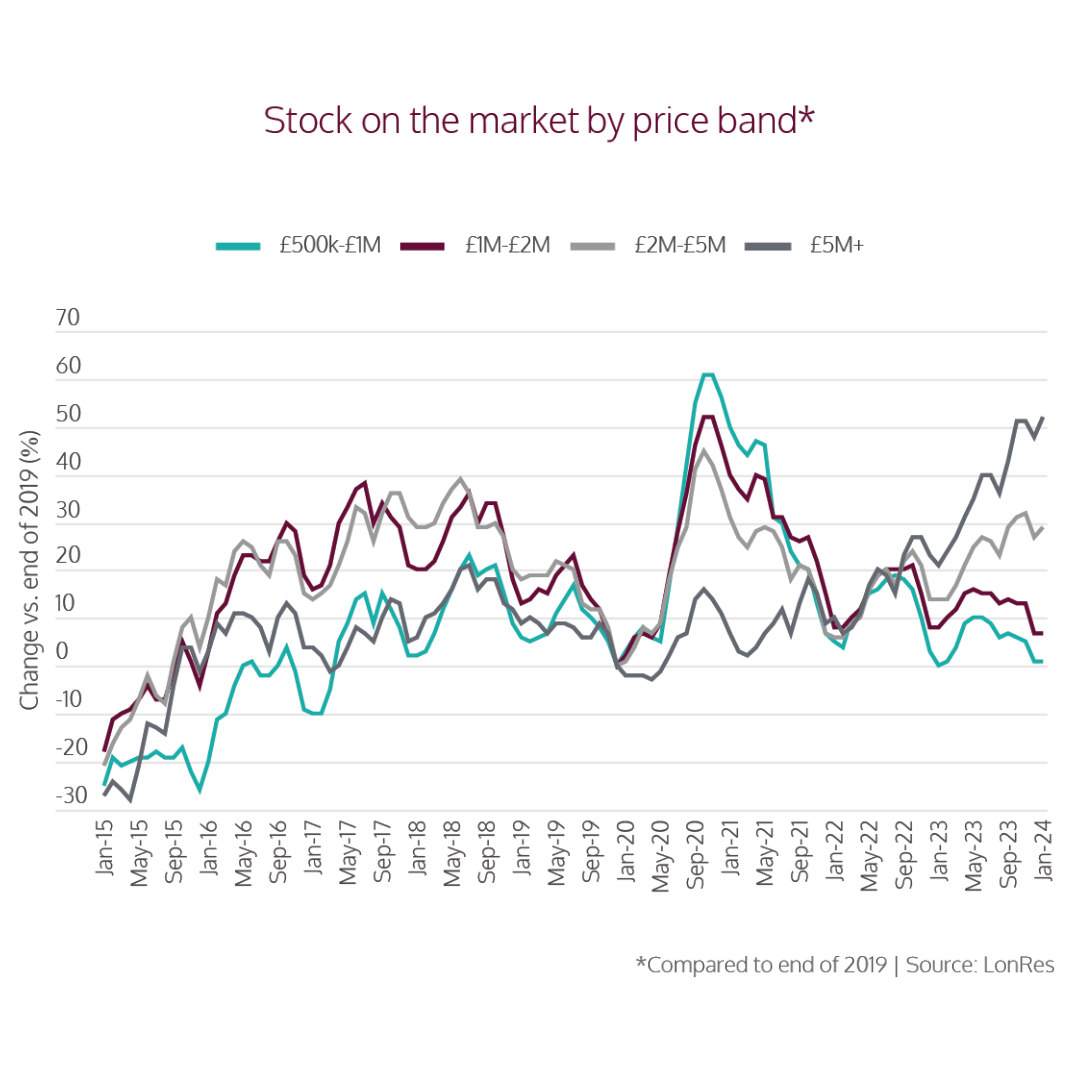

Analysing January and February 2024, the £5m+ market appears weaker. During this time, price reductions and new instructions were rising, and transaction volumes were declining. Currently, there are 26% more £5m+ properties on the market in London than in 2023. However, when you look at the bigger picture, activity in 2024 is significantly higher than 2017-2019. Sales in the £5m+ market are up more than 40% compared to pre-pandemic.

Increase In Annual Rental Growth For Investors

In the prime London lettings market, we are seeing the first signs of spring. In February, we saw annual rental growth increase across the prime London lettings market. There was a slight rise of 3.4%. This increase boosts values by 26.7% above their 2017-2019 average. After four months of falls, this is welcome news to property investors and landlords.

Rental Income Remains High

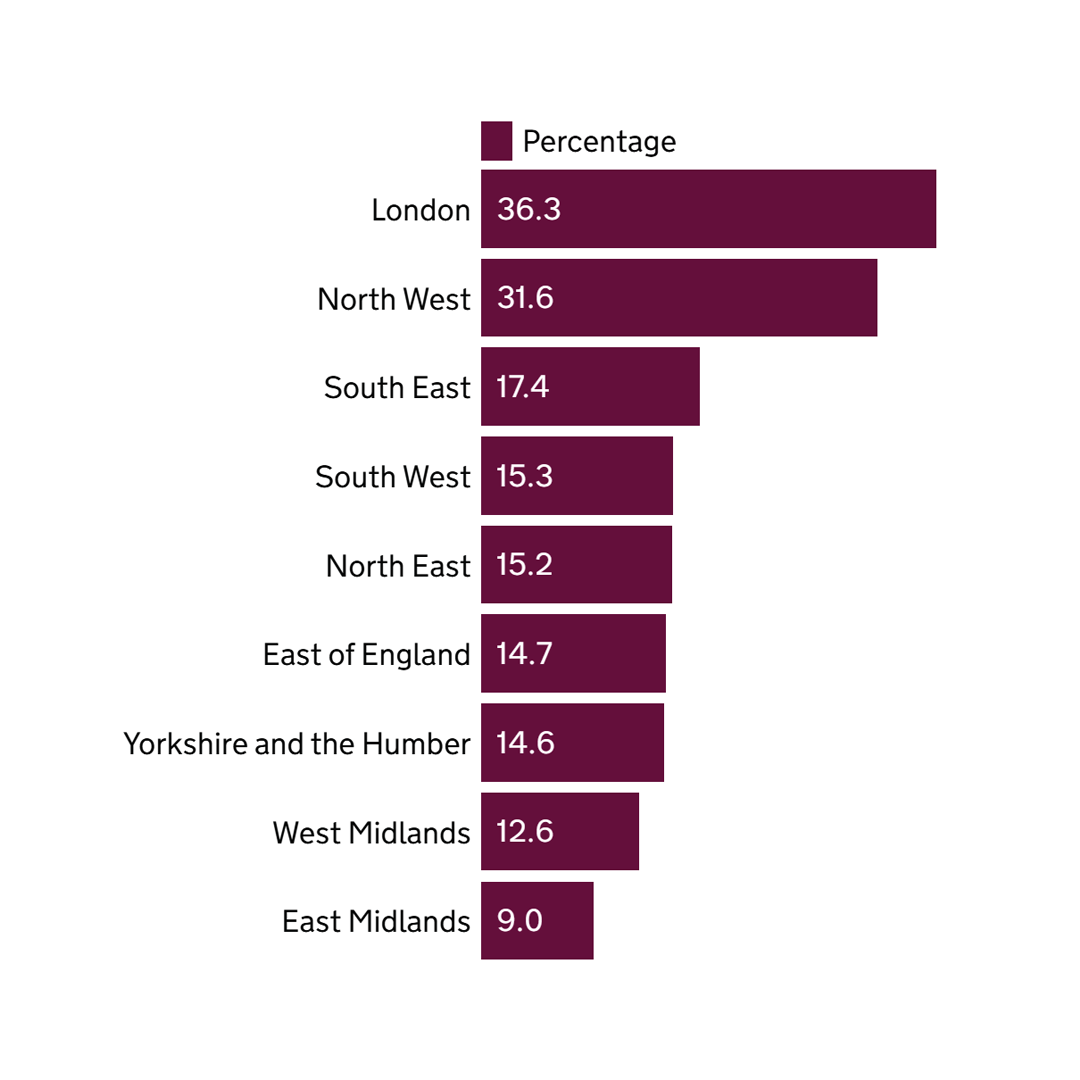

Zoopla reports that London is the most expensive location to rent in the UK. Average rent in London currently sits at £2,119 after a 6.4% growth in the last year. The most expensive places to rent are Kensington and Chelsea at an average of £3,460, and the City of Westminster at £3,153.

New Instructions

While we’ve seen many landlords exit amid tax changes and interest rate increases, new instructions are starting to rise as new investors enter the market. In February 2024, there was an increase of 17.6% in instructions on an annual basis. This remains 42% below the pre-pandemic level. However, across prime London, there are 48.1% more properties on the lettings market than in 2023, indicating a trajectory.

Discounts And Demand

In Q3 2022, discounts and price reductions were at an all-time low. This denotes that demand was notably outstripping supply. In February 2024, the average discount was 4.2%, compared to -0.5% in September 2022. With supply now on the rise, we are also seeing reductions in price, with 35.1% of properties being reduced before the let was agreed.

With high-interest rates pushing up the cost of borrowing for potential buyers, buyers may turn to renting as an alternative, increasing the demand for rental properties. Should interest rates begin to fall later in the year, the rental market may begin to stabilise.

The Impact Of New Legislation For Landlords

With the Renters Reform Bill on the horizon and the government’s commitment to requiring all rental properties to have an EPC rating of A-C, landlords do have challenges to navigate. Landlords may be required to enhance the property, and may increase rent to pay for required works. The looming general election also adds uncertainty. However, with increased demand for rental properties, high yields, and the weak pound, there are opportunities to be sourced for overseas and local investors.

Final Takeaway

We’re seeing the first signs of spring in the prime London sales and lettings market. From an increase in new listings across sales and lettings to a stabilising of discounts and price reductions, there are plenty of opportunities to invest, buy, and let with confidence.

Contact our Central London estate agents office to discuss the opportunities in the prime London housing market, hear about house price changes, and view properties for rent and sale.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 57

- Leasehold dwellings make up 20% of English housing stock

- A lease extension can cost tens of thousands of pounds, depending on the property value

- When a lease falls below 79 years, costs triple

Properties are either freehold or leasehold. If your property is freehold, you own the building and the land. If your property is leasehold, you own the property but not the building or the land it’s on. In 2021-2022, around 20% of the English housing stock was leasehold dwellings.

What Does Leasehold Mean When Buying a Flat?

Leasehold flats can have a lease of 99 to 999 years, and you have the right to occupy the property for the duration of your lease. However, when the lease is short, typically under 80 years, problems start to arise. The cost of lease extension increases, mortgages may be more challenging to obtain, and it can be harder to sell in the future.

Short-lease properties for sale might appear to be a great deal, often with a lower premium. However, with lease extensions costing thousands of pounds, costs may outweigh that great deal. It pays to explore your options when it comes to short lease flats.

What’s a short lease?

A short lease is below 80 years. If a property has a lease of 100 years, you’ll need to factor in how the flat may decrease in value when you come to sell. If the short-lease flat is an investment to rent out, you may own it for well over 20 years.

The problem with a short lease

Buying a short lease flat presents a few significant problems.

Extra expense

You can pay for a lease extension. However, this can be tens of thousands of pounds, depending on the property's value. Once the lease falls below 80 years, the landlord will receive 50% of the profits from renewing the lease. For example, if the property will gain an additional £30,000 in value from the lease extension, the landlord will receive £15,000. Leaseholders will also have to pay legal costs for themselves and the freeholder, adding further expense.

Mortgage issues

If you require a mortgage, many lenders won’t lend on flats with a lease below 80 years. If a lender does release funds for an 80-year lease, the remortgage rate might be considerably higher. Prospective future buyers may struggle to get a mortgage on a short lease flat, limiting the sale to cash-only buyers.

Careful planning

Extending a lease on a flat when over 80 years are remaining is much cheaper than extending a lease with 79 years remaining, which can be close to triple the cost. The freeholder has no obligation to extend the lease before the sale, either. As the buyer, you have no legal right to extend the lease until you have lived in the flat for two years.

Delays

If you need to move or buy the property quickly, beware that a lease extension could likely add months to the buying process.

Limited buyers

When the lease is very short, the property may linger on the market longer as it limits the buying pool to cash-only buyers.

Short Lease and Property value

Buyers might consider how much they’d pay if the property had a long lease. They will then understand the costs involved in the lease extension and deduct it from the asking price. This is a reasonable way to ask for a reduction.

How to extend the lease

Legally, the leaseholder can apply to extend their lease, and the freeholder can’t refuse. However, you must consider the costs and hassle of extending the lease.

One option is to give the seller the option to extend the lease before you buy the property, requiring the seller to pay for the lease extension. They can use the purchase funds if they don’t have the money. This is called “new lease on competition.” With this option, when you or your tenants move in, the lease will be resolved. However, if it’s a competitive market with many prospective buyers who don’t mind buying a flat with a short lease, you may lose out as it’s unlikely to be the vendor's preference.

A new lease on completion can take up to a year to complete. There’s the option to speed things up with an informal lease extension. However, your legal team must review everything before making any agreements.

Another option is to ask the seller to start the lengthy lease extension process and transfer it to you when you complete the sale. This does come with potential problems. Firstly, you’re still buying a short lease flat, and secondly, there is plenty of uncertainty with lease extensions that will become your problem.

Remember, sellers are unlikely to be interested in the flat they’ve sold in the future. With your professional advisors, you must ensure the process is transferred and negotiated before or on completion.

How to Extend the Lease If You Want to Complete It Quickly

Once you’ve owned the flat for two years, you can ask for an extension. This can be a long process. Once served the Section 42 notice lease extension, the freeholder has two months to respond. Following their response, there will be a two-month negotiation period. If they don’t reach an agreement, there may be cause for a Leasehold Valuation Tribunal to extend the timeline. You need to save money to pay for the lease extension, too.

Are properties with a short lease a good investment?

A short-lease flat will likely come with a reduced price or the chance to negotiate. However, the costs of extending the lease, the time it takes, and the uncertainty might be off-putting.

The lease cost depends on the property's value, so if the flat is in a premium location and has a short lease, expect high costs for a lease extension.

While you don’t need to avoid flats with a short lease, a flat with a long lease might be a better option if you're looking for a seamless and stress-free investment. For more information on selling or buying short lease flats, contact our Central London estate agents.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 45

In the UK, demand for rental properties has consistently outstripped supply, increasing rental yield. In London, rents have risen by 31% between November 21 and November 23. With high mortgage rates contributing to a shortage in supply, the average rental property receives three times more enquiries from prospective tenants than in 2019.

Although signs for investors appear promising, mortgage and tax rises and uncertainty over changes to legislation, investors are continuing to exit the market. Hamptons data shows close to 300,000 more rented homes have been sold than purchased since 2016.

But is now the right time to sell? Or should landlords expand portfolios? We explore the current rental market, considering the Renters Reform Bill, EPC pressures, the prospect of a new government, and tax changes.

Section 21 Eviction Reform Delay

Under section 21, landlords can evict tenants with two months' notice without reason. In 2019, the Government committed to scrapping Section 21 notices in the general election manifesto. However, in 2023, the idea was paused until there were necessary changes to the court system.

Michael Gove said that the Conservative government would end no-fault evictions by the time of the general election, which will likely be this autumn. He said, “We will have outlawed it, and we will put the money into the courts in order to ensure that they can enforce it.”

With a general election looming, Labour has said it will ban Section 21 evictions quickly if it wins power. The party has also created a Renters’ Charter, which focuses on tenants' rights. The charter proposes ending automatic evictions for rent arrears, introducing a four-month notice period for landlords, and allowing renters to make reasonable alterations to the property.

While Section 21 is causing some confusion for landlords, with the delay, at the time of writing, landlords can continue to regain their property at any point during the tenancy by serving a Section 21 notice.

No More Blanket Bans

Under the Renters Reform Bill, landlords and letting agents are prohibited from banning tenants who receive benefits or have children. This ensures families and vulnerable people are not discriminated against when renting. While some landlords have reservations about tenants being able to pay their rent, DSS tenants often stay longer. The increase in benefits and minimum wage should help to omit these concerns.

Under the new rules for blanket bans, landlords cannot unreasonably refuse a tenant's request to have a pet in the property.

Support For Low-Incomes

According to the most recent set of figures from the National Housing Federation, tenants paying with Universal Credit remains at 33-34%, and these tenants account for 56-58% of total arrears. Previously, landlords with concerns about arrears may have banned people on benefits. However, with the new rules against blanket bans in place, landlords will not discriminate.

There is welcome news for tenants on benefits and for landlords, too. The Local Housing Allowance will increase to cover the lowest 30% of local rents, giving 1.6 million households an average of £800 annually. This, coupled with benefits increasing by 6.7% and a rise in minimum wage, will provide tenants with more income to keep up with rent payments.

The reduction in National Insurance also puts more money in tenants' pockets. With these changes, landlords have more confidence in receiving monthly rental payments.

New Standards For Landlords

Standards for landlords are changing. The Rental Reform Bill will require landlords to pay to join an approved ombudsman scheme. The dedicated ombudsman will ensure all landlords adhere to a code and resolve disputes effectively.

The ombudsman will provide impartial advice to resolve issues between landlords and tenants. Tenants can complain for free to the scheme should the landlord not adequately address their issue. The ombudsman works on behalf of the tenant but does not champion them. Instead, it helps reach a suitable agreement without costly and lengthy court proceedings.

The government also announced plans to apply a Decent Homes Standard to the private rented sector. The review of the plan will consider the following changes:

- Set the standard on dampness and mold to protect residents

- Introduce a minimum energy efficiency standard

- List of items that must be in a reasonable state of repair for a ‘decent’ home

Each of these examples might mean the landlord needs to modernise a property, which could come at a cost. However, with a well-maintained property comes satisfied tenants who are more likely to stay longer.

The new standards will be outlined when the Renters Reform Bill passes Parliament. Local councils will have the power to ensure landlord compliance, issuing fines of up to £30,000.

Landlord Tax Changes In 2024

In April 2024, landlords selling buy-to-let properties may face higher capital gains tax. In April 2023, the tax-free allowance for capital gains decreased from £12,300 to £6,000. This year it will halve to £3,000. Investors who sell properties will now have to pay profits above the £3,000 threshold. This means landlords selling up will pay tax on £9,000 more of their gains than they did in 2022-23.

Invest Or Sell?

While some landlords sell up and retire, the rental market remains strong with high demand and impressive yields.

In January 2024, rental values were 26.1% higher than their 2017-2019 average. While buy-to-let mortgages aren’t as low as a few years ago, they are the weakest since September 2022. Later this year, the Bank of England closes in on the target of reducing inflation to 2%, potentially leading to lenders reducing mortgage rates further.

While the Renters Reform Bill likely means costly upgrades to properties, there are possible savings. For example, several lenders offer lower mortgage rates and cashback for properties with an EPC rating of A-C.

The ombudsman scheme is another expense for landlords. However, it protects the tenant and the landlord from costly court cases and provides an impartial organisation to manage the challenge.

Changes to regulations for landlords can feel complicated. At BHHS London, we stay current with legislation to ensure our clients avoid fines and further action. Contact our team to discuss new regulations for landlords or the rental market in London.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 787

Our next global convention at Berkshire Hathaway HomeServices will be held in the great city of Seattle. Home to Amazon, Microsoft, Starbucks, the Space Needle, and a man who was lonely & couldn’t sleep. My thoughts drifted to this great city as I reflected on this quarter. It is often said that the loftier the building, the deeper foundations must be laid, and like the above companies and buildings which set solid foundations in the city, so this quarter I believe represents the foundation stones of the property market for the next two years.

So let’s take a moment and review quarter one of 2024 before discussing potential forecasts for quarter two in both sales and lettings markets.

The purpose of this review/blog post is ideally not to tell you things you already know. Most of the data published in the press and media, while insightful, is naturally slightly behind the curve. They often use metrics such as land registry analysis, which is usually six months behind completions, or analysis from lending providers, which again is often found at the end of a sales process. What I would like to provide you with is data from an earlier point to give you the ‘on the pulse’ analysis of the market and what we are seeing.

You can often predict an increase in available stock and agreed transactions by looking at certain internal metrics. These are what I will try to focus on.

Firstly, let's briefly remind ourselves of the market conditions at the end of the previous quarter. The end of 2023 proved to be challenging for both sales and lettings, with high-interest rates and inflation acting as deterrents for potential buyers. This led to a market where sitting and waiting became a common strategy.

Similarly, on the letting side, we faced strong headwinds, with rental prices hitting a ceiling after 18 months of growth. Increased living costs led tenants to resist paying higher prices, while we found a rise in accidental landlords (vendors not being able to sell looking to rent their home instead) contributing to increased stock levels. This increased supply and lower demand led to a stalling in the market as we came to the year-end.

However, we anticipated a more positive outlook for 2024, expecting improvements in both sales and lettings markets. Now, let's delve into what we've observed this quarter and where we were right in our predictions, or should I keep my crystal ball firmly locked away in future?

Let’s start with the sales market before moving onto Lettings. The sales market in 2023 was challenging, with high-interest rates, and a wait-and-see mindset dissuading many potential buyers. However, quarter one of 2024 has continued to provide clarity regarding the path ahead. There's growing acceptance of the long-term trajectory of interest rates. The trajectory seems to be that we will see a decrease in interest rates, but it will be a slow, shallow line down vs an instant cliff-edge drop. The second pill of acceptance we have all had to take is that the days of uber-low borrowing are likely behind us. With, we imagine, a new normal settling lower than we have now, but definitely higher than before. Finally, we have seen a lack of rabbits pulled from the chancellor's property budget hat. Despite the usual rumour mill, there was no major stamp duty giveaway or reform. Looking ahead to a potential election, there doesn’t (as of yet) seem to be any market-changing policy that may be about to drop. Therefore, with the clouds clearing, this newfound certainty, and sight of the likely road ahead have been prompting more buyers to enter the market. Why wait for what seems like a very likely eventuality to arrive when you can get in ahead of the competition and perhaps find a better home now than wait for everyone to realise the obvious and face larger competition and higher prices?

As we mentioned before, you buy your house, but you rent your mortgage rate! Any savings on waiting for a marginally cheaper 2-year deal could be wiped out by increased capital and overall borrowing with increased competition and in turn higher asking prices being commanded.

As widely reported in January, we observed a surge in buyer demand. In January, we saw a 56% increase in buyer registration. This demand has softened slightly over February and March, but we still have an increase in buyer demand by 14% on 2023 same quarter. However, crucially, while 14% may seem a notable increase, the real difference has been the buying behaviour of those registering with us. The applicants who have entered the market have arrived with their decision-making hat on and are more inclined to make offers this year than last, and in turn, vendors seem more willing to listen to reasonable and fair offers. While applicant demand has increased 14%, we have seen agreed deals increase by 50% on the last quarter. When comparing with the same period last year we have seen agreed transactions increase by 150% on Q1 2023. This stat hopefully illustrates the buyer behaviour narrative I was trying to paint. An increasing amount of buyers are confident in the long-term outlook and certainty to make decisions now to benefit later.

Zooming in we are seeing a significant increase in buyer registration specifically at the core market level. With over 40% of buyers registering looking within in this category. We have seen 27% of buyers in the prime markets, and 3% of new buyer registration in the super prime category.

And those buyers in the market do have some great options available to them with an increase in stock available. Our friends at Lonres Data suggest there are 11% more homes on the market than this time last year. Our internal data also mirrors their assessment. However, given we have seen a 166% increase in people requesting valuations on their property this quarter, I would expect to see a surge in Sales stock coming to the market over Q2. Part driven by seasonal factors – The Spring Sales Swing! And part due to wider factors I mentioned earlier, with a feeling of now is a good time to look to sell with motivated buyers in the market while also spotting a window to upsize and benefit from a potential motivated upward chain!

Looking ahead, we anticipate continued growth in buyer inquiries and property listings, as both vendor and buyer spot the positives that 2024 has to offer. We expect the economic narrative to continue to become more positive, which generally leads to increased buyer and vendor confidence.

Looking at lettings, it's been a positive start to the year. Typically, January sees a surge in demand, followed by a slight softening in February and a return to high registration levels in March. However, this year, as expected, we witnessed a significant improved January vs December, in terms of applicant demand, but unusually an even stronger lift in demand in February and March!

In February alone, applicant demand increased by 20% compared to the previous year, signalling a return of lettings applicants to the market. It certainly feels like the lettings market took an extra month to really get going, but now it has we are seeing some very promising results.

Moreover, the increased availability of competitively priced properties contributed to this demand surge. While that may seem somewhat odd, there is a certain level of availability of stock that is optimum to entice applicants into the market. I once spoke to a well-known hotelier who told me 100% occupancy isn’t great for them, as it means their hotel goes off the radar for booking and it ends up in a reduction in demand. Somewhat similarly, if we face such a shortage of stock available to tenants, the word eventually gets around among tenants that people really shouldn’t move as they have no choice, and they just park things. Once they hear there is again a resupply of stock, it causes those who don’t need but would like to move to re-enter the market. The increase in stock I believe, and stock priced competitively has enticed more demand into the rental sector.

Our internal data indicates a significant uptick in available properties compared to last year, reflecting a more competitive market for landlords. The reasons we reviewed last quarter still continue to fuel this extra supply: higher interest rates, accidental landlords, and new penalties on leaving your home vacant for too long have all led to us having a 25% increase in valuation requests this quarter vs last quarter. When we analyse our overall stock availability for lettings, we see we have double the amount of properties available to let vs the same time in 2023. Meanwhile, we have seen applicant demand, while up overall on Q4 2023, down on Q1 2023.

Wider industry statistics also show an increase in stock – 49% more this year vs the same time last. They also interestingly show a decrease in transactions this year vs the same time last, Lonres reported rental transactions across London down by about 11%, with rental price drops increasing by about 70%. This, as alluded to earlier, shows a market where landlords have recalibrated their prices to meet the increased competition in the market.

Contradictory (and hopefully pleasingly if you read this as one of our clients) our own data reveals an increase in successful rental transactions vs last year. If I may be allowed a brief biased moment, our team works in a very specific part of the market and is well-honed to achieve market-beating results for our clients vs some of our competitors. While it is pleasing, it is not entirely surprising for me given the large amount of work, planning, and preparation that has taken place over the last 12 months.

The robust and in-demand core market (think 1,2, and 3-bedroom homes under £1500 per week) has been the catalyst for these large numbers of transactions. This segment of the market is often represented by working-age corporate professionals who seem to be increasingly returning to London and specifically Prime Central London.

We expect to see a similar pattern on the lettings side to sales – positive trading conditions. While we currently find ourselves in an applicant and stock-rich market, I do expect to see some minor tightening of stock once again. Part due to an increased seasonal spring and summer demand, but also with some accidental landlords deciding to revisit the sales market. We do often find the spring market leads to some homes transitioning from lettings to sale as part of the natural process where some landlords and investors decide to try the market. I would expect rental prices to remain steady with a 12-month increase of between 3-5%.

One final point. The Election! Despite an upcoming election in 2024, which historically might have impacted the market, we foresee minimal disruption, as both major parties offer similar outlooks for the property market. Without getting into the minefield of politics, the real politique differences of the two parties don’t seem as extreme as it may have been in 2019, and any change of government seems to offer some semblance of certainty in the short to mid-term status quo governance for the market.

Matt Staton

Head of Residential

Berkshire Hathaway HomeServices London

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 770

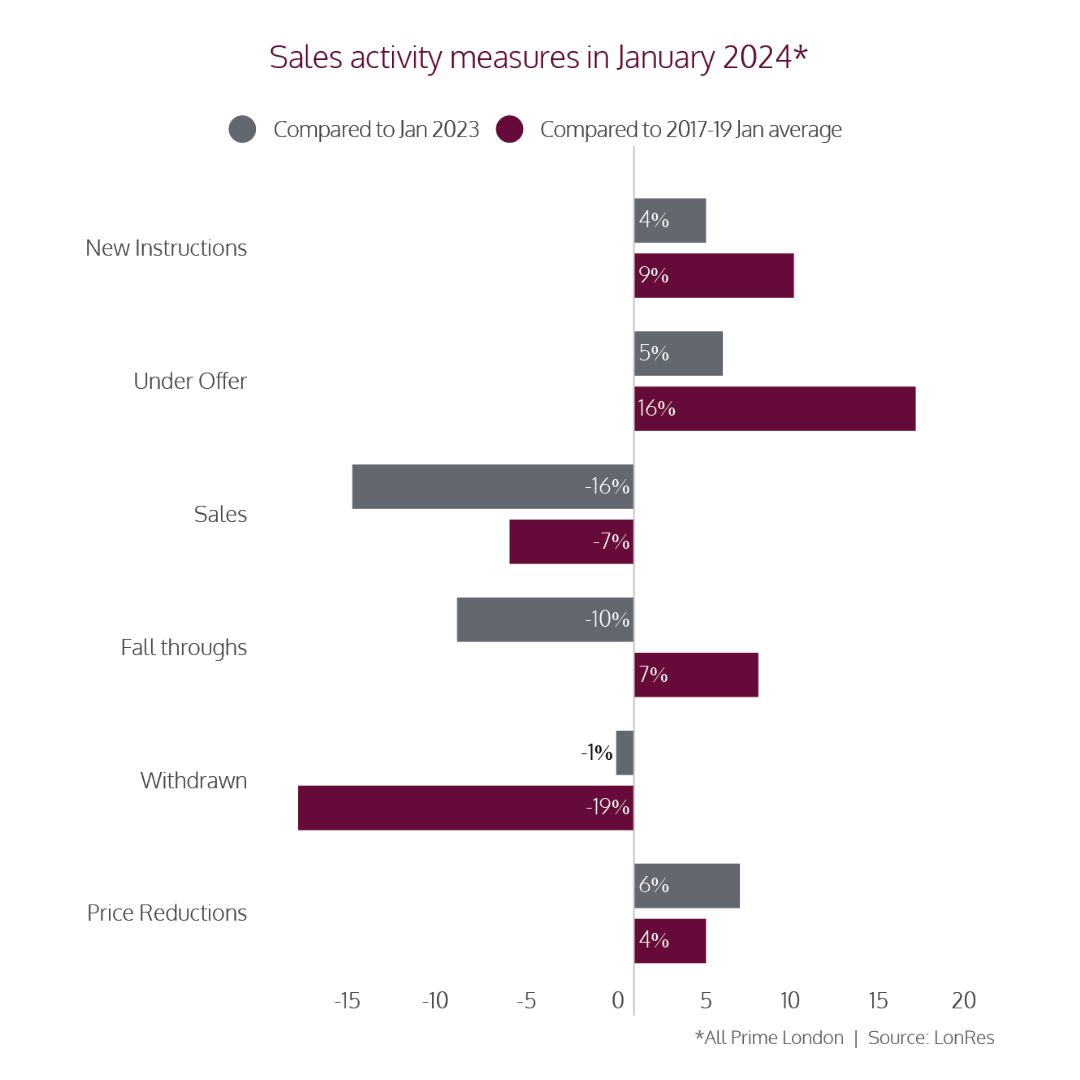

With increased instructions and decreased fall-throughs, we have seen a positive start to the 2024 property market. While the £5m+ Prime Central London sales market has returned to normal activity levels following two strong years, values remain 26.1% above 2017-19. The data used in this report comes from three designations: Prime Central, Prime Inner, and Prime Fringe.

For the Prime Central London lettings market, there was an annual fall of lets agreed, but an increase in new instructions to indicate positive months ahead.

Entering Spring and Q2, a traditionally busy period for property, we explore the London real estate market.

- In January 2024, the number of properties under offer grew by 5.4% annually

- Fall through and withdrawals in January were lower than in 2023

- House prices are only 0.8% higher than in 2014

- Overall, on average, prime London fringe grew by 18.3%

(Source: LonRes)

A Positive Start

With Spring on the horizon, we see positive signs in the sales and lettings property market. In January, the number of properties under offer grew by 5.4% annually. During this period, instructions increased by 4.2%. The volume of for-sale stock at the end of January was 5.4% higher than the previous year.

Achieved prices fell to -7.1% in January, the most significant drop in five years. However, properties under offer have a brighter outlook. LonRes reports an annual increase of 5.4%, increasing levels to 15.6% above the average pre-2019.

Fall-throughs and withdrawals in January 2024 were lower than the previous January, and price reductions were just 6% higher. These metrics indicate a healthy market.

Trends Over The Decade

House prices are only 0.8% higher than in 2014. However, there has been a fluctuation throughout London neighbourhoods. New transport links and housing developments bolstered some areas, while others have remained the same.

At just 3.1%, Prime Central London has witnessed the least growth in price. South Kensington saw -2.5% and Chelsea 0.9%. However, some neighbourhoods here thrived. Mayfair and St James saw 20.7% growth.

For inner prime, Fitzrovia, Bloomsbury and Soho have seen a change of 32.6%. Other neighbourhoods experienced a rise, too. Kensington, Notting Hill & Holland Park saw a hike of 26.2% and Hampstead 29.3%. The overall average for prime inner was 18.9% growth.

For prime fringe, Vauxhall, Nine Elms, Borough & Kennington have experienced a 28.8% increase, possibly boosted by the extension of the Northern Line, regeneration and new homes. Overall, on average, prime fringe grew by 18.3%.

With the rise in mortgage rates, buyers may be priced out of Prime Central London and move to fringe and inner London. The addition of new transport links will make areas in the prime inner and prime fringe more connected and desirable. For example, the Northern Line extension, the introduction of the Elizabeth Line and the planned extension of the Bakerloo Line, opens up new places to live.

A report by Zoopla made predictions for the coming year stating, “we expect market conditions in London to continue to improve over 2024, with earnings rising faster than house prices. This will continue to improve affordability and support levels of housing sales rather than boost house prices.”

The £5m+ Market

In January, activity in the £5m+ market slowed down. However, transaction levels remain ahead of historical trends. While sales were 17% lower than in January 2023, they remained 64% higher than the January 2017-2019 average.

The supply of premium London homes priced at £2-5m+ is increasing. In January 2024, new instructions were 42% higher than the same month in 2023 and 148% higher than January 2017-2019. New instructions for homes priced at £500k-£1m are falling.

Rental Growth

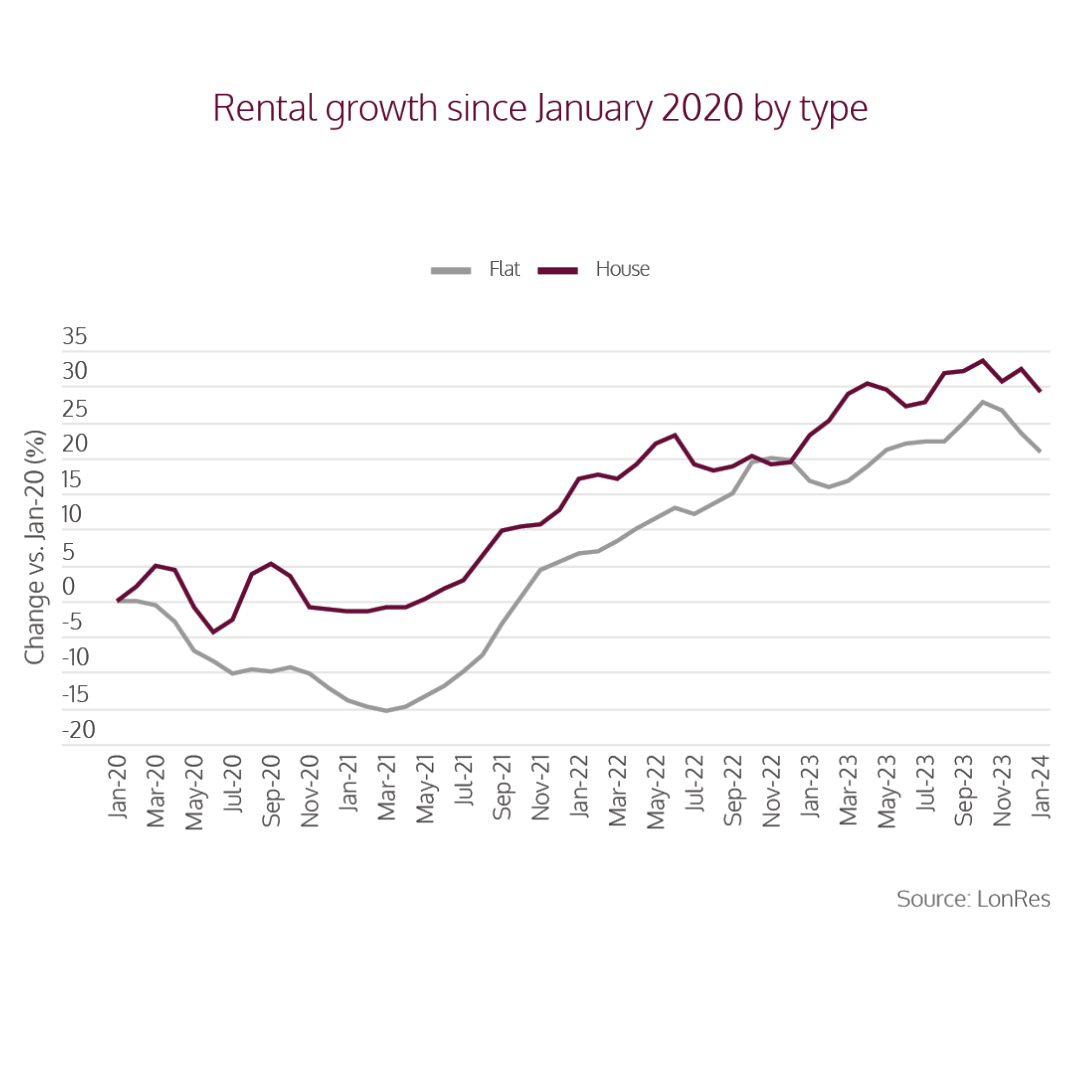

While rental values remain 26.1% higher than their 2017-2019 average, annual rental growth fell to 3.1% in January. Data from LonRes indicated a yearly fall of 11.5% in lets agreed, which is 60.8% below the January 2017-2019 average.

However, instructions for properties to rent in London rose by 22.1% in January 2024. While fewer houses are on the prime London rental market than in 2020, the increase in instructions presents a positive sign.

Buy-to-let mortgages are at the lowest levels since September 2022. With the hike in the Bank of England base rate, buy-to-let mortgages peaked at 6.79% in August 2023. In February 2024, the average fell to 5.5%. While it’s still higher than the 3.06% of February 2022, it's a move in the right direction.

Planned legislation updates will force landlords to increase the EPC rating of their investment properties. By doing this, landlords may be eligible for green mortgages that offer lower rates and cashback.

In the second quarter of 2020, with reduced demand for rental properties across central London during lockdowns, the value of flats and houses fell. Houses picked up again quickly, and in Spring 2021, they were back to their January 2020 level. Flats remained 15% below. In 2022, the growth gap closed, but since then, the flat premium has fallen to 6%.

Moving Into Spring

As we move into Q2 and Spring, we are seeing the market moving in a positive direction.

While transactions in January were 15.5% lower than in January 2023, the increase in properties under offer is a positive sign. Property prices have increased throughout Prime Central, inner, and fringe, with Prime Inner seeing the most significant average.

If you’re interested in the prime London housing market and properties for sale in London, contact our Central London estate agents team to start a conversation.

The analysis for this report takes in the three LonRes catchment areas:

PRIME CENTRAL

South Kensington

Mayfair & St James’s

Knightsbridge & Belgravia

Kensington, Notting Hill & Holland Park

Chelsea

PRIME INNER

St Johns Wood, Regents Park & Primrose Hill

Pimlico, Westminster & Victoria

Marylebone & Medical Territory

Hampstead

Fitzrovia, Bloomsbury & Soho

PRIME FRINGE

Vauxhall, Nine Elms, Borough & Kennington

Hammersmith & Brook Green, Chiswick, North Kensington

Fulham & Earls Court

Bayswater & Maida Vale

Battersea, Clapham & Wandsworth

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 915

Property Disputes

In the complex world of property, disputes can be challenging to navigate. In the UK, there are two key redress schemes to resolve property disputes: The Property Ombudsman (TPO) and the Property Redress Scheme (PRS).

Designed to secure fair outcomes for consumers, neither are consumer champions. They’re impartial and always aim to reach fair decisions without court proceedings.

In the UK, it is an offence for an agent not to be a member of a redress scheme. The new Renters Reform Bill also means landlords must be members of the Housing Ombudsman. When working with an agency, it’s important to understand their chosen scheme should a problem arise. The scheme will give all parties peace of mind that there is a fair dispute management process.

Redress Schemes in the UK

The two main redress schemes pave the way to a fair and structured outcome. Whether the dispute is between a letting agent, an estate agent, or a landlord and tenant, the schemes aim to reach a suitable result. The TPO and the PRS have aligned goals but different backgrounds and processes.

In our post, we explore the two schemes. We uncover codes, backgrounds and how they fit into the property market.

What is TPO?

Whether you’re a landlord with a contractual breach, a tenant recognising professional misconduct or a seller with a complaint, The Property Ombudsman (TPO) is an impartial, independent body aiming to reach a full and final settlement for disputes. The not-for-profit organisation is for redress, not regulation, existing for the benefit of the consumer.

Should the agent not settle the dispute, clients visit the TPO for free advice or to handle the enquiry. The TPO aims to resolve issues quickly, avoiding lengthy and costly court cases. Katrine Sporle, The Property Ombudsman, explains, “An ombudsman exists to deal with complaints that haven’t been resolved by the person who sold the service.”

The TPO covers a maximum of £25,000 on a case-by-case basis. While some outcomes might cover a smaller amount of £50-150, more serious complaints where the client has lost money may be awarded with costs covered plus compensation. In 2022, the biggest awards were £21,779 (lettings), £15,500 (sales) and £23,634 (RLM).

The not-for-profit organisation isn’t funded by the government, meaning they can be impartial with no conflict of interest. While it’s not mandatory for an agency to be a member of the TPO, agencies join this scheme specifically to increase consumer confidence and develop quality agents.

TPO Code of Practice

The TPO code of practice sets the rules for how agents within their scheme should behave, conduct their work, and treat clients. This helps set high standards in the industry while protecting consumers. Following an aligned rule book ensures clients offer high standards and remain lawful. Agents who are members of the TPO must make the code of practice available to consumers. The TPO can consider consumer complaints against members should they go against the code.

Any agent who is a member of the TPO scheme but fails to comply with the Ombudsman’s award or direction faces expulsion from the scheme. With a Memorandum of Understanding in place with PRS, agents cannot join another scheme while they have an outstanding matter with another. The list of expelled agents is public for individuals to see.

In 2022, the TPO had almost 45,000 consumer enquiries. The organisation handled under 14,000 issues from tenants and landlords about their letting agents at the enquiry stage, avoiding formal complaints. The year saw an increase in the requirement for formal decisions, indicating the increasing complexity of cases.

Who Does the TPO Cover?

The TPO covers anyone who works with an agent who is a member of the TPO. Landlords, tenants, buyers and sellers can raise a claim against a TPO member if they have gone against the code. While the TPO doesn’t cover private landlords, if an agent who is a member of the TPO represents the landlord, the landlord is protected against a poor code of practice through the scheme.

What is the Property Redress Scheme?

The Property Redress Scheme (PRS) is government-approved. While similar to The Property Ombudsman in how it helps resolve disputes and maintains industry standards, the scheme works slightly differently. For example, with PRS there is no code of practice. Instead, they implement reasonable industry practices.

PRS offers structured processes for lodging complaints and resolves the issues quickly without needing court proceedings.

The Renters Reform Bill and Redress Schemes

The new Bill requires all landlords to join a designated government-approved ombudsman, regardless of whether they use a letting agent. This allows tenants to make a complaint against a landlord and raise an independent investigation. With the introduction of the Renters Reform Bill, the property redress landscape is evolving.

The government has approved just one scheme for all landlords to join, the Housing Ombudsman. With one scheme for all landlords, tenants will have a streamlined service. Jacob Young, Under-Secretary of State for Levelling Up, explained, “Having one provider for all social and private renting tenants would provide streamlined and simple-to-use redress services for complainants.” This is likely to change how PRS operate.

The Difference Between PRS and TPO

PRS and TPO seek to solve disputes without court and ensure agencies comply with legal obligations. While PRS agents don’t follow a code of conduct, TPO agents do. The code of conduct helps set a high standard for the industry, giving consumers more confidence.

While PRS is industry-funded and TPO operates independently, they both have proven track records in satisfying consumer outcomes. Both schemes safeguard consumers, and property agents remain accountable to ensure a fair and transparent property industry.

Central London Estate Agents

BHHS London are members of The Property Ombudsman, and we proudly adhere to the high standards in the Code of Conduct. We ensure landlords, tenants, buyers, and sellers receive the best outcomes from our service and any disputes.

If you need guidance or advice for your lettings, contact our Central London Estate Agents team.

- Details

- Written by Balaji Venkatesh

- Category: Local Events

- Hits: 1699

- Use mirrors to create more light in dark spaces

- Chose sheen surfaces, paint and floorings to reflect light

- Control light and maintain privacy with carefully considered window treatments

- Trim back foliage covering windows to welcome light in

- Consider renovations to add skylights, sliding doors and oversized windows

Living in a city or a period property doesn’t mean you have to compromise on natural light. Natural light makes spaces appear larger and colours look brighter. According to a study by UCLA, it also improves moods and boosts happiness.

Whether you have floor-to-ceiling windows, small clerestory windows, statement windows or even very small cottage windows, you can maximise and adjust natural light in your property with our expert tips.

Understand Your Space

Your space and how you use it is unique to you. Take time to understand your property, its light challenges, and where natural light is abundant – and if the light gets too intense, note the time of day when it happens.

Make detailed observations of your windows and doors and assess how much light they allow. Are any rooms or spaces lacking light? Are large trees, foliage, or buildings restricting daylight from pouring into the area?

Consider each room of your home in close detail. Take in the natural light at different times of day, and think about how it impacts your experience of the space. While the warmth and brightness of the sun through the windows may be enjoyable for short periods, it’s unlikely to be a comfortable space to work or spend time viewing a screen, for example.

We’ve taken a look at a variety of properties, making impeccable use of the natural light available. While some enhance light using glossy surfaces, others use fittings for privacy and light control.

Home Office

If you have a home office, natural light has been found to increase productivity and reduce eye strain and headaches. However, the glare of the sun can be much at certain times of the day, making your computer hard to see or your eyes tired.

Think about your desk position when considering natural light in the office. A window behind you may reflect on your computer screen, while light in front may dazzle during sunny days. If possible, position your desk perpendicular to the window. If you can’t arrange your desk this way, add a translucent roller blind to protect you from the sun's intensity while still bringing in light.

This property in Chiltern Street has a large, traditional sash window. The desk is perpendicular to the light source, and adding a roller blind helps ease periods of intense sun. The grey hues of the walls and soft furnishings, coupled with white furniture, give the room a cheerful and inspiring place to work.

Property for Sale in Chiltern Street

Lounge

Your lounge is a place to unwind and entertain. Whether you have traditional cottage windows or bi-folding doors opening out to the garden, there are opportunities to control and enhance natural light in the space.

South-facing rooms will experience strong sunlight during the day. Adding shutters maintains visual access to the outdoors while keeping the sun's brilliance at bay.

North-facing living spaces are commonly darker. Invite the daylight with natural hues, shiny surfaces, light-coloured flooring, mirrors and plants. In these darker rooms, choose glossier paints over matt alternatives. Place mirrors in front of the window but away from direct sunlight. You’ll see light from the mirrors reflect throughout the room without an uncomfortable beam.

This two-bedroom apartment in a renovated red-brick mansion on Basil Street features three wide windows in the lounge. The light floods the room, but the shutters offer the opportunity to adjust the natural light and close them up for a cosy evening feel.

Bedroom

Oversized windows in the bedroom bring the outside in, and perfectly frame your views. However, too much natural light can impact sleep during the summer months. Choose roller blinds, curtains, or shutters to take control of the light in this space.

For darker bedrooms with small windows, choose pale wood or mirrored furniture and natural or pastel textiles to maximise light. Trim any foliage covering the windows and keep them clean to direct more light into the room.

Property for Sale in Harrington Road

This penthouse bedroom on Harrington Road enjoys views of the terrace. The addition of blinds changes the light when required and adds privacy. The soft furnishings' light hues and the fabrics' shimmer elegantly bounce natural light around the room.

The mirror wall, coupled with the clerestory windows in the primary bedroom, creates an illusion of more space and light. Heavy drapes allow light to be successfully blocked out for sleep. There is an exquisite use of mirrors throughout this property: from the mirrored pillars in the living area and the mirror wall in the bedroom to the mirrored furniture, this penthouse is a reflective, light-giving masterpiece.

Kitchen

While some contemporary kitchens feature long bi-fold doors, others have a single window. To make the most of the light you have, choose dazzling smooth surfaces to create a bright and airy kitchen. This compact kitchen in a four-bed mews house in Greens Court uses light units and a natural palette to draw in and scatter light.

House for Sale in Greens Court

The 1970s complex in Hyde Park Gate has a wall of windows in the kitchen. Light reflects from the smooth and shiny countertops and flooring, giving the illusion of even more lighting.

Light reflects spectacularly in this kitchen on Albion Street. Sunlight casts across the sheen worktop, glass cupboards, and dark polished flooring. The blend of dark and light tones creates an inviting and inspiring space for creating culinary delights.

Duplex Penthouse for Sale in Hyde Park Gate

Embracing Your Home's Character

Your home will have its own character, and you’ll bring your own style to it, too. These elements should guide how you enhance natural light in the property.

Cosy cottages and traditional mews houses may benefit from strategically placed mirrors, reflective surfaces and light furniture – particularly if there is limited opportunity to increase window size or change window shapes.

A contemporary minimalist property may feature oversized windows that call for blinds, sheer curtains or shutters to help you adjust the light to suit the occasion.

Dressing Your Windows

Window treatments add colour, pattern, and privacy to the rooms in your house. Fabric designer Penny Morrison advises that full-length curtains allow you to be bold and make a statement. However, if the window is small, you should opt for blinds that won’t take up unnecessary space and don’t restrict light.

While the window treatment design is important, it will also dictate the light that casts into the room. Tilt Venetian blinds to adjust the light and increase privacy. Use translucent roller blinds for privacy or blackout – ideal for bedrooms. Woven bamboo blinds offer privacy while casting a playful light pattern. For spaces requiring privacy without sacrificing natural light, a loose-weave linen voile provides a relaxed and bright feel.

When considering curtains, select a pole that is longer than the window so you can fully open the curtains. Some window styles, such as round or Palladian, make it notoriously hard to add curtains or blinds. If you have a statement window in your property, particularly the bedroom, weigh covering them and losing their beauty against embracing the adorning light – even first thing in the morning.

Interior designer Helen Harry says, “Consider if the window is worth celebrating or disguising. Some are way too beautiful to be completely covered over by window dressings. I also look at the natural light, the view and the amount of privacy needed.”

Renovations To Bring In More Natural Light

If you have significant property lighting challenges, there are opportunities for light-giving renovations. Of course, larger windows, sliding doors and bi-folds are clear options. However, if this isn’t possible in your property, consider skylights, or layout adjustments.

For substantial renovations, rearranging the interior layout of your property into an open-plan living area will draw in more light. With an open plan area, follow the same flooring throughout and include reflective surfaces.

Take a look outside your property, too. If large trees or foliage cover the windows, note what needs doing to bring in more light and seek relevant permissions.

Artificial Lighting

Artificial lighting has its place in every home. In her book Mad About the House, Kate Watson-Smyth explains how one pendant light isn’t enough. “...if it’s all you have, it should be on a dimmer.”

Other lighting in the room should be layered and on different circuits to vary the mood of the space. Watson-Smyth writes that you need “a table light for atmosphere and a floor light to throw a soft glimmer up onto your walls.” She also suggests a task light for reading and an accent light to highlight a feature or picture.

Bring Natural Light Into Your Property

From intense midday rays to the soft orange glow of the sunset, natural light plays a huge part in your home. By manipulating light with shutters, shades and sheer curtains, rooms can appear larger or even cosier. Light helps zone spaces and soften areas, and through clever arrangements of furniture and mirrors, it can even brighten dark, small-windowed rooms.

Invite plenty of natural light into your property, but add the right window dressings to take charge of how the light moves in the room.

If you’re looking for a house for sale in London with abundant natural light, contact our Central London estate agents to discuss your details.

Sign up for our VIP monthly newsletter

Get the latest ideas, insights and inspiration It's free